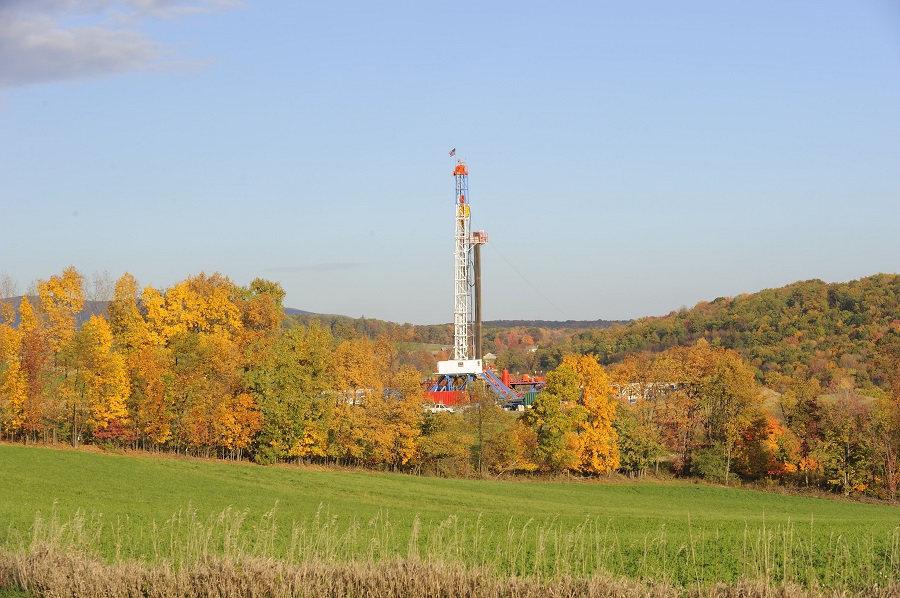

U.S. energy firms this week added oil and natural gas rigs for a third week in a row for the first time since October 2018 after price increases in recent months prompted some producers to start drilling again.

U.S. energy firms this week added oil and natural gas rigs for a third week in a row for the first time since October 2018 after price increases in recent months prompted some producers to start drilling again.

The oil and gas rig count, an early indicator of future output, rose five to 266 in the week to Oct. 2, energy services firm Baker Hughes Co said in its closely followed report on Friday.

The total rig count fell to a record low of 244 rigs during the week ended Aug. 14, according to Baker Hughes data going back to 1940.

U.S. oil rigs rose six to 189 this week, their lowest since the week to June 19, while gas rigs fell by one to 74, according to Baker Hughes data.

More than half the U.S. oil rigs are in the Permian basin in West Texas and eastern New Mexico where total units rose four to 129 this week, the most since late June.

Even though U.S. oil prices are still down about 39% since the start of the year due to coronavirus demand destruction, U.S. crude futures have gained 100% over the past six months to around $37 a barrel on Friday mostly on hopes global economies and energy demand will snap back as governments lift lockdowns.

Analysts said those higher oil prices have encouraged some energy firms to start drilling again.

“We’re increasingly optimistic that a bottom has now been set and still expect to see further (albeit measured) activity momentum into year end 2020,” analysts at Tudor, Pickering, Holt & Co said this week.

U.S. financial services firm Cowen & Co said the independent exploration and production (E&P) companies it tracks plan to slash spending by about 47% in 2020 versus 2019. That follows a capex reduction of roughly 8% in 2019 and an increase of around 23% in 2018.

Cowen also said that some E&Ps issued early estimates for 2021 that so far point to a 6% drop in spending next year versus 2020.

29dk2902l