After a slow start to 2024, Canadian licensing activity has increased for the second month in a row. Between April 13 and May 12, 623 licences were obtained. This represents a noteworthy 45.6% increase compared to the previous month, which saw companies obtain 428 new licences. This past month’s licences were spread across 69 unique licensees, representing an average of 9.0 licences per licensee. Overall, licensing activity for the month was split fairly evenly between oil- and gas-weighted producers. The Montney was the runaway favourite producing formation, however; around 19% of all licensing targeted the Montney. Using data from BOE Intel and Petro Ninja, we’ve identified a number of trends across the various producers and producing formations.

Licensees

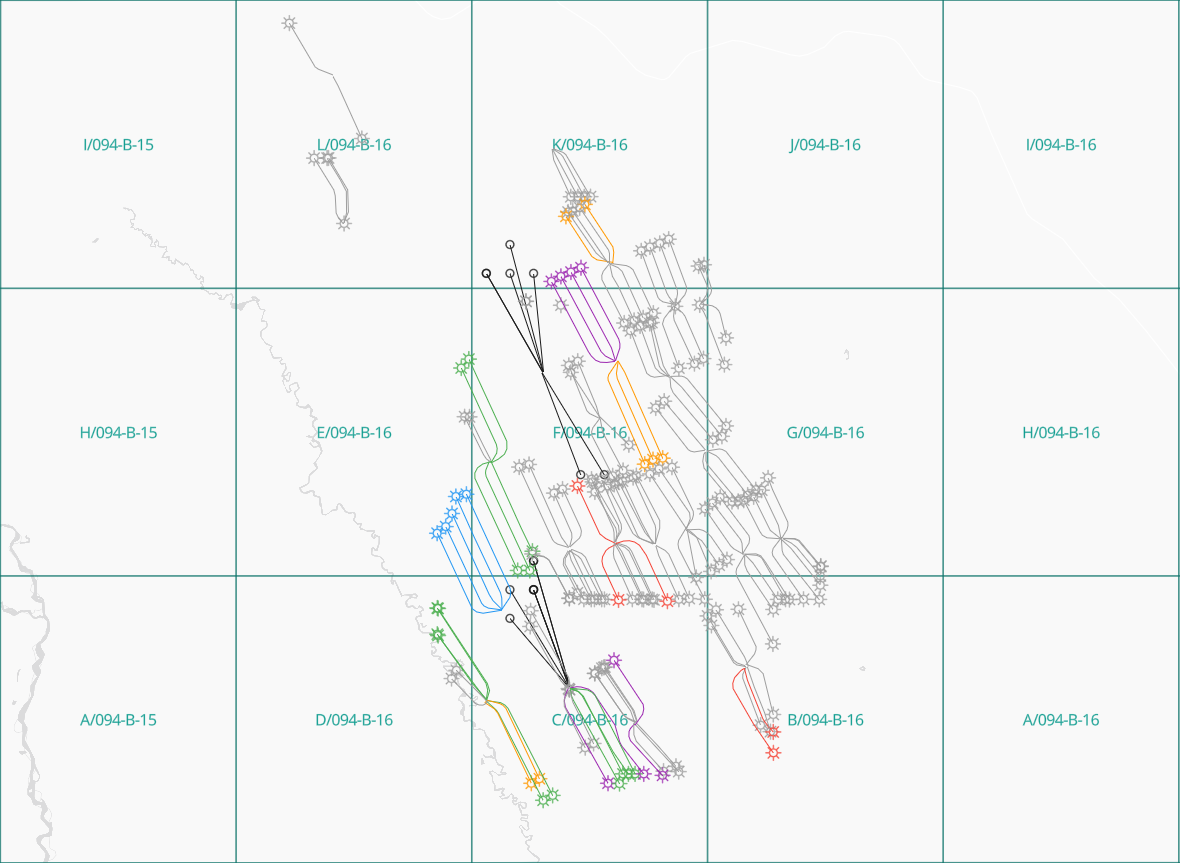

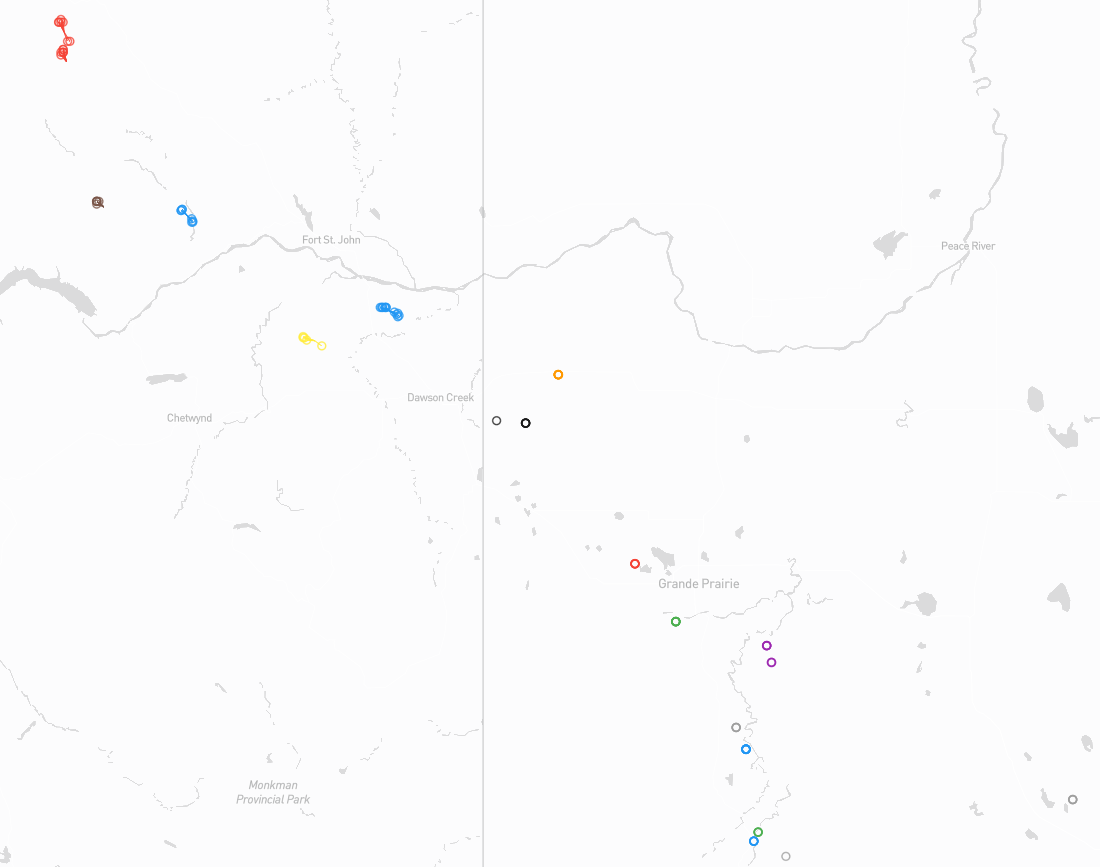

- CNRL led the way once again with 58 licences. While new licences were found across the company’s oil sands, Lloydminster heavy oil, Saskatchewan and Clearwater assets, the headline for us was the company’s activity in the BC Montney. The company obtained 14 licences at Town, 7 of which appear to be extensions of an existing pad with the other 7 forming what looks to be a new pad at Township F/094-B-16. For context, the company’s existing active wells at Town produced just over 34,000 BOE/d in gross licensed production in February 2024.

