Each week, XI Technologies scans their unique combination of enhanced industry data to provide trends and insights that have value for professionals doing business in the WCSB. If you’d like to receive our Wednesday Word to the Wise in your inbox, subscribe here.

Following the Supreme Court of Canada Redwater decision in January in favour of the AER and Orphan Well Association, producers must change the way they manage liability regarding end-of-life obligations. These changes are necessary not just to meet AER regulations, as they always were, but perhaps now more significantly to meet the audit requirements of lenders who are more forcefully taking future liabilities into consideration.

Considering this, isn’t it time for a new way to manage liabilities? Or perhaps more significantly, should we look at established ways of managing other business processes and see if we can take a similar approach to managing our liabilities and ARO?

Today, the most common way of managing ARO is with spreadsheets. These spreadsheets can initially be very effective, particularly if you have an expert on staff to manage them, but over time they become unwieldy, prone to errors, and difficult to audit.

Interestingly, these are the same issues producers used to face when forecasting, managing, and reporting reserves, before they started replacing cumbersome spreadsheets with well data management systems and reserves management software. What if you started to think of managing your liabilities the same way as your assets by taking a well data management approach to ARO?

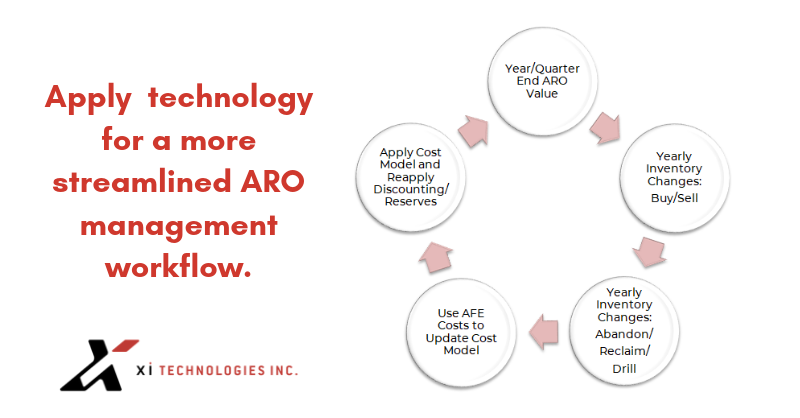

Doing so would mean centralizing your license list, with one repository of all licenses and no silos of information to try and compile at the end of the year. Cost decks, like the price decks used in reserves management, would be developed using broad industry data or proprietary AFE information. You then apply a software solution over that database to compensate for the common issues of dealing with spreadsheets. Ideally, that software would be web-based to avoid the overhead of managing such a program on your own infrastructure and allow more people in your organization to access and work with that data.

With such a program for your ARO, you can pass the information easily between stakeholders, with an audit log of who made what changes when, giving your team an overall picture of ARO instead of just their own piece of the puzzle. Having an easy to manage process allows you to report to decision-makers more easily and often, allowing you to incorporate ARO information in more processes, such as potential A&D, risk management, HSE planning, or area base closure opportunities, rather than just to meet your annual financial reporting requirements.

If these benefits sound familiar, that’s because they’re the same benefits producers realized upon switching other parts of their operations away from spreadsheets and over to application solutions. At XI Technologies, we offer just such a solution with our ARO Manager, part of our AssetBook suite of solutions. We will be hosting a webinar on August 14 to discuss XI’s approach to streamlined environmental liability management and decision making. Register for the webinar here.

XI’s ARO Manager is the ideal tool to help companies evaluate, track, manage, and report on asset retirement obligations. Companies can utilize a standardized cost model to assess total liabilities, or they can import alternate cost models and perform scenario analysis to determine the most efficient, low-cost approach to meeting the mandatory abandonment and reclamation deadlines.

For a more in-depth look at ARO Manager book a personalized demo, or contact XI Sales.