For the next entry in our BOE Intel Field Roundup article series, we’re examining one of the most established fields in the Canadian oil patch: Pembina. Despite a track record of production that extends decades into the past, this property continues to prove a productive asset for companies operating in the region. Unlike many other major fields in the Western Canadian Sedimentary Basin, a large number of companies own significant mineral rights holdings at Pembina; the field is operated by a generous handful of public and private companies that includes Cenovus, Ricochet Oil and Bonterra Energy. For the purposes of this article, we are focusing specifically on Cardium drilling at Pembina.

Ownership in the field is highly fragmented, and many companies hold land positions that aren’t contiguous. Our data suggests Cenovus, Obsidian Energy, Ricochet, Westbrick Energy, and Bonterra each own 10% or more of the mineral right agreements in the Cardium zone of Pembina, with the remainder being split among more than 10 other companies.

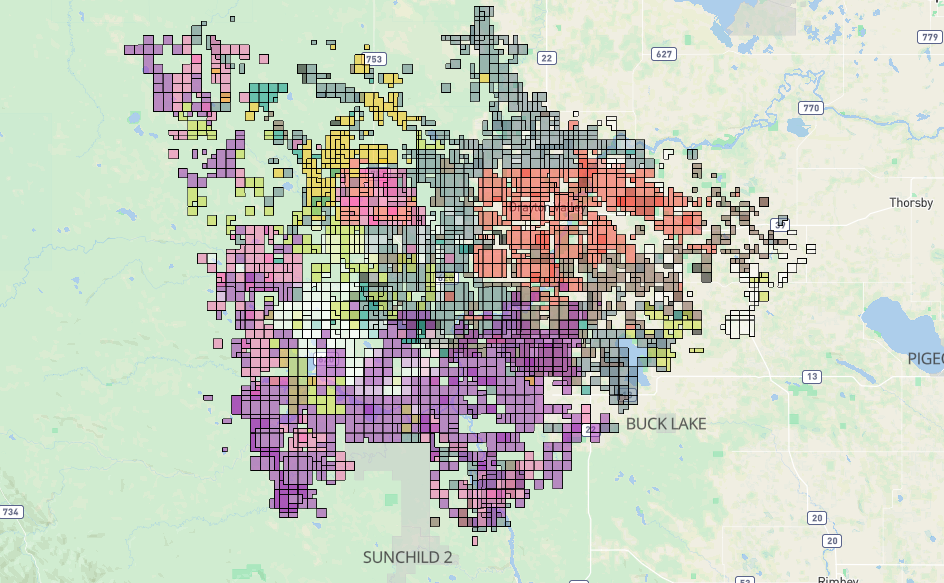

Pembina Area Crown Mineral Right Map by Company (Cenovus in purple, Bonterra in brown, Baccalieu in blue, Ricochet in red, Whitecap in yellow, Obsidian in grey, InPlay in black, Saturn in green, Sinopec in white, Westbrick in pink)

Over the past 5 years, Pembina Cardium licence and spud counts have fluctuated with lows of around 40 in 2020 and highs of just under 100 in 2022. Well activity has trended upwards since 2021, and this trend appears set to continue in 2023; assuming current trends continue to December 31, there will have been 91 licences and 82 spuds through the year.

Since January 1 2022, there have been 147 Cardium licences obtained at Pembina. Bonterra has been the most active licensee in the region by almost 30 licences, with the company obtaining 57 Pembina Cardium licences in the past 19 months. Whitecap Resources, Ricochet Oil and Obsidian Energy all have 10 or more licences, and the remaining 11 companies combined for 43 licences over the same period.

| Licensee | Pembina Cardium Licence Count |

| Bonterra Energy Corp. | 57 |

| Whitecap Resources Inc. | 19 |

| Ricochet Oil Corp. | 18 |

| Obsidian Energy Ltd. | 10 |

| Inplay Oil Corp. | 9 |

| Baccalieu Energy Inc. | 8 |

| Saturn Oil & Gas Inc. | 7 |

| Eclipse Resources Ltd. | 5 |

| Cenovus Energy Inc. | 4 |

| Westbrick Energy Ltd. | 3 |

| Spartan Delta Corp. | 2 |

| Tamarack Valley Energy Ltd. | 2 |

| Clearview Resources Ltd. | 1 |

| I3 Energy Canada Ltd. | 1 |

| Sinopec Daylight Energy Ltd. | 1 |

| TOTAL | 147 |

Pembina Cardium Licences Obtained Since January 1, 2022 (Bonterra in brown, Ricochet in red, Whitecap in purple, Obsidian in grey, All Others in black)

With its commanding lead in Pembina Cardium licensing activity, we wanted to specifically highlight Bonterra’s current position and recent activities. Bonterra’s Pembina Cardium assets make up the bulk of their gross licensed production and this has been the case throughout the past 5 years. Ignoring significant drops in pandemic-impacted 2020, Bonterra’s drilling activity and gross licensed production volumes have been largely consistent through time. The company’s Pembina Cardium production and drilling are reflective of trends we’ve observed across the field; consistent investment through time generating consistent output.

| Year | Bonterra Pembina Cardium Spud Count |

| 2018 | 26 |

| 2019 | 19 |

| 2020 | 17 |

| 2021 | 38 |

| 2022 | 25 |

| 2023 | 28 |

| Total | 153 |

The top 10 Pembina Cardium wells by recent production provide an interesting picture of the varied output observed across different areas of the play. While recent production from the Pembina Cardium is skewed more towards oil, the top 3 wells in this list are actually under 50% oil by recent production, and the 5th and 6th most productive wells did not produce any oil. Part of this can be explained by maturation of Gas-Oil Ratios (GORs) for these wells, but it’s interesting to note that highly-productive Pembina Cardium wells can be found with a range of commodity mixes. Cenovus’ advantage with respect to contiguous mineral right ownership in the west and south portions of the field appears to be paying off, as they own the top 3 wells in our list. This is not to say that productive wells can’t be found in other areas of the field, as Ricochet Oil, Westbrick Energy, and Whitecap Resources each have 2 wells each in the top 10.

