After the market closed yesterday, Saturn Oil & Gas and Crescent Point announced a transaction whereby Saturn will acquire certain Saskatchewan assets from Crescent Point, including Flat Lake and Battrum.

Crescent Point announced the deal to include 13,500 BOE/d (95% liquids) for a disposition amount of $600 MM. The production quoted was the expected average over the next 12 months.

Saturn announced the transaction value as $525 MM from a “net” purchase price perspective including closing adjustments. Saturn press released the acquired production to be 13,000 BOE/d and 96% liquids (11,400 bbl/d of light/medium crude oil, 1,100 bbl/d NGLs and 3,020 mcf/d of natural gas).

For the purposes of our M&A table, we’ve included the deal metrics from Crescent Point’s press release. While there haven’t been too many comparable transactions specific to conventional Saskatchewan assets as of late, we’ve narrowed down a few comparables from the last year and a half and shown them in the table below.

Figure 1 – M&A comparables – Tilt phone sideways to view full table on mobile device

| Date | Acquirer | Seller | Value ($) | Region | BOE/d | % Liq. | $/BOE/d |

| 2024-05-06 | Saturn Oil & Gas | Crescent Point | 600,000,000 | South Saskatchewan/Battrum & Flat Lake | 13,500 | 95 | 44,444 |

| 2023-11-27 | Whitecap Resources | Baytex Energy Corp. | 153,800,000 | SW Saskatchewan/Viking | 4,000 | 100 | 38,450 |

| 2023-03-08 | Woodland Development Corp. | Vermilion Energy | 225,000,000 | SE Saskatchewan | 5,500 | 40,909 | |

| 2022-11-02 | Surge Energy Inc. | Enerplus Corporation | 245,000,000 | SE Saskatachewan/Sparky | 3,850 | 99 | 63,636 |

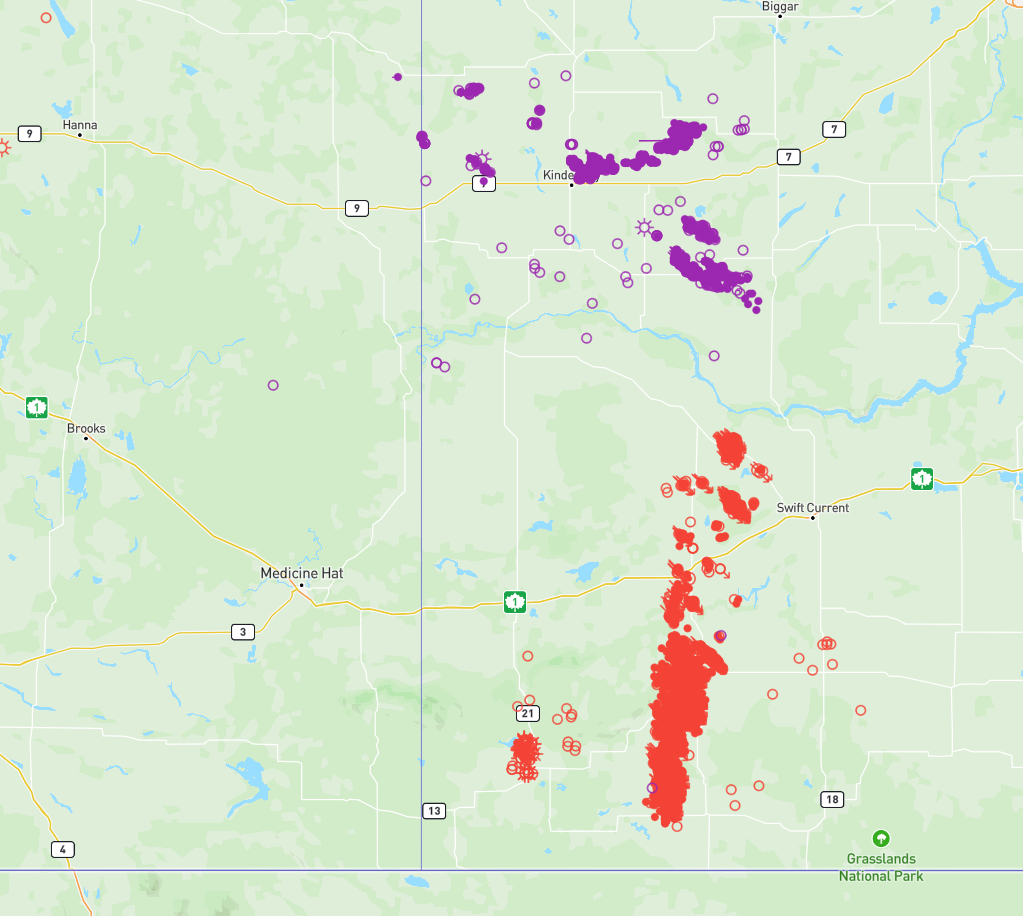

While neither company included a map of the assets involved, we put together a quick map based on Petro Ninja public data to view assets that we think are likely to be part of the transaction. Note that BOE Intel subscribers will be able to view the actual well licences involved in the asset transfer and associated production as soon as the licences officially change owners.

