Oct 19 (Reuters) – The White House is nearing the end of its scheduled release of 180 million barrels of crude oil from the U.S. Strategic Petroleum Reserve, the largest such release from the stockpile in history.

The move was announced following Moscow’s invasion of Ukraine on Feb. 24 and subsequent sanctions slapped on Russia by the United States and its allies. Overall, the releases have helped reduce the price of crude worldwide, as the international benchmark Brent is currently around $90 a barrel, down from a peak of nearly $130 touched in early March.

The Biden Administration has sold roughly 165 million barrels of its planned 180 million barrel release, but has discussed bringing forward sales already approved for 2023, with additional plans to buy back oil later if prices decline.

WHY WAS THE SPR CREATED?

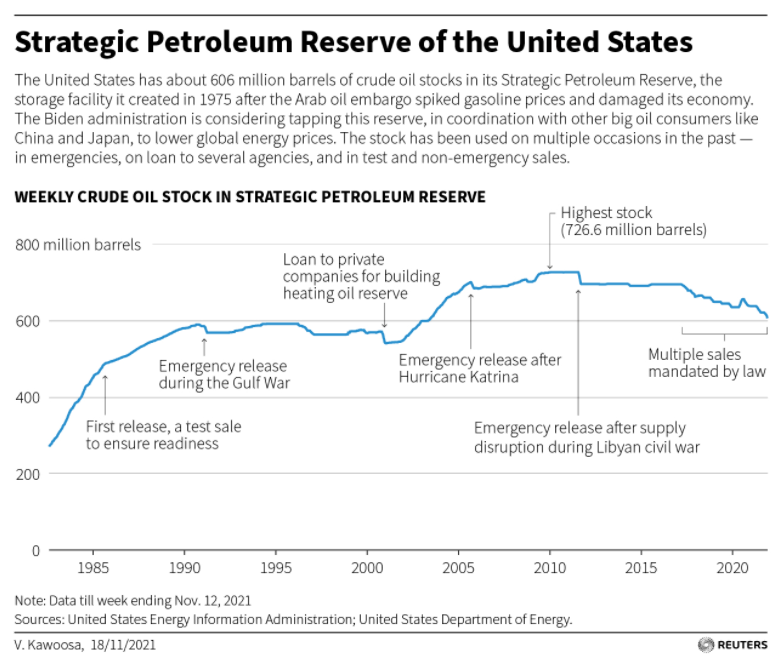

The United States created the SPR in 1975 after the Arab oil embargo spiked gasoline prices and damaged the U.S. economy. Presidents have tapped the stockpile to calm oil markets during war or when hurricanes hit oil infrastructure along the U.S. Gulf of Mexico.

HOW MUCH OIL DOES THE SPR HOLD?

The reserve currently holds about 405 million barrels in dozens of caverns in four heavily guarded locations on the Louisiana and Texas coasts. The country also maintains small heating oil and gasoline reserves in the U.S. Northeast.

HOW DOES THE SPR GET OIL TO MARKET?

Because of its location near big U.S. refining or petrochemical centers, the SPR can ship as much as 4.4 million barrels per day. It can take only 13 days from a presidential decision for the first oil to enter the U.S. market, according to the Energy Department.

Under a sale, the Energy Department usually holds an online auction in which energy companies bid on the oil. Under a swap, oil companies take crude but are required to return it, plus interest.

U.S. presidents authorized emergency sales from the SPR in 2011 during a war in OPEC member Libya, during the Gulf War in 1991 and after Hurricane Katrina in 2005.

Oil swaps have taken place more frequently, with the last exchange held in September after Hurricane Ida.

WHO HAS BEEN BUYING U.S. RESERVES?

The largest buyers of U.S. strategic reserves have been U.S.-based refining companies, led by units of Valero, Marathon Petroleum, and Exxon Mobil. Some of the barrels have made their way overseas, as oil companies with large trading arms like Shell and BP ship crude around the world.

WHAT OTHER COUNTRIES HAVE STRATEGIC RESERVES?

The United States is responsible for about half of the world’s strategic petroleum reserves.

The United States and the other members of the International Energy Agency, which include Britain, Germany, Japan and Australia, are required to hold oil in emergency reserves equivalent to 90 days of net oil imports. Japan has one of the largest reserves after China and the United States.

State storage across the Organisation for Economic Cooperation and Development, most of whose members belong to IEA, came to 988 million barrels of crude as of August, down from nearly 1.2 billion barrels in January, according to the IEA.