Bonavista made headlines in 2020 when the company announced that it was delisting from the Toronto Stock Exchange as part of a recapitalization. Much has changed in Canadian oil and gas since then, and we wanted to do some digging to see what Bonavista has been up to since going private. The company, a sizable gas and condensate producer, has largely stuck to its core assets over the past few years. The most important sources of Bonavista’s production are its Deep Basin assets, which the company divides into “Deep Basin Northern” and “Deep Basin Central”.

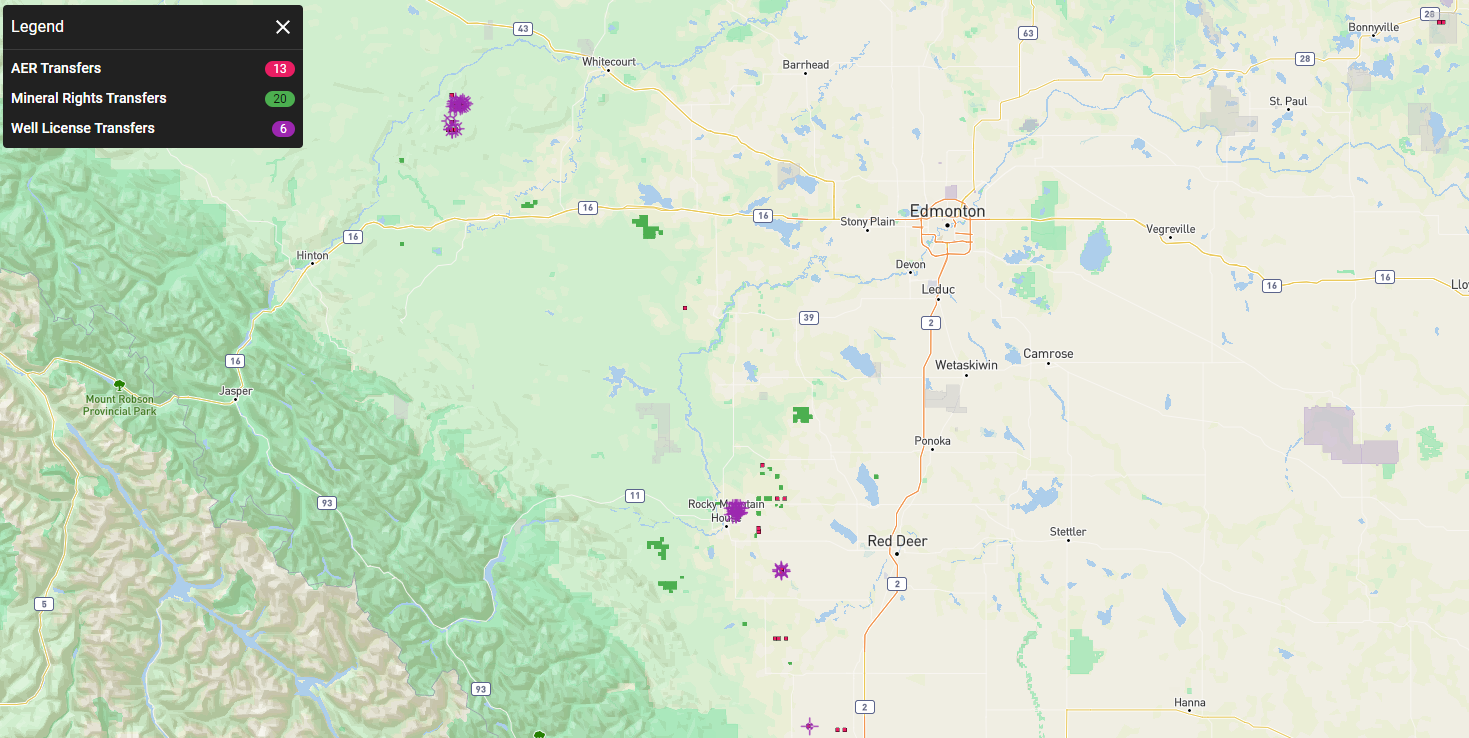

Bonavista Crown Mineral Rights as of September 6, 2023

Bonavista has been involved in numerous large transfers over the past two years, with the company seemingly shifting away from non-core assets while bolstering its position in the Deep Basin area. With respect to assets that Bonavista has transferred to other firms, a number of key well licence transfers are highlighted on the map below. The largest transfer involved 468 wells that were moved to HWN Energy Ltd. in May/June 2023. These wells produced over 2,100 BOE/d in the last month prior to being transferred and targeted a variety of formations including the Cardium, the Lower Manville, and the Ellerslie among others. The company also transferred 184 licences to Tourmaline in April 2022, which produced a combined total of over 1,300 BOE/d in the last month prior to the transfer, representing the end of the company’s significant activity in BC.