Crescent Point’s Flat Lake area appears to be the red wells to the west of Estevan along the Canadian – US border (Figure 2). The Battrum area is likely northwest of Swift Current, at the northern end of Crescent Point’s active wells shown in Figure 3.

Figure 2 – SE Sask – Saturn active well licences (purple) – Crescent Point active well licences (red)

*see text above for areas suspected to be part of the transaction

Figure 3 – SW Sask – Saturn active well licences (purple) – Crescent Point active well licences (red)

*see text above for areas suspected to be part of the transaction

The assets have not seen much capital from Crescent Point over the last few years, as they have definitely become non-core for the company as it further focuses on its impressive Montney and Duvernay assets in Alberta. In fact, a quick look at spud activity over the last year for Crescent Point shows no spuds in the suspected Battrum area and only 8 in the Flat Lake area.

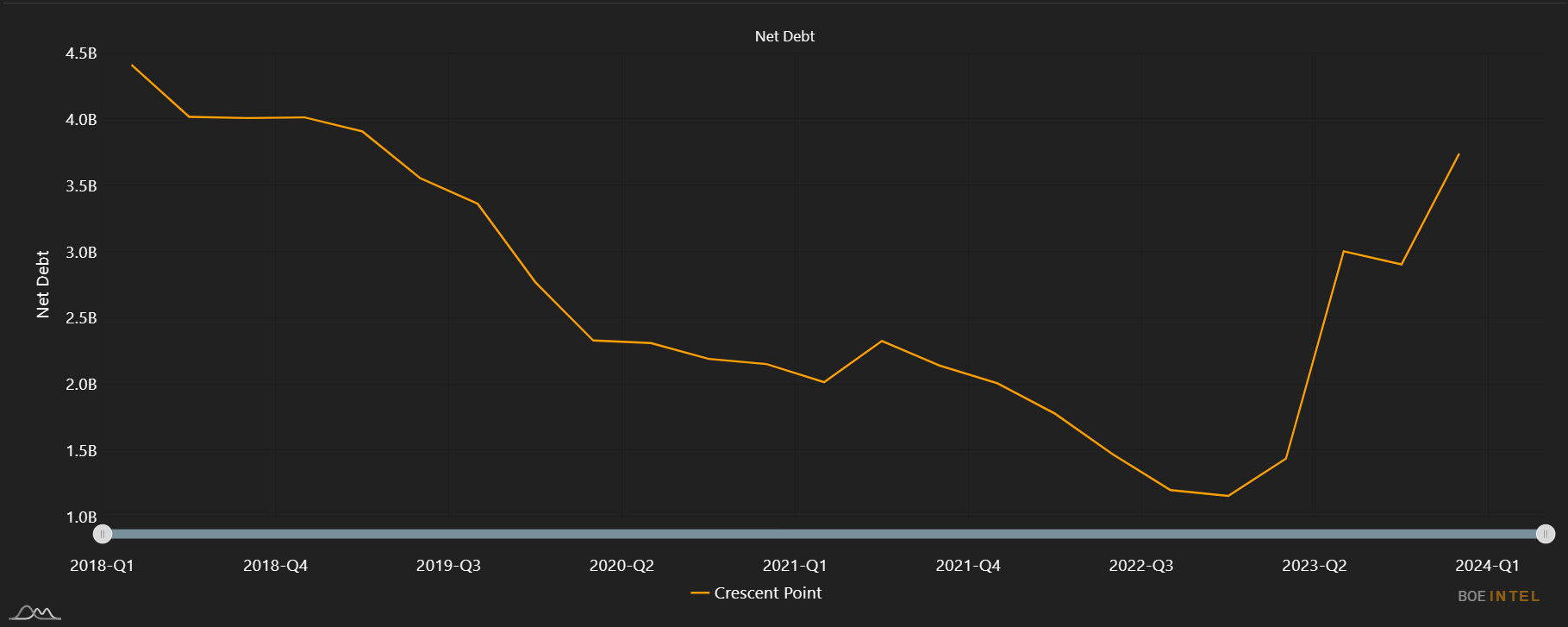

Crescent Point expects to use the proceeds from this disposition to lower net debt levels, with pro-forma net debt guidance of $2.8 billion by year end 2024. Note that that would be a lower net debt level than where the company was prior to the Hammerhead acquisition.

Figure 4 – Crescent Point net debt as of Q4/2023

To stay in the know on A&D transactions, check out BOE Intel.

To view Crescent Point’s press release, including updated guidance, click here.

To view Saturn’s press release, click here.