Canadian Natural Resources announced earlier this week that it is acquiring Chevron’s Alberta assets for US$6.5 billion, before closing adjustments. In total the acquired production is ~122,500 BOE/d (76% liquids), and includes Chevron’s:

- 20% interest in the Athabasca Oil Sands Project (AOSP), which includes 20% of the Muskeg River and Jackpine mines, the Scotford Upgrader and the Quest Carbon Capture and Storage facility.

- 70% operated working interest Duvernay assets (KUFPEC owns the other 30% working interest).

- Other working interest in various additional undeveloped oil sands leases.

The acquired oil sands production is 62,500 bbl/d of Synethetic Crude Oil (“SCO”) production, while the Duvernay assets represent a 2025 targeted average of 60,000 BOE/d (including 30,000 bbl/d of liquids).

To see the official acquisition press release from CNRL, click here.

To see the official disposition press release from Chevron, click here.

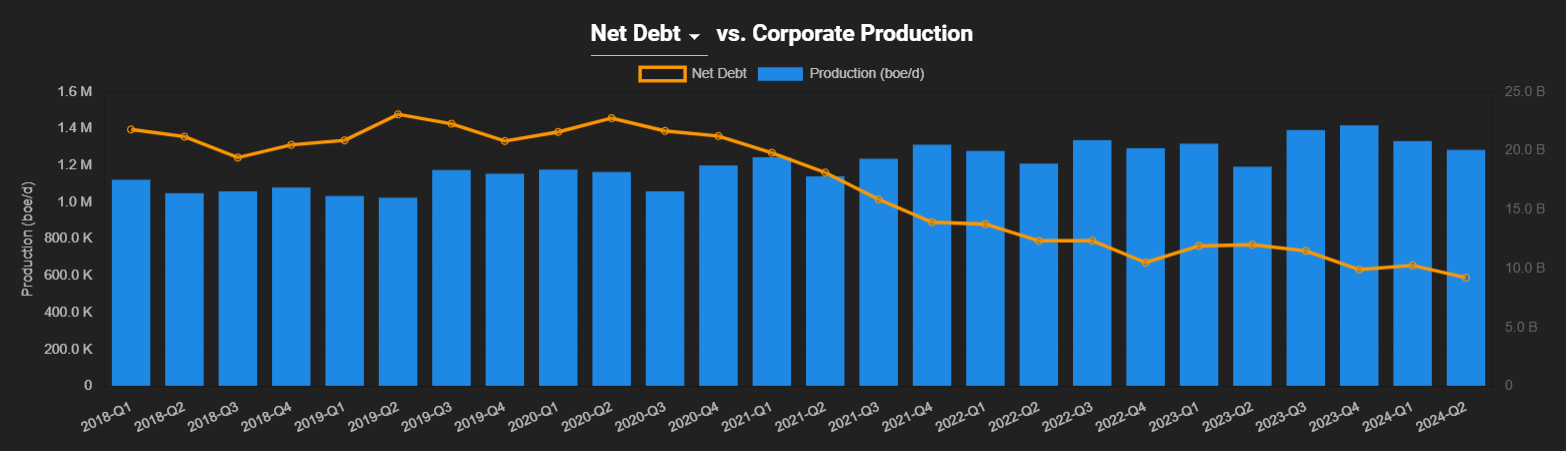

While it was publicly known that Chevron was marketing its Duvernay assets, the oil sands assets being sold as well came as a surprise to many. That it was Canadian Natural Resources who emerged as the buyer, was both a surprise, and perhaps not a surprise when you consider the company’s history. CNRL has always been a strategic counter cyclical acquirer, and through a strong period of net debt reduction (Figure 3 below), the company was in excellent financial position to pull this off. In the words of Mark Stainthorpe (Canadian Natural’s Chief Financial Officer), “we are in an excellent position to take advantage of these opportunities that don’t come along very often.”

