Each week, XI Technologies scans its unique combination of enhanced industry data to provide trends and insights that have value for professionals doing business in the WCSB. If you’d like Wednesday Word to the Wise delivered directly to your inbox, subscribe here.

We reviewed the Montney in March of 2021 and activity in this play since then has continued to remain essential to the Western Canadian Sedimentary Basin development. Today, we’ll draw on XI Technologies’ enriched industry data to update a few perspectives as to what’s continuing in the Montney play.

Ownership in Montney Assets

Last year, we looked at a specific area of the Montney: the BC Dawson Creek area. This time let’s look at the full spectrum.

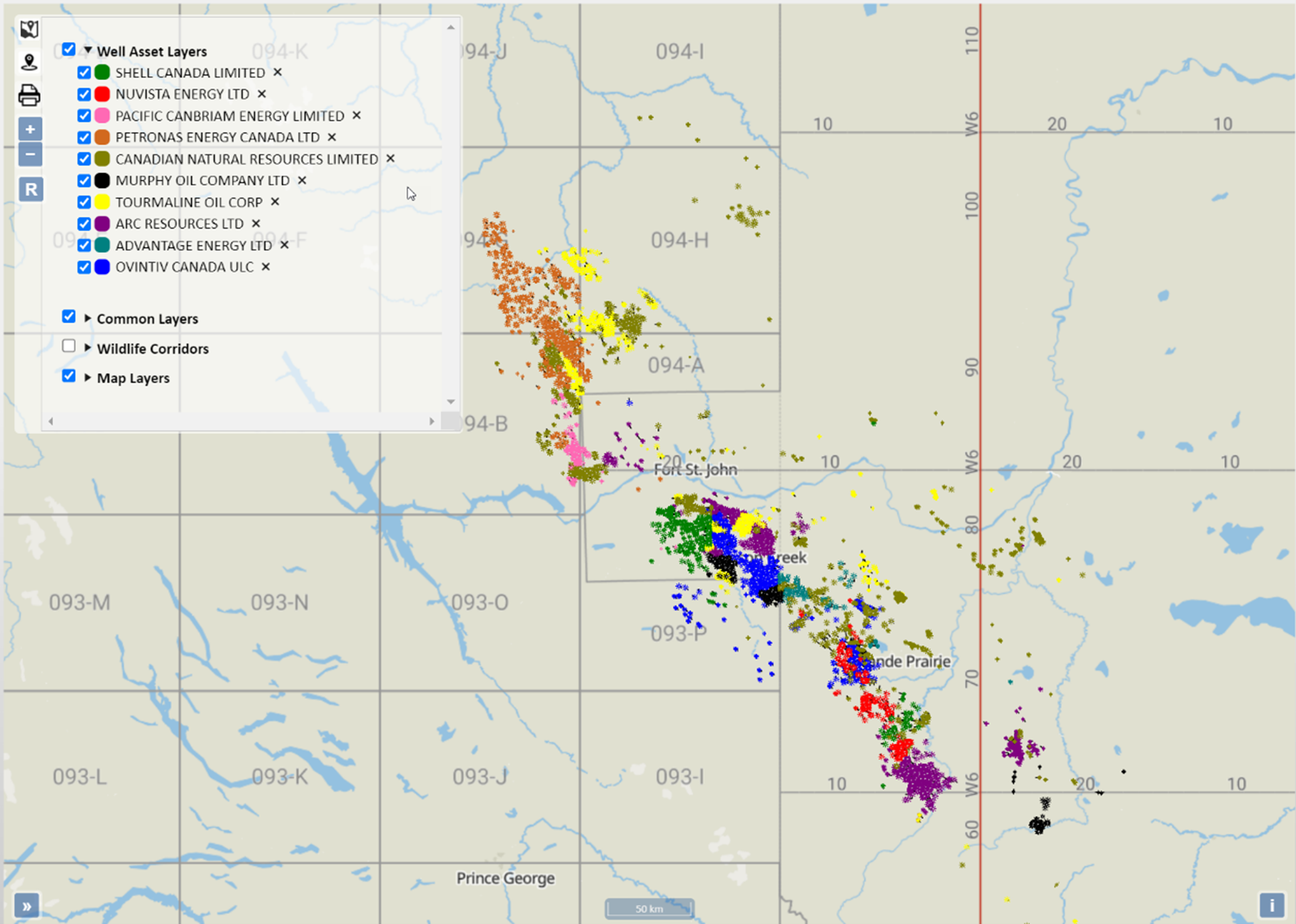

A little over 80% of the ownership of this prolific zone is held by the top 10 companies and there is approximately 1.6 million boe/day being produced in total. Twenty-two companies have more than 80% of their production from this zone, seven of which are in the top 10 companies who own it. These statistics make it very clear how critical this play has become to our industry.

Click here for a spreadsheet of this data.