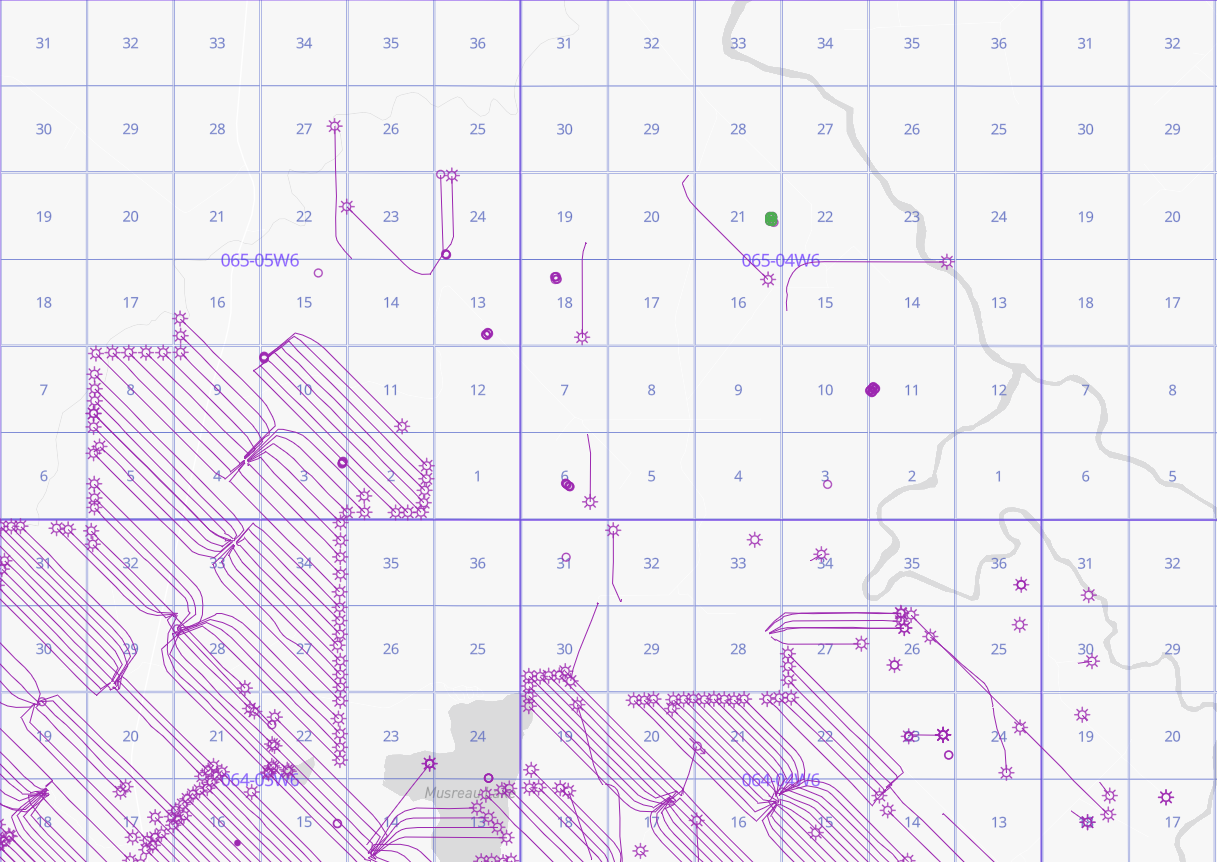

- ARC Resources was also busy in the BC Montney (see the Montney Producing Formation section below), but its Alberta assets saw some interesting action as well. ARC obtained 14 licences clustered at Township 065-04W6, just to the north of the bulk of the company’s Kakwa asset licences. While this could eventually turn into an exciting development, we want to note that the company has licensed a few other clusters in the region in 2024 and does not appear to have spud any of them. With this in mind, it’s an area worth keeping an eye on in the second half of 2024.

