Each week, XI Technologies scans its unique combination of enhanced industry data to provide trends and insights that have value for professionals doing business in the WCSB. If you’d like to receive our Wednesday Word to the Wise in your inbox, subscribe here.

Merger and acquisition deals in 2021 were the highest they’ve been in three years. And with oil prices expecting to average around $80-85 a barrel, it is likely this trend will continue. To help get a sense of the current state of M&A, we are pleased to offer some high-level summaries of a recent purchase of assets between Tenth Avenue Petroleum Corp. (“Tenth Avenue”) and Avalon Energy Ltd. (“Avalon”).

What do the companies look like prior to completing the agreement? What do we know about each company’s assets, core areas, and recent activity? How might this combination affect others in the area? We’ve looked at both companies through a few different lenses using our AssetSuite software tools to allow you to compare the companies and gain some insight of your own.

Click here to download a pdf report of the above data.

Core Areas

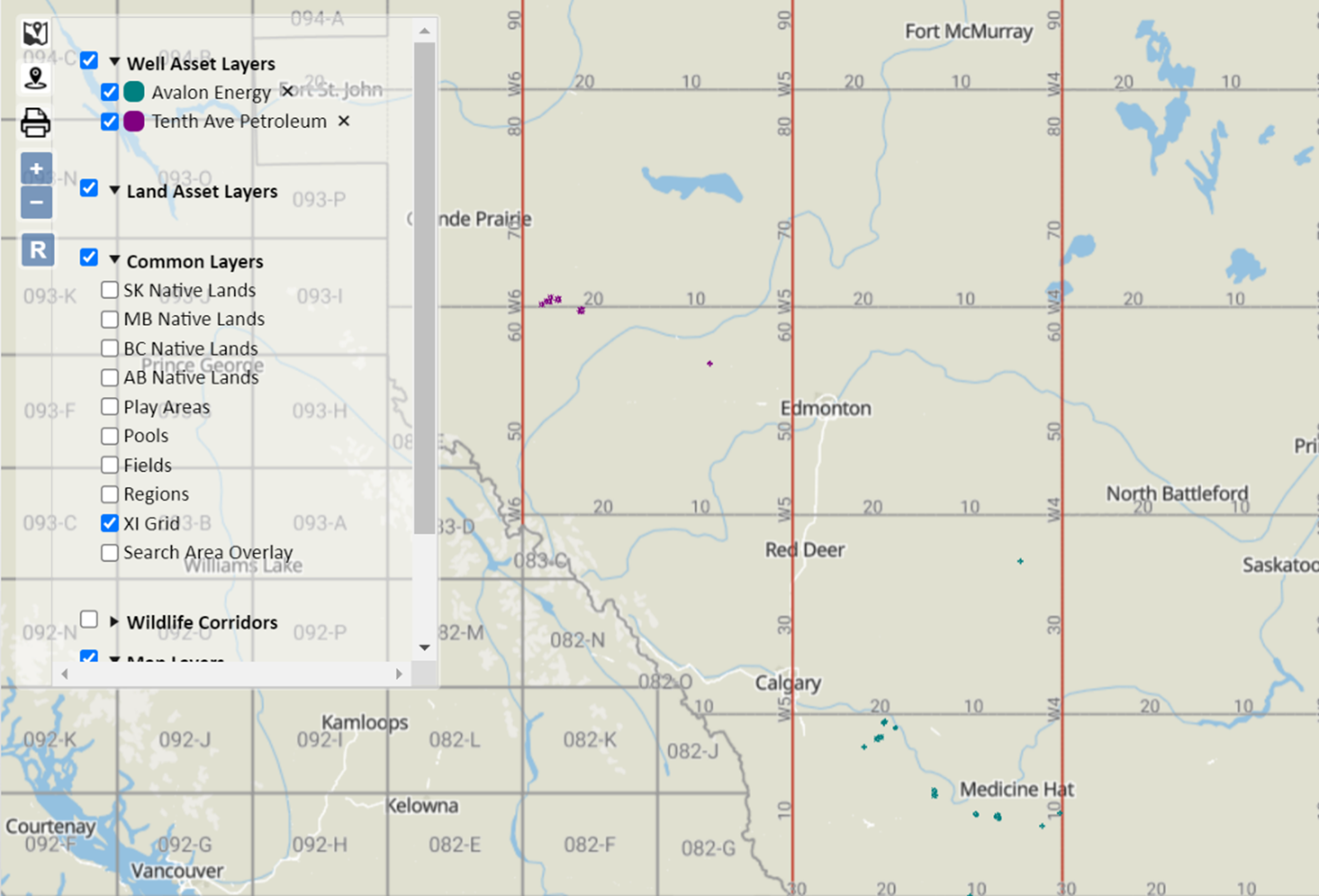

The announcement release mentioned the acquisition was transformative. This is apparent when looking at a map of these assets

There is no direct overlap in the two companies’ land positions.

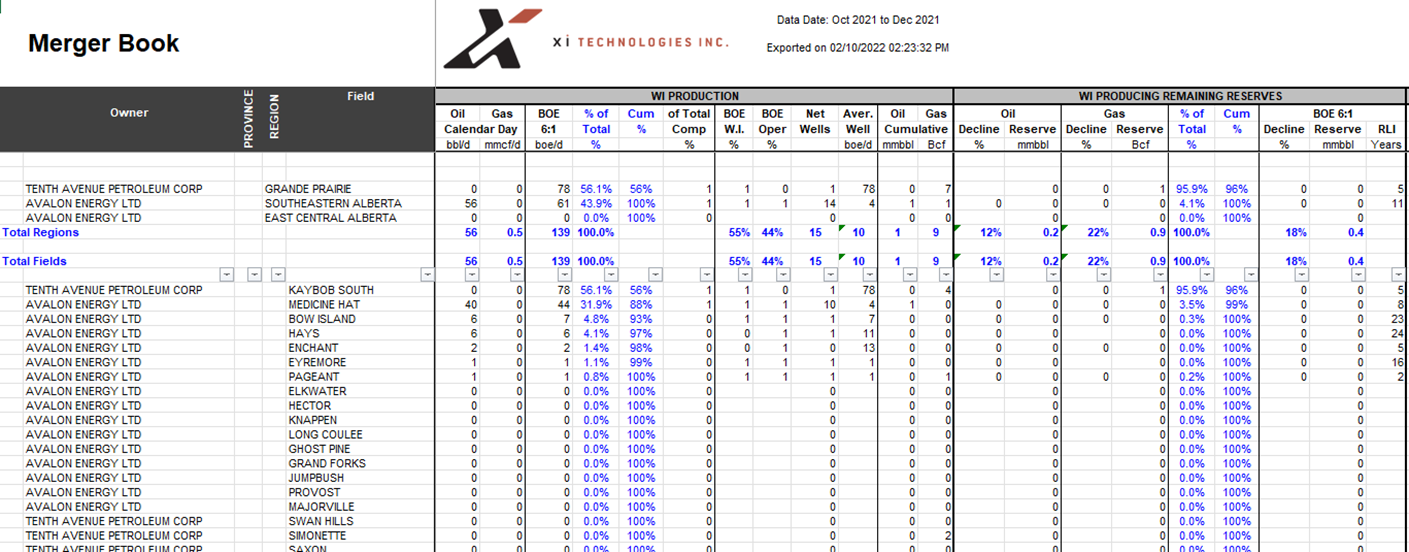

As this acquisition is a move for Tenth Avenue to a new area, the typical workflow of looking for non-core fall out properties does not make sense. However, we have added a Merger Book for your reference.

Click here to download the Merger Book report from AssetBook.

If you’d like to learn more about how XI’s AssetSuite software can analyze potential mergers and acquisitions, including examining potential liabilities and emissions, contact XI Technologies.