Each week, XI Technologies scans its unique combination of enhanced industry data to provide trends and insights that have value for professionals doing business in the WCSB. If you’d like Wednesday Word to the Wise delivered directly to your inbox, subscribe here.

Industry consolidation is a common occurrence in the Western Canadian Sedimentary Basin, especially in periods of downturn such as the downturn in 2014 or the oil price crash in 2020. At XI Technologies, we periodically look at our data to see where the industry is at in terms of consolidation, having previously looked at the 2019 data.

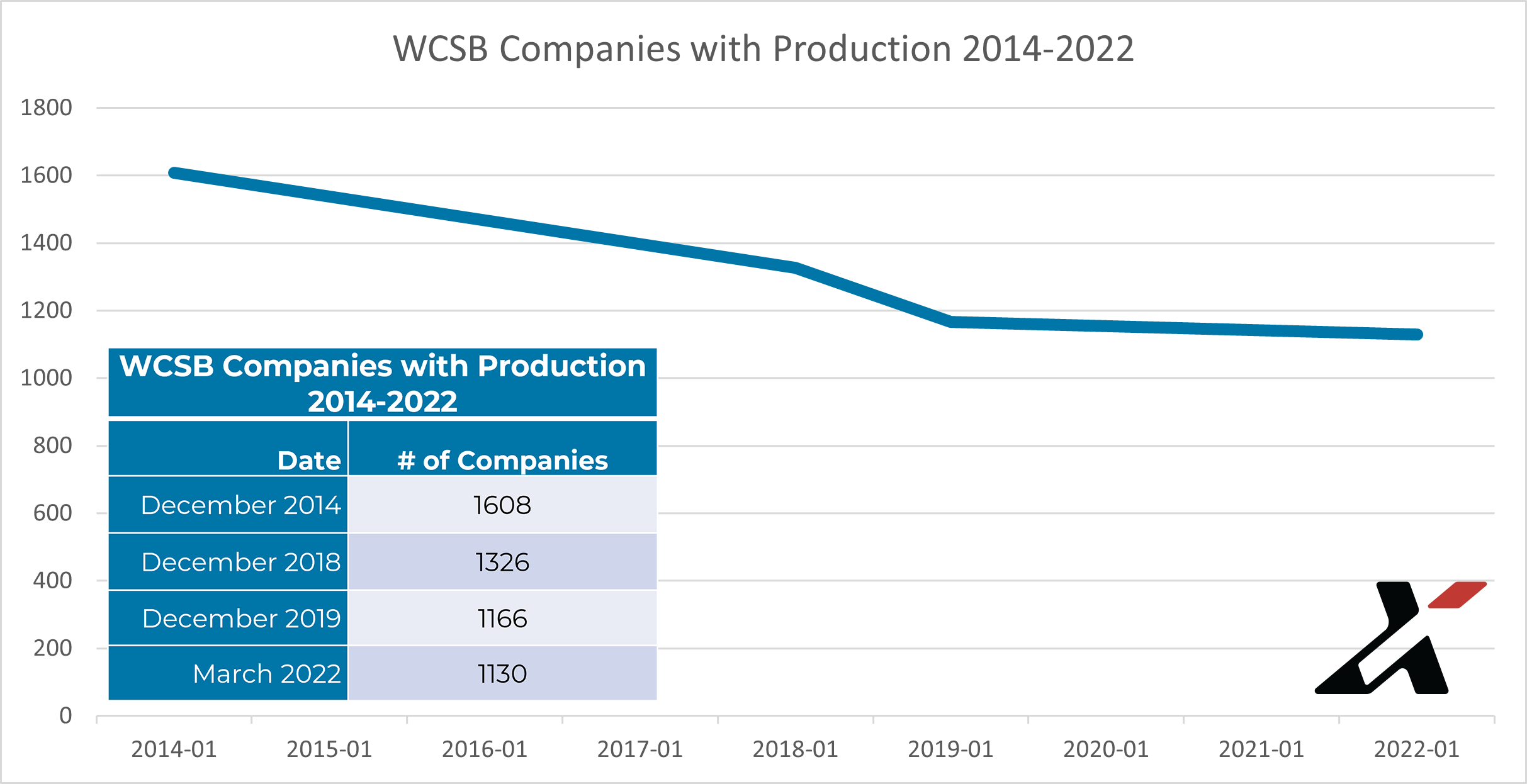

According to the enhanced public data in XI’s AssetBook, from December 2019 to March 2022, the number of active companies with reported production in the WCSB shrunk by 3 percent. Active company count (greater than 0 BOE/Day) went from 1,166 in December 2019 to 1,130 at the end of March 2022.