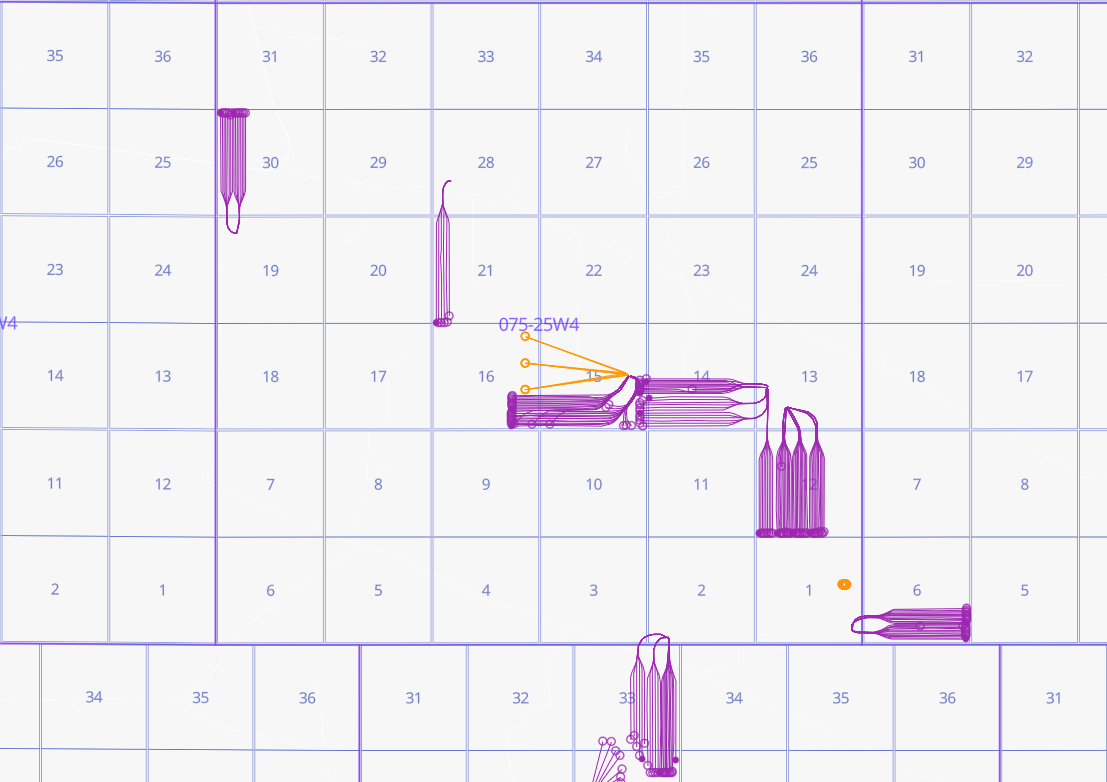

- Spur Petroleum licensed an impressive 39 wells last month, all targeting the Clearwater as per usual. From the looks of it, Spur appears to be expanding its existing project near Township 075-24W4 near Otter Lake; the company licensed 3 wells near an existing pad and also a cluster of wells that appears to be the makings of a new 11-well pad.

