If you enjoy being angry, politics is your surest bet, and so by all means analyze that hellhole until you are purple in the face. It will get you nowhere (this advice aimed mostly at myself, but wise for all to absorb), it will endanger friendships, the hardbitten on either side will remain hardbitten, and the great tide of history will just do its thing regardless.

Having said that, there is slightly more tangible prescription for annoyance, one that is equally pointless to fight on a day to day basis, and that is Tax Freedom Day. This one, we all should roll up our sleeves and fight against.

It is worth noting that both leading parties have acknowledged that reducing personal taxes is important, but nothing good amount to much if the proposed tax cuts are semi-symbolic, simply pandering to voters. Yes, they will add more $ to every pocket, which is great, but the problem runs far deeper. There are many taxes that hobble us. Tax Freedom Day is a compendium of all governmental hands in your pockets, and they all need to be dealt with. That isn’t exaggeration; the US has a plan up its sleeve that might really put a fire under Canada to do something.

Tax Freedom Day, in case you don’t celebrate, is the theoretical day in the year at which you start working for yourself, and not the government. The calculation takes the total estimated tax bill for a family of four – income taxes, property taxes, sales taxes, you name it – as a percentage of the household income of a typical family, and ticks off that percentage of the days of the year.

The Fraser Institute calculates the date each year 2024’s date was June 13. For an ‘average’ family of four last year, household/family income was $147,570, and the calculated tax bill was $65,766 (44.6 percent). Voila.

An interesting point arises though, and it is particularly interesting when this data is re-referenced to a different group of people, as in, those that make substantially more than that amount.

The average family making $147,000/year, which is $81,804 after those average taxes, or $6,817 per month, is spending all that money treading water. The cost of living is formidable. To own a house is a tough task, and to rent one is no picnic either, and that is what many are left with because coming up with a big 5-figure downpayment is not easy to do. This rental advice site pegs the average rental expense for a 3 bedroom home in Canada at $2,831/month. Out of the rest of that monthly income comes: food, insurance, utilities, clothes, auto expenses, cell phones, entertainment, kids sports, dental, and a thousand other things…with cost pressures of the past few years, it is a mystery how average families do it. Check out the price of a new vehicle. It’s insane. Then check out the price of a used vehicle. 90 percent of insane. Take public transit? Sure. Pay nearly $8/day round trip, for unreliable service, to sit amongst fellow travellers that smell like pee and fall over on the ground in front of you. At 7 am. And oh yeah, when it’s coldest, public transit works the worst. They don’t mention that in the ads.

So anyways, the average family is not in any position to “invest in the economy”. They are treading water at best.

The task of investment falls to people with more disposable income. But what is their tax freedom day?

The Fraser Institute calculation that shows the tax slice of income for average families shows a total tax bite of 44.6 percent. But that calculation “only” includes an income tax hit of 15 percent. Let’s say we consider an income of $250,000, enough to live comfortably and invest some. The talent.ca website shows an Ontario tax bite of 41 percent, and an Alberta one of 37 percent. Because this is a single earner number whereas the ‘average family might be two earners, so let’s call it 35 percent as an overall tax hit to equalize for that.

Assuming all the other tax burdens stayed the same, which they wouldn’t, they would be higher, because the higher income family consumes more, but keeping the other burdens the same yields a total tax bite of $131,180 on $250,000 of income, and a tax freedom date of July 11.

And it gets worse the more you make.

So the people that have more income to invest, can’t, because they send more and more to the government, and governments tend (to put it mildly) to put those tax dollars into unproductive enterprises. I would provide an example, but it is far more fun to just Google search something like “wasteful government programs” and be prepared to howl in outrage.

Now, let’s turn to one of Canada’s biggest economic problems: cratering productivity. The Bank of Canada, not a bastion of hysterical shrieking, issued a statement last year that was about as wild as they will ever get. With respect to Canada’s productivity problem, the BofC said: ‘You’ve seen those signs that say, “In emergency, break glass.” Well, it’s time to break the glass.’

The BofC lays out some of the challenges, culminating with what we can all feel: “When you compare Canada’s recent productivity record with that of other countries, what really sticks out is how much we lag on investment in machinery, equipment and, importantly, intellectual property.”

Where can that investment come from? A number of sources: Canadian citizens, foreign investors, or pension funds.

Canadian citizens are in no position to invest, in large part because of this tax millstone around their necks, but also for another reason the BofC report lays out: the smothering blanket of regulatory hurdles and roadblocks. Business is hard enough; layer on enough red tape and unproductive requirements and that capital simply goes elsewhere, or stays in GICs.

