Each week, XI Technologies uncovers trends and insights using our enhanced data and software focused on the WCSB. If you’d like Word to the Wise delivered directly to your inbox, subscribe here.

On May 30, 2023, XI Technologies took a deeper dive into the region of Grande Prairie with respect to expiring lands, assets and drilling activity. We asked at that time what other regions would be of interest, and various areas in Saskatchewan were requested.

Let’s take a deeper look at the region of Saskatchewan Area II (Sask Area II) and its oil and gas ownership.

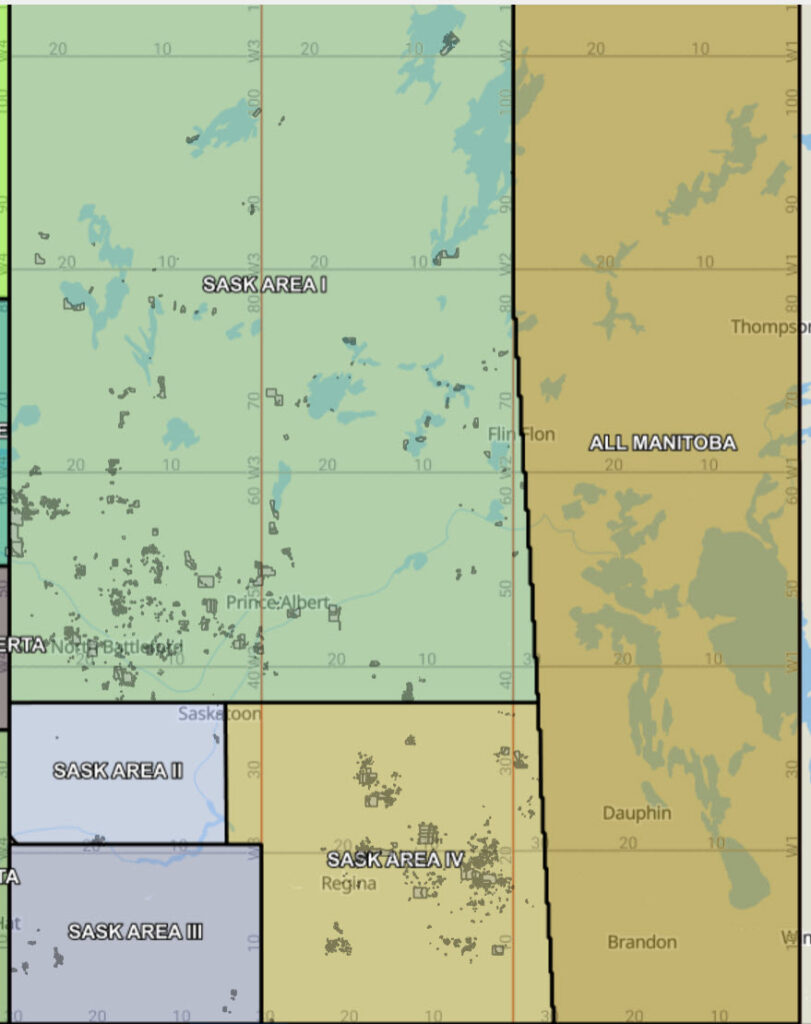

Figure 1 – Saskatchewan areas defined.

The smallest landmass of all Saskatchewan regions, this little powerhouse had 42.6%, or 702 out of 1648 of the wells drilled in Saskatchewan in the last 12 months.

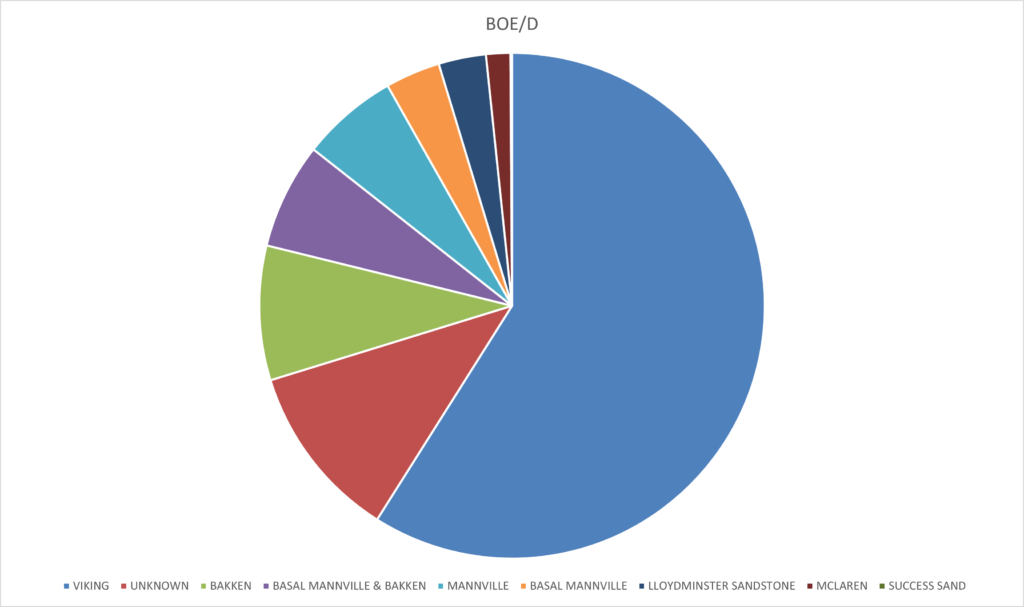

There are currently 109,361 boe/day coming from the region defined as Sask Area II or 21% of all production in Saskatchewan (Figure 1). The Viking zone currently makes up just shy of 60% of the production from this area:

Figure 2 – Sask Area II zone breakout.

There is a large tranche of “Unknown” zone production the bulk of which is brand new and most likely will prove out to be Viking or Success Sand, almost all of which is horizontal drilling.

While the Viking play in this area is not new, the vertical well drilling into the Viking started around 2020 and really gained momentum in 2017 with 1025 wells having a final drill date in that year. The biggest owner of this play is Teine Energy Ltd., as the graph below illustrates:

Figure 3 – Sask Area II Viking production by company (top 10).

These Viking wells and facilities have a total undiscounted liability of approximately $1.322 Billion, with 31% of the well licenses and 65% of the facilities designated as inactive. Over 66% of the active wells are 10 years or younger, and 728 spills have been reported on all assets.

To see a full summary of Sask Area II ownership, please download our Sask Area II report here.

If you’d like to learn more about how XI’s AssetSuite software can analyze companies, packages, or regions throughout Western Canada, visit our website or contact XI Technologies.