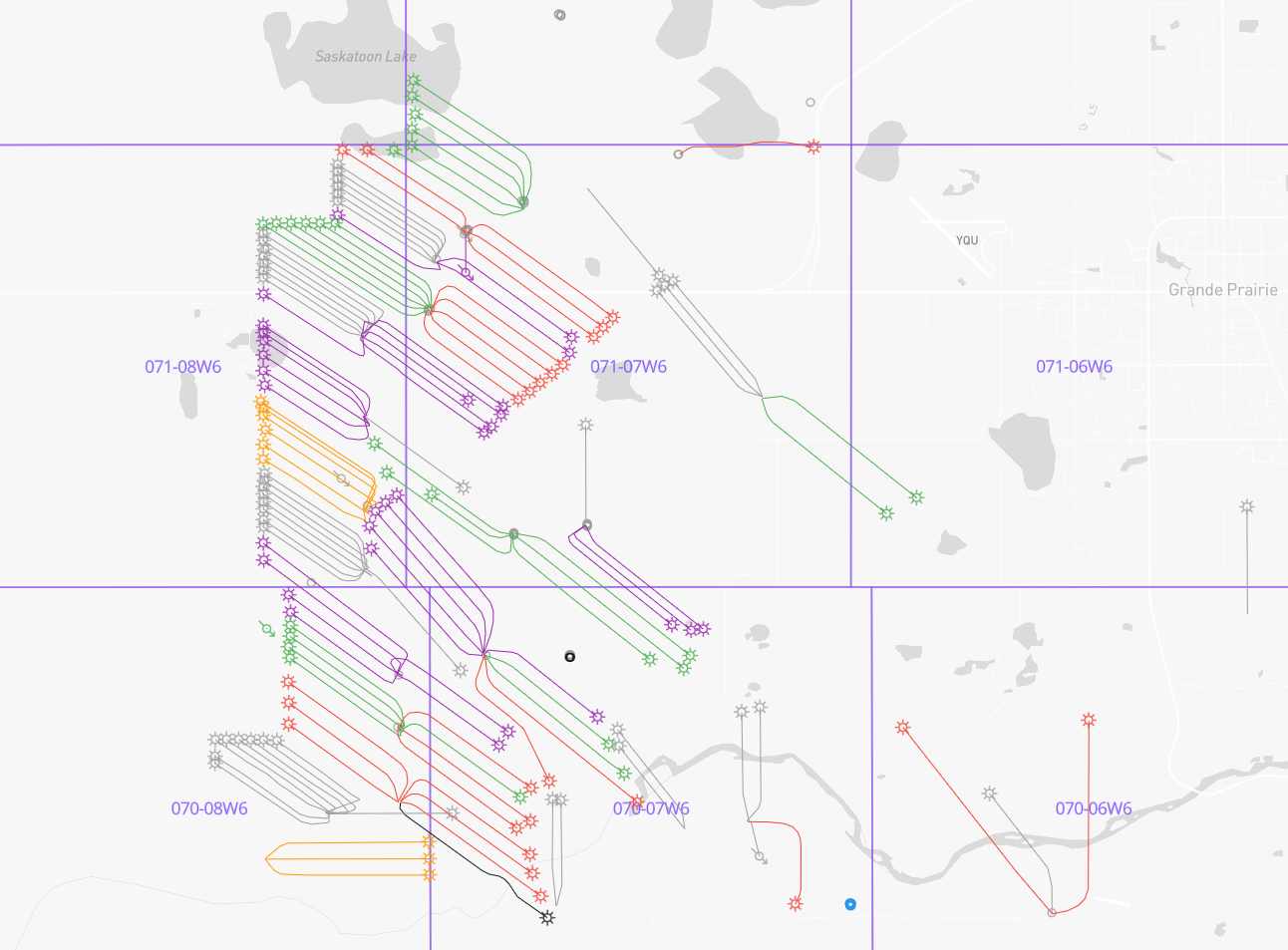

- Strathcona Resources licensed across Alberta and Saskatchewan, with the company demonstrating a continued focus on its Lloydminster heavy oil assets. With that said, we were interested by some other activity last month; Strathcona appears to be expanding its production base at its Grande Prairie asset. The company obtained 9 licences at the southeastern corner of the Grande Prairie asset, compared to 4 at Kakwa and zero at Groundbirch. This is particularly interesting given the fact that the company’s 2024 capital budget announcement suggested that Groundbirch and Kakwa would receive priority allocations of its $100 million in 2024 Montney growth capital.

| Licensees | Count |

| Canadian Natural Resources Limited | 58 |

| Cenovus Energy Inc. | 44 |

| Obsidian Energy Ltd. | 43 |

| ARC Resources Ltd. | 41 |

| Spur Petroleum Ltd. | 39 |

| Strathcona Resources Ltd. | 35 |

| Baytex Energy Ltd | 30 |

| Crescent Point Energy Corp. | 30 |

| Whitecap Resources Inc. | 18 |

| Tourmaline Oil Corp. | 17 |

| Karve Energy Inc. | 15 |

| Others | 253 |

| Total | 623 |

CNRL April-May Licences and Historical Spuds at Town (April-May 2024 Licences in Black, 2023 Spuds in Blue, 2022 Spuds in Red, 2021 Spuds in Green, 2020 Spuds in Purple, 2019 Spuds in Orange)

ARC Resources Licences North of Kakwa (April-May Licences in Green, All Other ARC Resources Licences in Purple)

Spur Petroleum Licences near Township 075-25W4 (April-May Licences in Orange, All Other Spur Licences in Purple)

Strathcona April-May Licences and Historical Spuds at Grande Prairie (April-May Licences in Blue, Other 2024 Licences in Black, 2023 Licences in Red, 2022 Licences in Green, 2021 Licences in Purple, 2020 in Orange, Others in Grey)

