How do you transform an idle power plant spanning three locations into a multi-million dollar windfall in just months? This was the challenge faced by one of Canada’s largest oil and gas companies when it decided to divest a massive industrial asset in Alberta.

While some producers and midstream companies have materials management handled by surplus teams, warehouse or asset management staff, there’s an almost universal problem of companies not having the expertise or systems to keep up with cataloging what sits idle, never mind finding buyers. This is true even for the majors.

But when the finance department or executives start rattling chains about the capital stuck in idle equipment, or storage space needing to be repurposed, something has to be done.

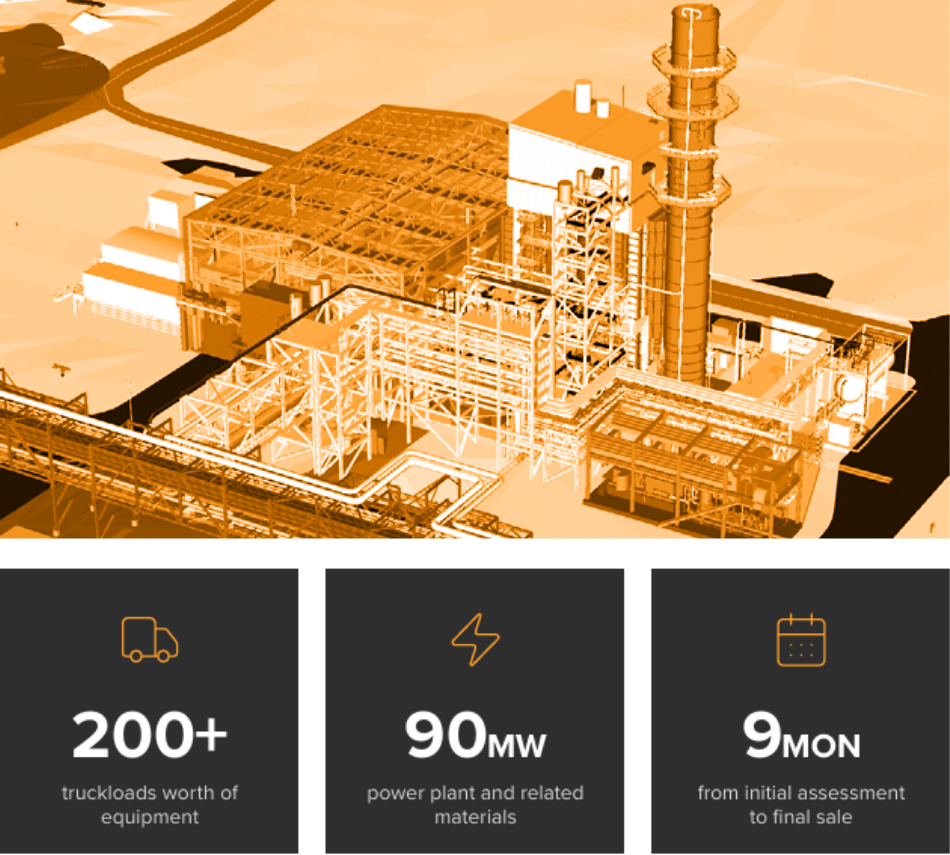

This case study examines how a leading oil and gas company chose IronHub to tackle the complex project of finding a buyer for and coordinating the removal of a 90 megawatt power plant and related materials stored across three locations, amounting to over 200+ truckloads worth of equipment.

[View Case Study]

Case Study: From Idle to Income: How IronHub Monetized a Multi-Million Dollar Power Plant For an Energy Leader

The challenge:

The project posed significant logistical, financial, and time-sensitive hurdles.

- The massive industrial asset spanned three storage locations across Alberta, with the largest site occupying over 80 acres.

- The diverse assets included high-value turbine generator components intermingled with less desirable construction materials.

- The company urgently needed to clear their space to allow for expansion, necessitating a swift sale within a few months.

- And the customer strongly preferred a single, package buyer who would acquire all assets rather than pursue piecemeal sales

The approach:

- IronHub applied a turkey surplus sale approach, completing the process from initial equipment assessment to final sale and removal logistics in 9 months.

- The process respected strict safety policies around site access and preferred vendor relationships.

The outcome:

- After vetting qualified buyers, conducting inspections and negotiations, a single buyer acquired all assets.

- The sale earned our customer well over asking, showing the untapped potential of dormant industrial equipment.

“IronHub got us a return over our expectations, and the benefits extended far beyond monetary gains. The overall process management includes crisp and clear timeframes, cross-functional meetings, and set schedules. That project management allowed our team to be hands-off and saved us considerable time,” Supply Chain Manager, one of Canada’s largest oil and gas companies.

Read the case study to learn how the materials management partner worked with head office and field teams to manage the multi million dollar surplus sale.