The map below shows the top 10 Montney players (based on current boe/d) in this area:

Production History of Montney Assets

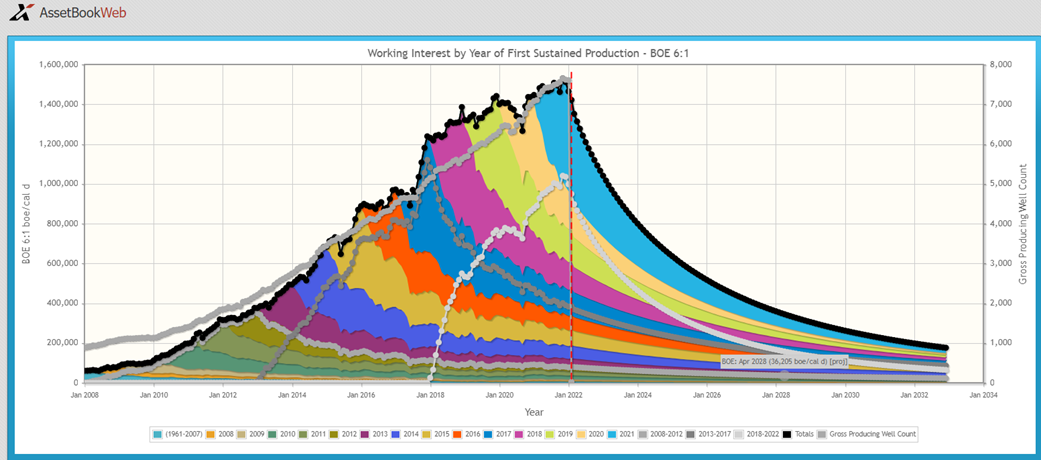

Let’s investigate the Montney play a little further. Looking at the vintage of this production confirms that most activity in the Montney is relatively recent with a good percentage of the production coming from 2017 or later.

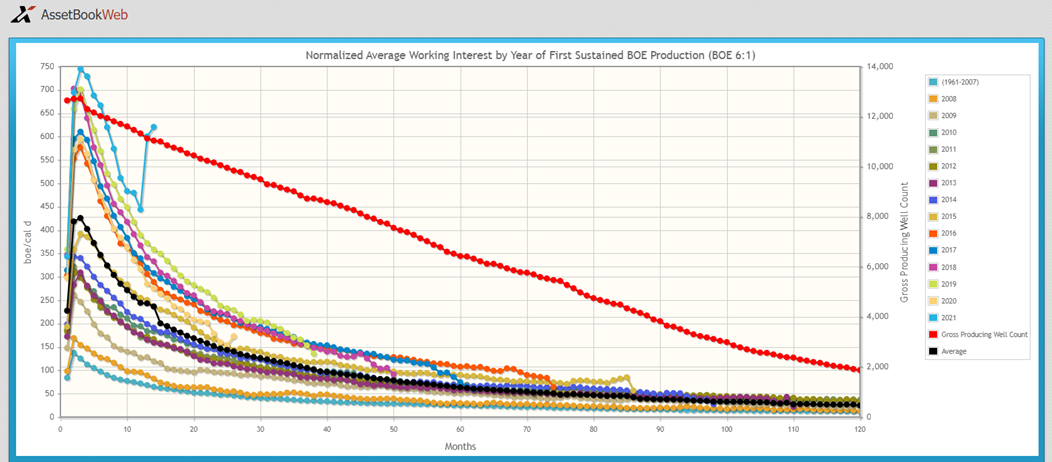

Looking at normalized average production based on year gives a sense of the change in the productivity of the play over the years and the current uptick in activity.

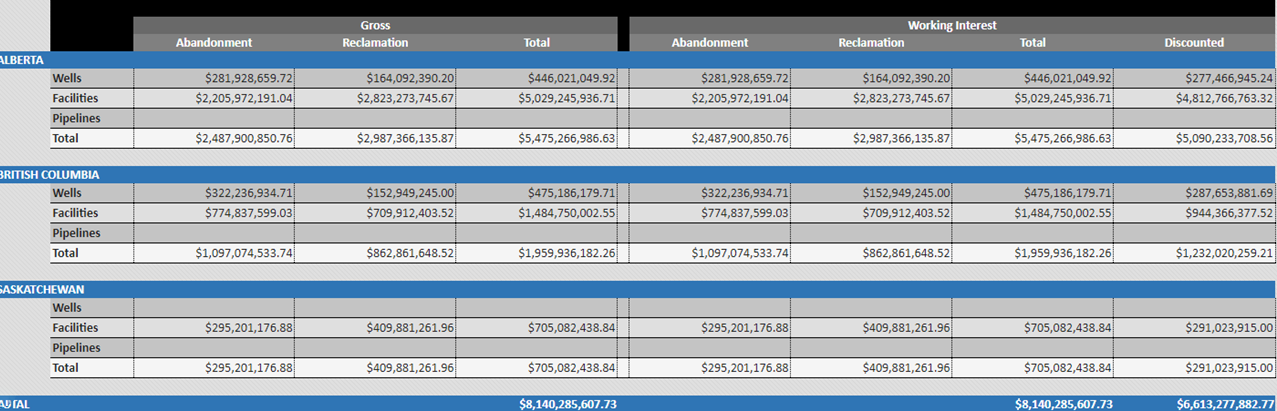

It is also important to look at liabilities between various acquisition opportunities to determine differences in future obligations.

In a future article we’ll explore drilling activity to get a more complete picture of the area.

If you’d like to learn more about how XI’s AssetSuite software can analyze regions throughout Western Canada, contact XI Technologies.