Producing Formations

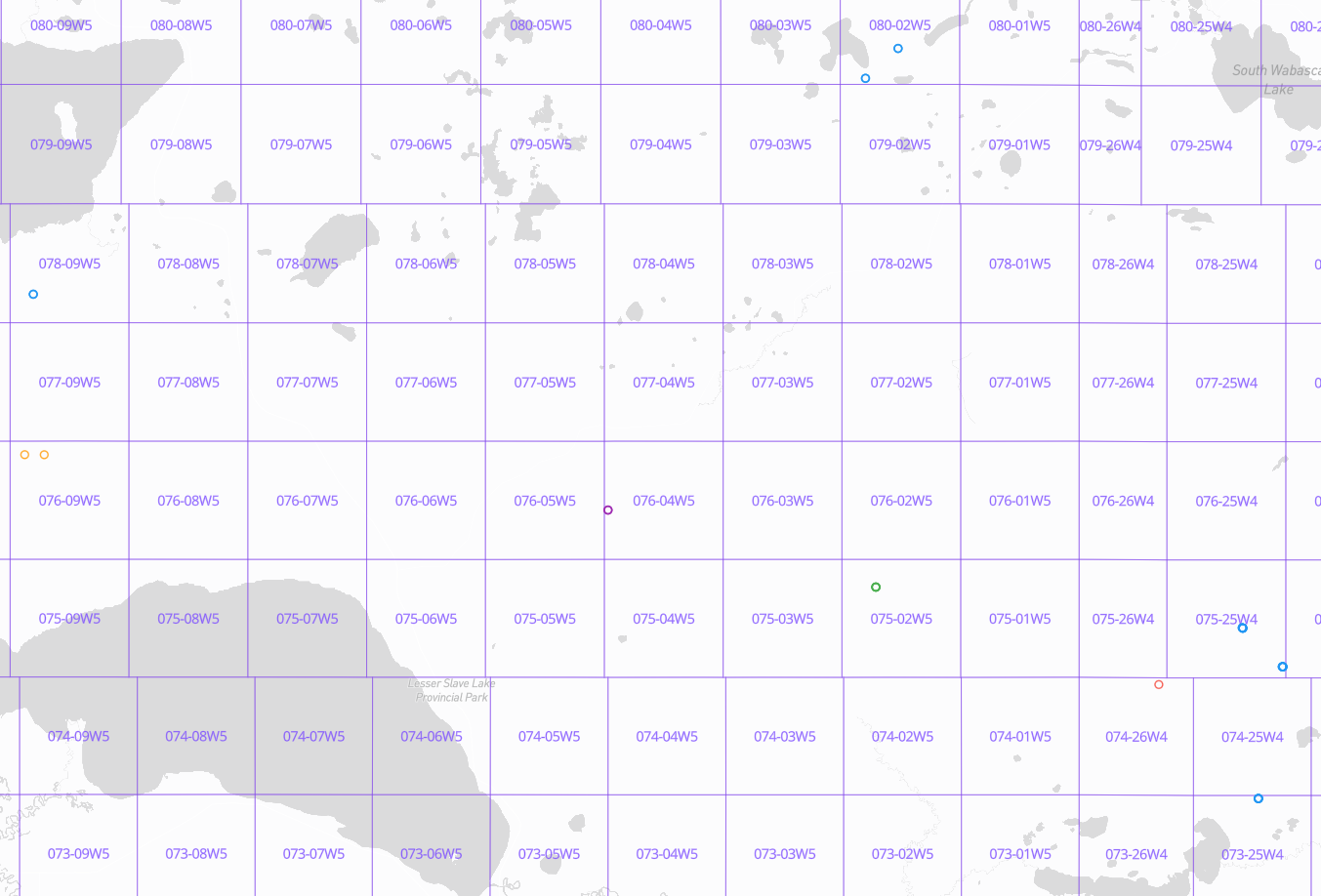

- The Montney occupied the top spot among producing formations once again this month; 117 licences were obtained by 11 unique licensees. The top Montney licensee last month was ARC Resources which obtained 41 Montney licences, making the Montney the only producing formation targeted by the company. ARC Resources licensed across its Kakwa, Parkland, and Attachie assets. The Attachie component drew our attention on account of the number of licences involved; ARC obtained licences for what appears to be a 6-well pad at Township 084-24W6. According to the company’s May 2024 Corporate Presentation, ARC’s 2024 capital guidance for Attachie is $600 million. Other top April-May Montney licensees include CNRL (20 licences), Strathcona (13 licences), and Crescent Point (8 licences).