Top 10 Wells

| UWI | Licensee | Spud Date | Recent Daily Oil (BBL/d) | Recent Daily Gas (mcf/d) | Recent Equivalent (BOE/d) | Recent Oil % |

| 100091304609W500 | Cenovus Energy Inc. | 2022-10-10 | 193 | 1947 | 518 | 37.3 |

| 103011304609W500 | Cenovus Energy Inc. | 2022-10-25 | 215 | 1679 | 495 | 43.4 |

| 100081304609W500 | Cenovus Energy Inc. | 2022-09-27 | 218 | 1623 | 489 | 44.6 |

| 100051204906W500 | Ricochet Oil Corp. | 2022-08-09 | 344 | 383 | 408 | 84.3 |

| 100162004509W500 | Westbrick Energy Ltd. | 2022-12-14 | 0 | 2433 | 405 | 0.0 |

| 100152004509W500 | Westbrick Energy Ltd. | 2022-12-28 | 0 | 2280 | 380 | 0.0 |

| 102152904907W500 | Ricochet Oil Corp. | 2023-02-27 | 255 | 693 | 370 | 68.8 |

| 100092404911W500 | Whitecap Resources Inc. | 2023-02-27 | 309 | 235 | 348 | 88.8 |

| 102162404911W500 | Whitecap Resources Inc. | 2023-01-28 | 288 | 307 | 340 | 84.9 |

| 100063404507W500 | Tamarack Valley Energy Ltd. | 2022-11-11 | 29 | 1818 | 332 | 8.6 |

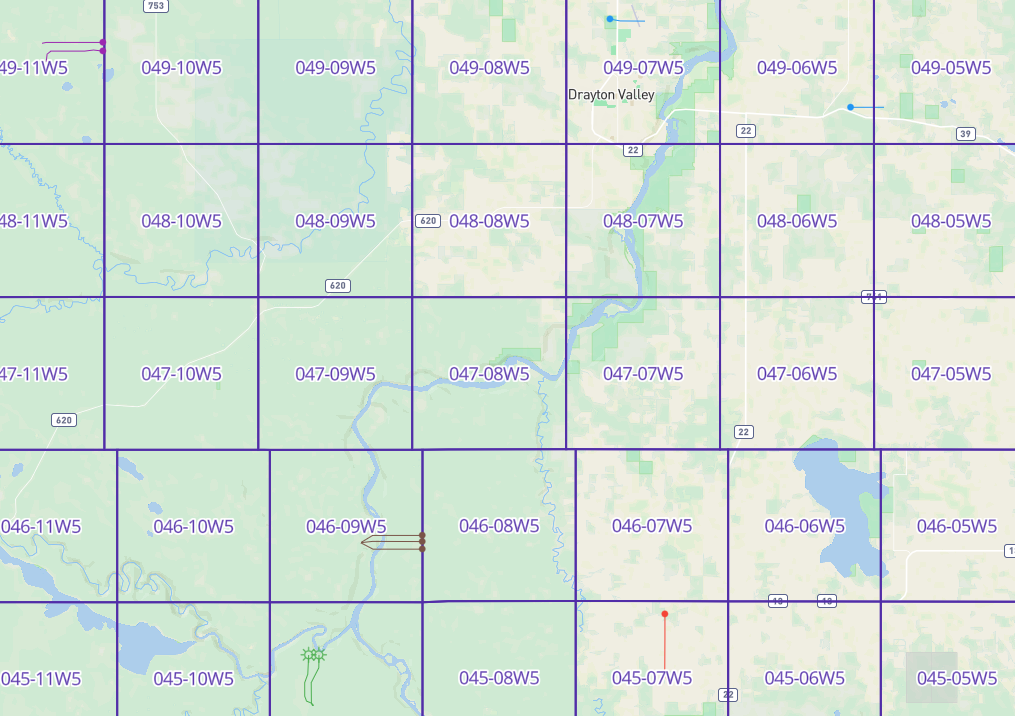

Top 10 Pembina Cardium Wells (Cenovus in brown, Ricochet in blue, Westbrick in green, Whitecap in purple, Tamarack Valley in red)

With respect to future developments in the Pembina Cardium, our team are intrigued by the possibility that new technologies will begin to open up more extraction opportunities in the field. The advent of horizontal drilling and multi-stage fracturing brought this field back onto the map in the past 20 years, and we have seen activity in other Canadian plays, such as the Clearwater and the Viking, be reignited by recent technological innovations. In order to stay abreast of the latest developments in the Pembina Cardium, and all other fields in the WCSB, check out BOE Intel. Our platform provides unparalleled access to data on well activity, asset transfers, and more.