This reduction is marginal in comparison to the level of consolidation we’ve seen in other years, suggesting that the period of consolidation we’ve seen in recent years may be slowing. To demonstrate, let’s take a wider look at consolidation to possibly reveal some trends.

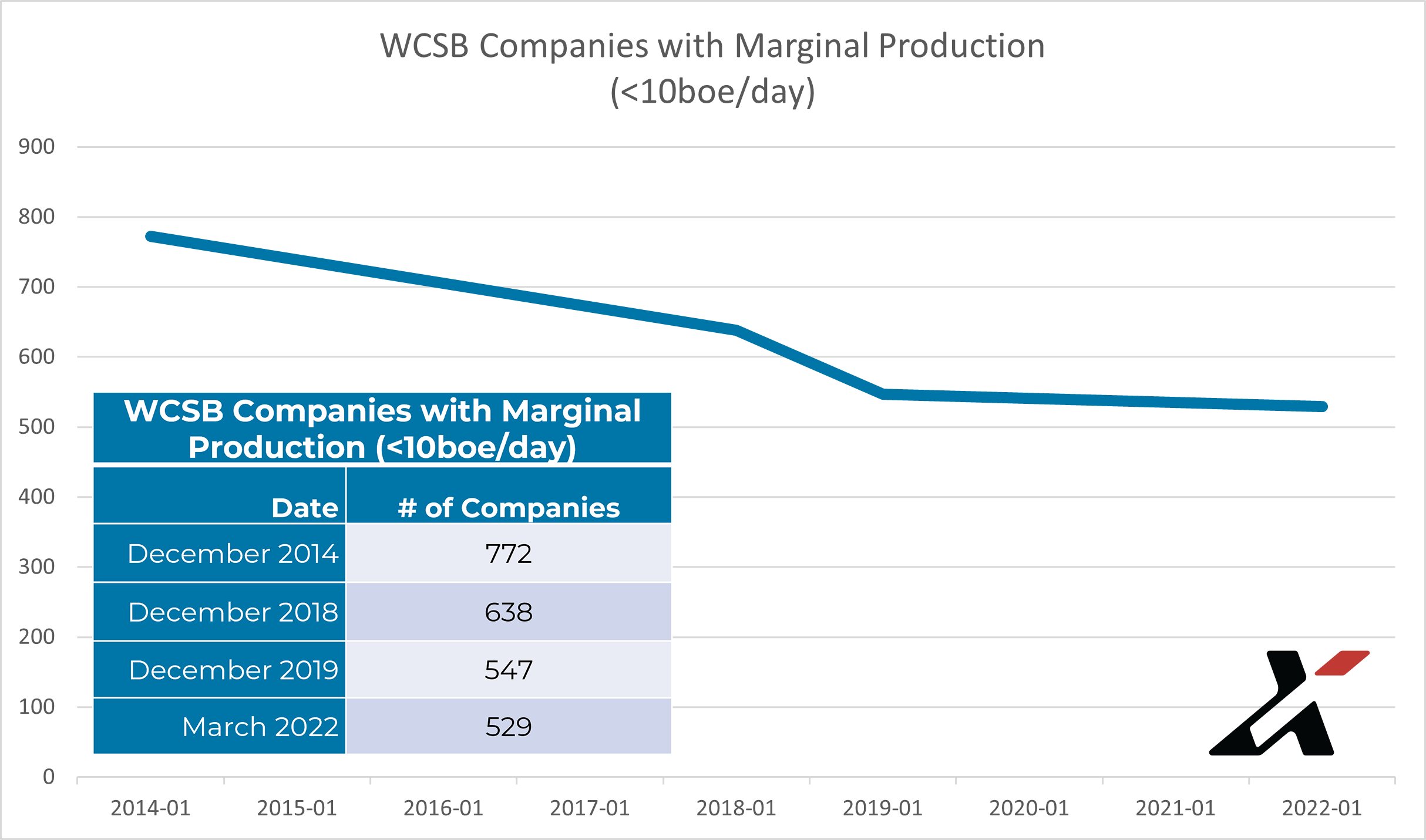

Because a lot of consolidation happens with companies at the lowest production levels, we thought we’d pull out the data among companies with marginal production (defined as total company production at less than 10 BOE/d) to see if the trend persists.

Looking at these trendlines suggests that consolidation has leveled out since the end of 2019. Note: the charts merely reflect the trend from 2014 to now and do not reflect any potential variance within the years not captured in the data table.