- Spur dominated Clearwater licensing in April-May, obtaining 39 licences focused primarily at the southeastern corner of the Marten Hills field with a handful of Nipisi licences for good measure. Other prominent Clearwater licensees include Rubellite (11 licences), Headwater (6 licences) and Tamarack Valley (3 licences). 10 of Rubellite’s 11 licences were obtained at Figure Lake, which could suggest a noteworthy expansion of the company’s South Clearwater project. For context on the asset, Rubellite’s May 2024 corporate presentation indicates that the Figure Lake asset produced just over 3,100 BBL/d of oil in Q1 2024.

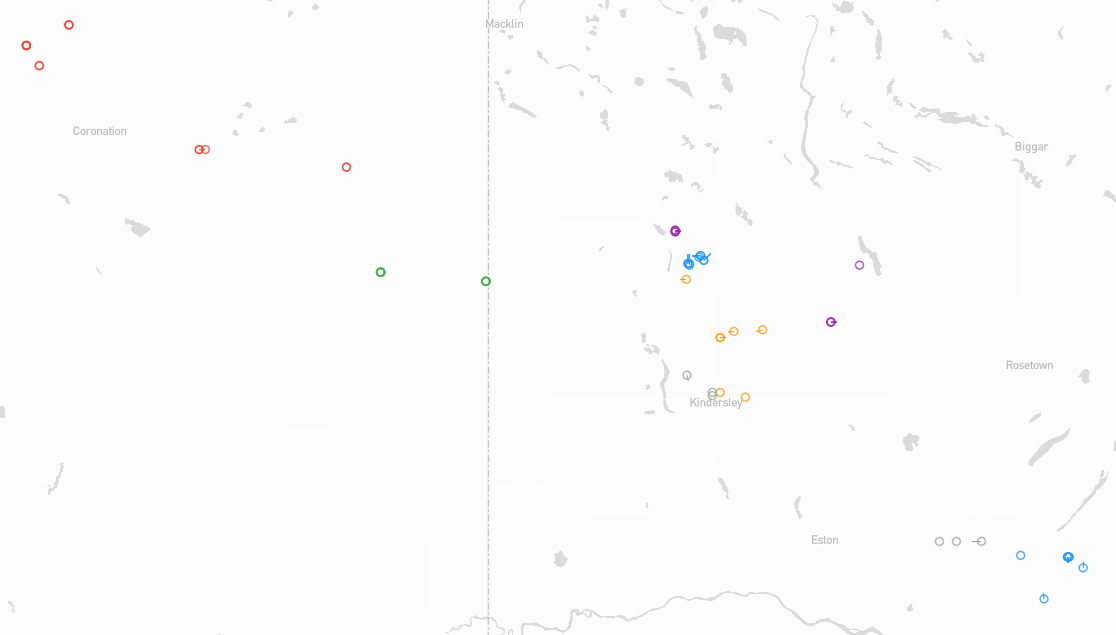

- The Viking saw a huge surge in activity this month, with Canadian producers obtaining 66 licenses targeting this oily producing formation. The top licensee was Whitecap Resources, which split its licensing evenly between the Oakdale and Monet fields. Interestingly, Whitecap’s Oakdale licences are in close proximity to licences obtained by Baytex and Teine (see the well map below). Other top Viking licensees include Karve (15 licences), Obsidian (13 licences) and Teine (8 licences).

| Producing Formations | Count |

| Montney | 117 |

| Viking | 66 |

| Clearwater | 62 |

| McMurray | 53 |

| Sparky | 41 |

| Bluesky | 32 |

| Spirit River | 24 |

| Duvernay | 18 |

| Frobisher | 17 |

| Lower Grand Rapids | 15 |

| Others | 178 |

| Total | 623 |

April-May Montney Licences by Licensee (ARC Resources in Blue, CNRL in Red, Strathcona in Green, Crescent Point in Purple, Logan Energy in Orange, Birchcliff in Black, Pacific Canbriam in Brown, Shell Canada in Yellow)

April-May Marten Hills & Nipisi Clearwater Licences (Spur in Blue, Rubellite in Red, Headwater in Green, Tamarack in Purple, Woodcote in Orange)

April-May Viking Licences by Producer (Whitecap Resources in Blue, Karve Energy in Red, Obsidian in Green, Teine in Purple, Baytex in Orange, Others in Grey)

To keep track of the latest licensing activity in the Canadian oil patch for yourself, check out BOE Intel.