When it comes to assets acquired by Bonavista over the same period, the company’s moves are best described as a strategic augmentation of its existing positions. The company was the recipient of just over 75 sections of land in the past 24 months, all within proximity of its main operating areas. Around half of this land was transferred from land brokers, however, and as such it’s possible that the company was operating in these areas prior to revealing its mineral rights ownership publicly. With respect to well licence transfers, the company has been the recipient of 24 licences. The most significant were transfers from Journey Energy and Paramount Resources, both of which involved 9 licences and added around 121 BOE/d in production.

Bonavista has been active in licensing and drilling over the past 5 years, highlighted by the 30 licences the company obtained in 2022. If the company’s current licensing pace continues for the rest of the year, it will end up obtaining over 40 licences in 2023. As outlined in the company’s most recent corporate presentation, Bonavista’s drilling activity has been clustered in the Deep Basin North and Deep Basin Central plays. The primary producing formation targeted by Bonavista over this period was the Glauconitic (67 licences).

Bonavista Spuds by Year (2018 in black, 2019 in green, 2020 in brown, 2021 in purple, 2022 in light blue, 2023 in red)

Bonavista’s gross licensed production in the Deep Basin has gradually declined in the past few years, although the company still generates over 50,000 BOE/d of gross licensed production. The company indicated that its full year average corporate production was around 65,000 BOE/d in 2022, which likely suggests the company is generating production from other areas or from stakes in wells licensed to other producers. The difference is possibly also explained by single stream reporting which does not accurately capture NGL or condensate volumes at the individual well level in Alberta. Given the company’s healthy licensing activity in 2022 and 2023, it’s possible that we see an increase in production in 2024.

Looking across all of the company’s active wells, 9 of the top 10 wells by production are located in the company’s Deep Basin Central project. 7 of the top 10 wells target the Glauconitic producing formation, including the company’s top well which accounted for 1,459 BOE/d in July 2023, while the 2nd and 4th most productive wells targeted the Duvernay. Overall, Bonavista’s wells appear to skew heavily towards gas production, although it’s important to note that public data reporting in Alberta does not include condensate and NGLs; as such the liquids weighting for some of these wells may be higher than shown.

Top 10 Wells

| UWI | Producing Formation | Spud Date | Recent Oil per day (BBL/d) | Recent Gas per day (mcf/d) | Recent BOE per day (BOE/d) |

| 100042003708W500 | GLAUCONITIC SS | 2023-03-28 | 0 | 8,757 | 1,459 |

| 102163104403W500 | DUVERNAY FM | 2023-03-23 | 751 | 2,390 | 1,149 |

| 100011805115W500 | WILRICH MBR | 2022-11-05 | 0 | 6,761 | 1,127 |

| 102153104403W502 | DUVERNAY FM | 2022-02-02 | 626 | 1,928 | 948 |

| 100043503709W500 | GLAUCONITIC SS | 2022-06-18 | 0 | 5,513 | 919 |

| 100033503709W500 | GLAUCONITIC SS | 2022-05-23 | 0 | 3,799 | 633 |

| 100020204106W500 | GLAUCONITIC SS | 2023-03-06 | 0 | 3,449 | 575 |

| 100071803708W500 | GLAUCONITIC SS | 2022-05-15 | 0 | 3,207 | 534 |

| 102140203404W500 | GLAUCONITIC SS | 2022-11-07 | 287 | 1,471 | 533 |

| 103153504007W500 | GLAUCONITIC SS | 2022-07-12 | 0 | 3,189 | 531 |

Top 10 Wells by July 2023 Average Daily Production

We are intrigued by some recent trends we’ve observed from Bonavista; traditionally not a company that drills Duvernay wells, it does appear to be experimenting with the play as of late. Bonavista brought 2 Duvernay wells on production in the last 3 months, with both wells featuring in the company’s top 10 wells as shown above. In fact, Bonavista’s top Duvernay well actually made the top 15 oil wells in the month of July in our top well report. It is also important to keep it in mind that the Deep Basin play is in focus following Peyto Exploration & Development’s acquisition of Repsol’s assets in the region; it will be interesting to see whether we see further activity in the area. To keep tabs on Bonavista and the other Deep Basin producers, check out BOE Intel.