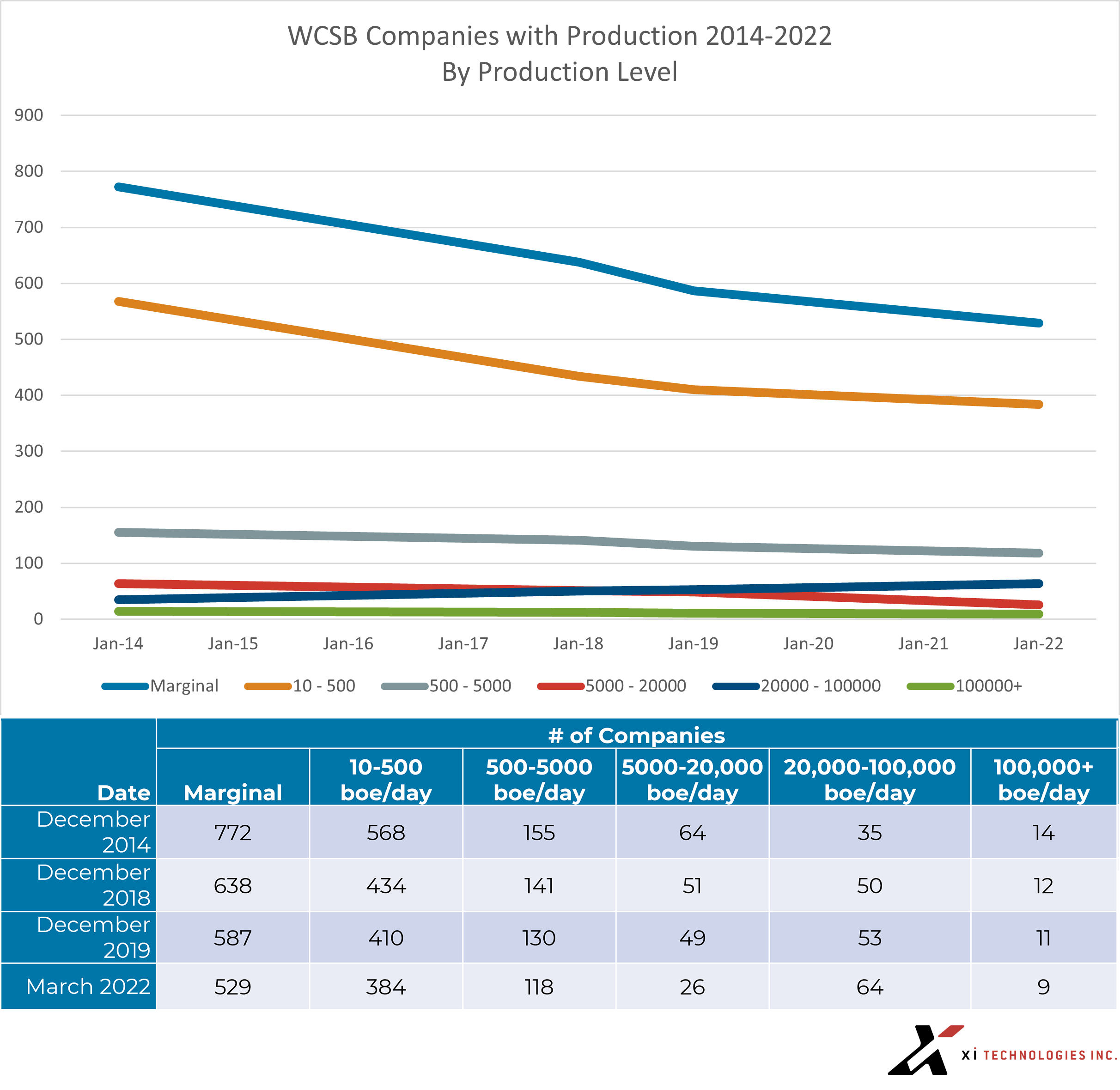

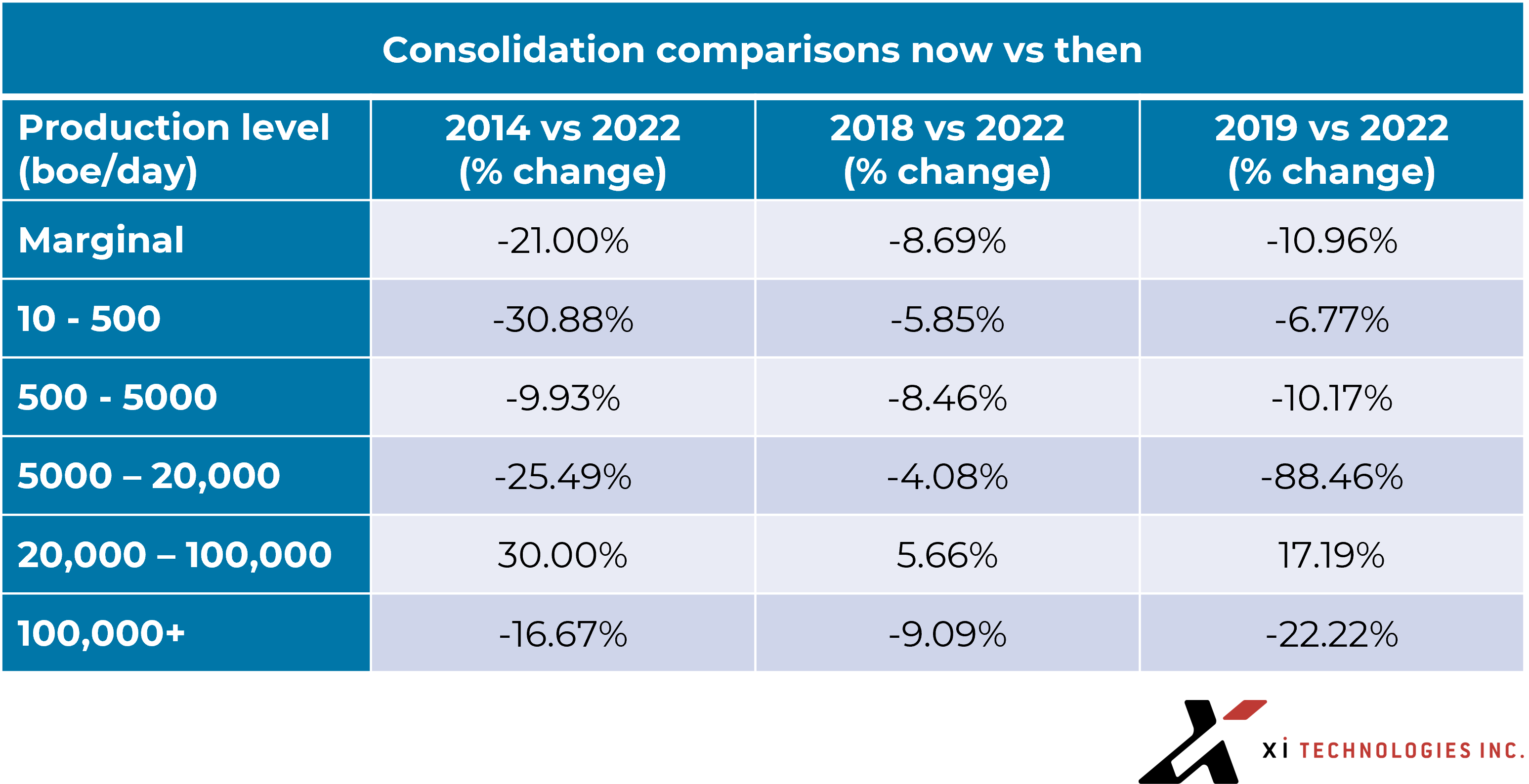

To get a better sense of what types of companies have been consolidating over the years, we grouped them into categories by BOE/day.

