BTG Energy Corporation has filed an application with the AER to transfer the licences for 297 pipelines, 146 facilities and 4 wells from Certus Oil & Gas Inc. to BTG. That licence transfer is currently listed as “Pending” AER Approval.

The affected locations for the transfer are mapped below via BOE Intel.

BTG is a freshly capitalized private equity fund that raised $74.2 MM in December, 2022 with the mandate to “make investments in the Canadian energy infrastructure sector.” The company boasts a strong advisory board and senior operating partners with decades worth of infrastructure experience.

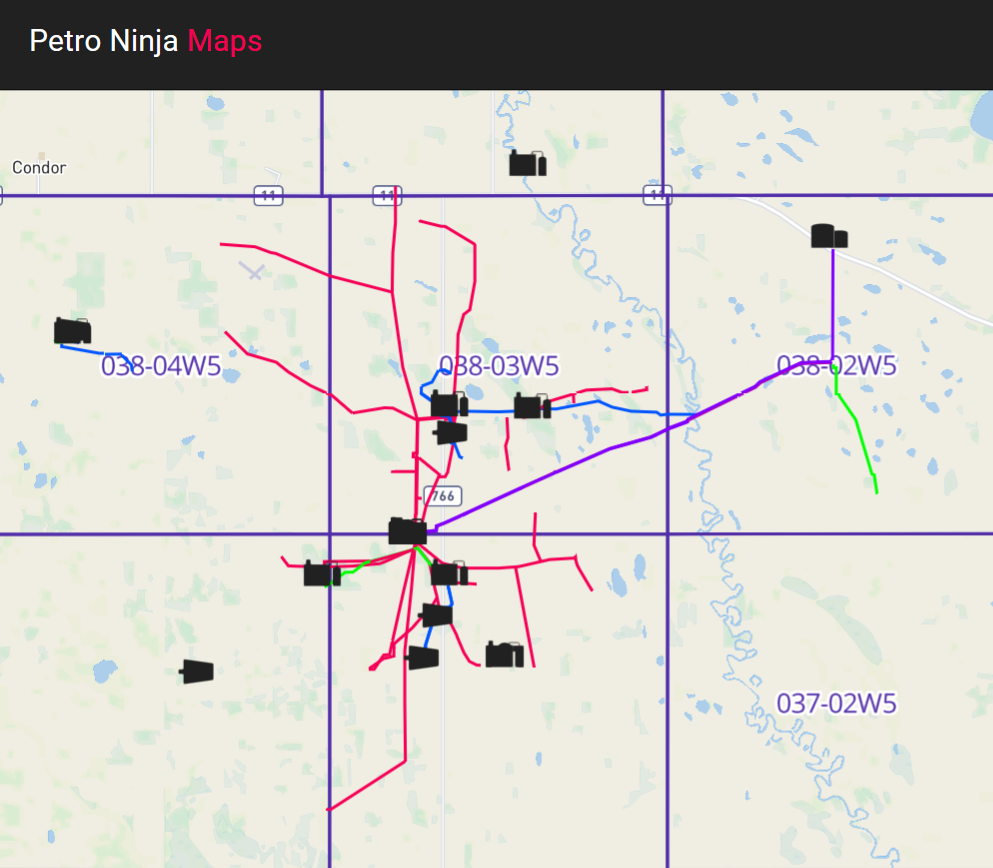

According to Petro Ninja, BTG does currently own some facilities and pipelines, with those assets pictured below. The assets set to be transferred from Certus would be surrounding the current assets.