That last point is important as well. Most Canadians are responsible for their own retirement these days, which brings an infinitely daunting challenge: how much to risk, and at what risk level? Should a person really be betting their retirement on risky stocks? Many Canadians feel forced to, because growing a retirement fund is an enormous challenge when saving is extremely difficult and safe returns are miniscule. As a compromise, many taxpayers simply run to the most trusted institution and dump their savings into mutual funds.

Not a bad solution, that, except that most investment dollars choose to go to other countries for better returns, because business in Canada is so difficult. In fact, Canada’s very own pension funds prefer to invest outside of Canada, which is a fairly condemning statement. One could argue that the Canadian economy is too small to absorb those hundreds of billions of investment dollars…but its’t it kind of a national embarrassment to say that out loud? Shouldn’t we be 100 percent focused on making this the best home for those investment dollars?

So that leaves foreign investors to lead the charge on capital investment. Will they? More on that in a second (quick answer: Gold Cards will ensure the answer is no).

And what would happen to the economy if we could dial back the Tax Freedom day by a few months? Look at the hypothetical model family with $147k in income. They pay a total of $43,680 to governments. What if that was cut by a quarter, and left in their hands? What would such a family do with an extra thousand dollars a month, as opposed to the few thousand per year currently being proposed by the current leading parties? It would be life changing.

Speaking of life changing, Canada needs to be acutely aware of what the US is up to, a move that, if Canada’s Freedom Tax Day remains stuck in summer, will possibly create a wealth drain of epic proportions.

Trump is proposing an immigration Gold Card, all yours for $5 million. Sounds steep, but not really, for the right crowd. The details are significant.

The Gold Card will allow a person to buy permanent resident status in the US. You can be a citizen, but you don’t have to be. As Howard Lutnick explains, wealthy people from around the world might choose to buy these for their immediate families (or whomever). If the world goes to hell, or their corner of the world does, they would have the right to go to an airport and fly directly to the US and stay there, with permanent resident status.

That feature could be incredibly valuable to all sorts of wealthy people, around the world. Say Canada continues on its march to economic oblivion, and future governments do not effectively get the economy unstuck from the mud bog it is in. Gold Card owners could simply decide not to keep waiting in four year chunks for things to improve, and head to the US indefinitely to ride it out.

And the card might be far, far more valuable in unstable jurisdictions of the world. Think of wealthy people anywhere that could come in the crosshairs of unfriendly/dictatorial/socilaist governments. Lutnick says the US will be screening to keep out the bad guys, and let’s hope so, but you can bet that there will be a great many that will skirt close to that edge that will look to buy one. I’m not saying that is a good thing, I’m just saying, the market could be substantial.

All of those wealthy people will bring investment dollars to the US, and other countries, like Canada, will have to compete for those investment dollars. Somehow. (If the US sells enough, this scheme actually has the potential to wipe out a very large chunk of the US national debt – a not inconsiderable feature in itself, and should that happen, it would free up the US government to pursue a lot of other policies high on Trump’s to-do list. It would enable him to truly run wild, with the credit card paid off…)

So, Canada, pay heed to wise words on this topic. Here, from BofC again:”Higher productivity should be everyone’s goal because it’s how we build a better economy for everyone. When a business gives workers better tools and better training, those workers can produce more. That, in turn, means more revenue for the business, which allows it to absorb rising costs, including higher wages, without having to raise prices.”

And, my favourite part from the BofC report: “History shows that advances in productivity often come from the start-ups, the new companies led by entrepreneurs with groundbreaking ideas.” Yes, we need the mega-projects, or the wise ones anyway: roads, pipelines, transportation corridors, etc. (No multi-billion dollar vanity projects though please, and y’all know what I mean.) But more than that, to gain critical momentum in enthusiasm if nothing else, we need the little guys.

Clear the path for entrepreneurs. Cut their tax bills, and not just income taxes. Reduce them all. Bring tax freedom day back to March. Or before. Cut the red tape. The big bucks will flow, just as they always do, to the best ideas that prove themselves. But those ideas need petri dishes in which to grow. It simply has to be a governmental priority.

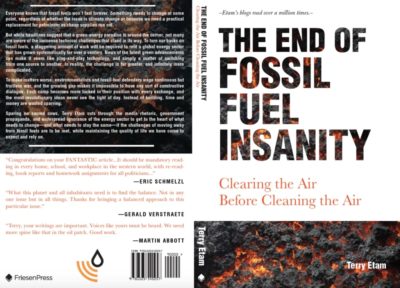

An energy transition is far more challenging than most realized, which is why we are we are where we are. Find out why in The End of Fossil Fuel Insanity – the energy story for those that don’t live in the energy world, but want to find out. And laugh. Available at Amazon.ca, Indigo.ca, or Amazon.com.

Read more insightful analysis from Terry Etam here, or email Terry here.