Some notes on these comparisons:

There are 10 companies that moved into the 500-20,000 grouping in 2022, three of which were because they purchased smaller companies.

There are 29 companies who moved into the 20,000 – 100,000 grouping in 2022 from a lower group – 17 due to amalgamations of smaller companies. Two companies moved into this category from a higher production group due to the divestment of assets.

As for marginal producers:

- 12 were purchased and amalgamated as “subsidiaries” in our data.

- 20 moved to the next highest grouping (10-500 boe/day), 3 of which moved from having less than 10 to more than 100.

- 36 ceased to exist

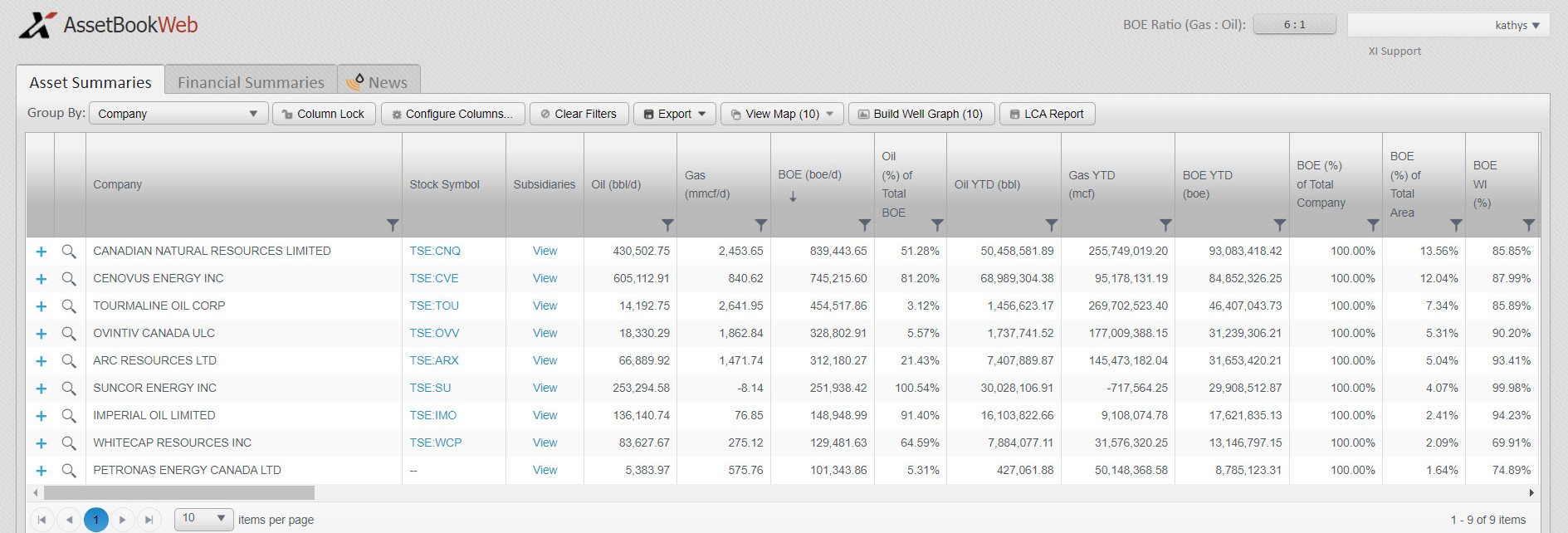

These are the 9 companies in the 100,000+ group:

XI has the data required to independently evaluate opportunities and spot trends for strategic business planning. To learn how XI’s AssetSuite can help you optimize your M&A process, visit our website or contact us for a demo.