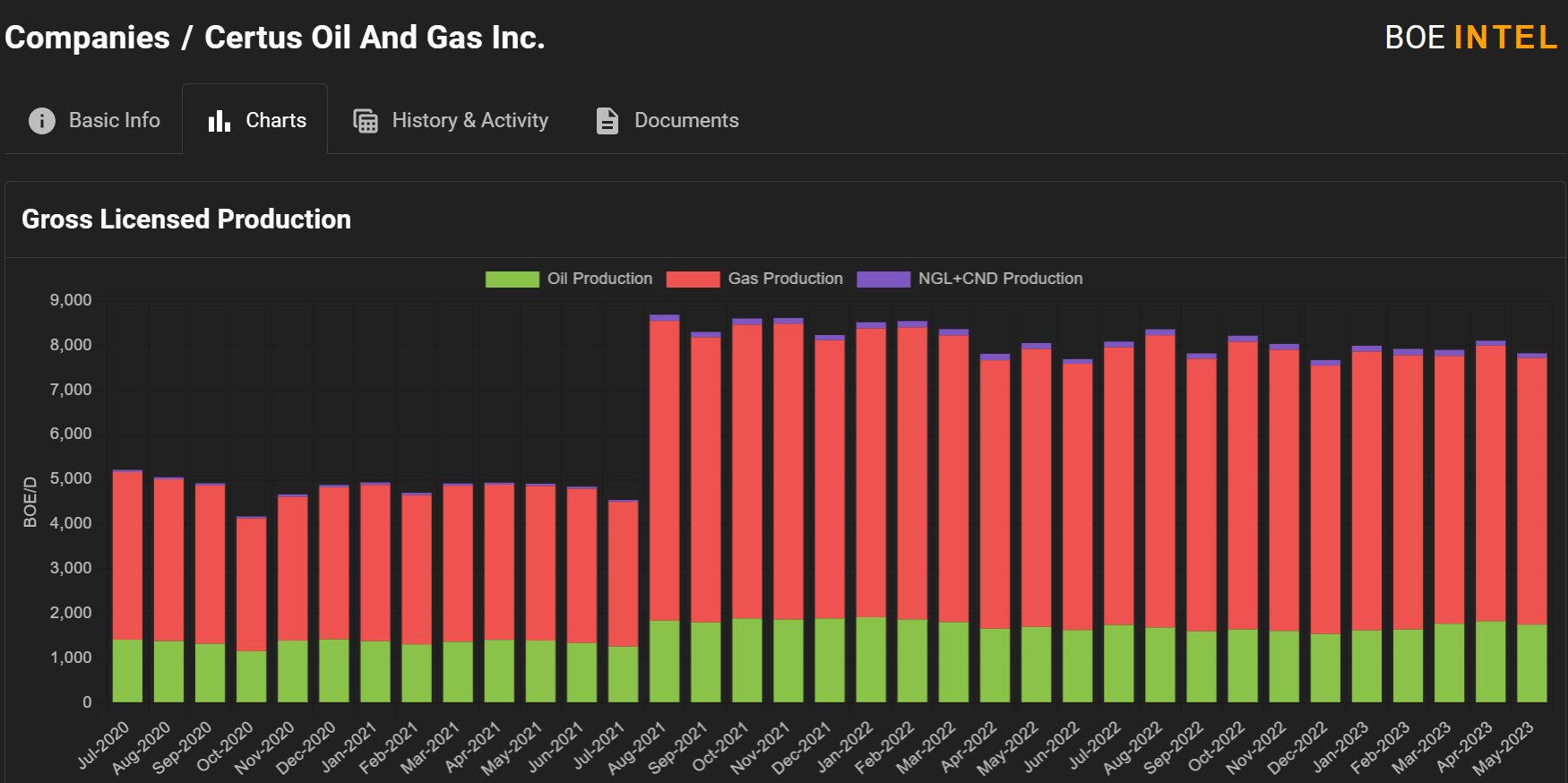

We don’t know much about the financials for Certus Oil & Gas as it is private, but it acquired Sitka Exploration in the summer of 2020. Certus has not been particularly active as a driller, only spudding 3 wells in the last couple of years, targeting the Glauc and Ellersie plays. BOE Intel estimates gross licensed production (all wells licensed to the company at 100% working interest) of slightly less than 8 mboe/d in May 2023. Note that NGLs do not get reported at the well level in Alberta, but instead get stripped out of gas volumes later on, so actual liquids volumes for Certus are likely higher. You will also observe that gross licensed production did not reflect the Sitka acquisition until the summer of 2021 when the actual well licences were transferred.

If you would like a demo for BOE Intel, contact us here.