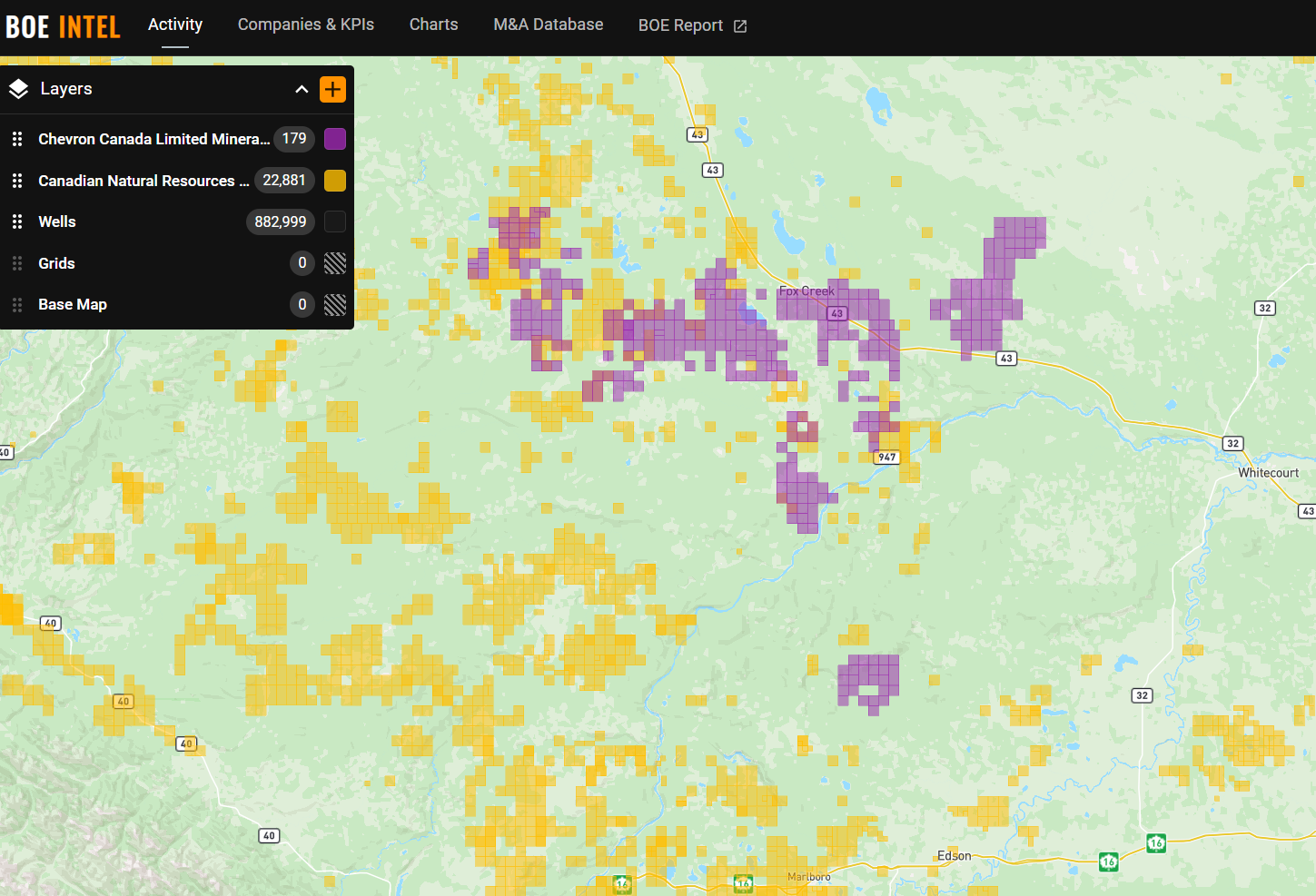

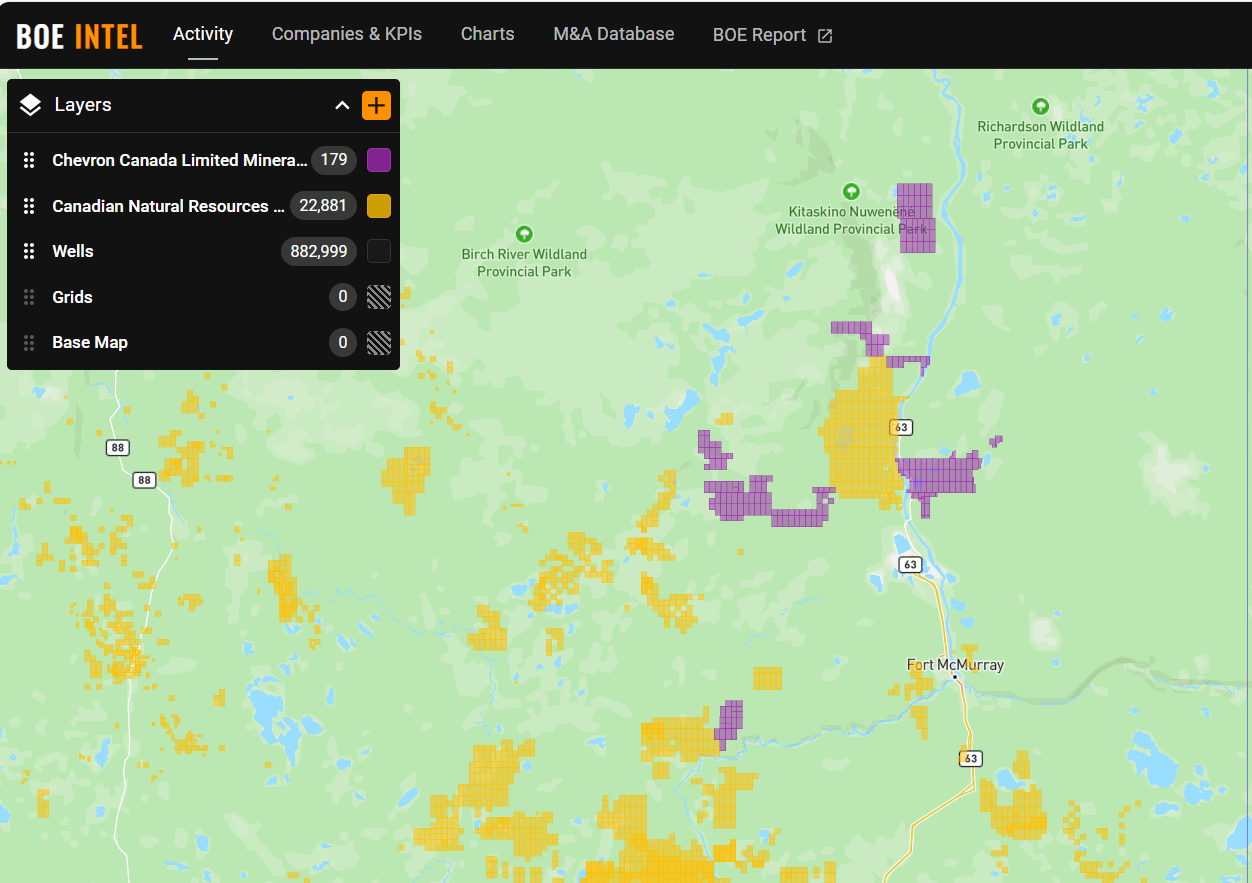

PUBLIC DATA MINERAL RIGHTS MAPS

Figures 1 and 2 below show the public data view of the Crown mineral rights held by both companies. Figure 1 shows Chevron’s Duvernay position (keep in mind all mineral rights are shown, not just Duvernay), while Figure 2 shows the area around Fort McMurray.

For a refresher on Duvernay activity, see this article from June:

Duvernay in focus – Updates on Chevron and a look at top Duvernay producers by area – BOE Intel

Figure 1 – BOE Intel Crown mineral rights map

Figure 2 – BOE Intel Crown mineral rights map

CNRL was able to make this an all-cash transaction as a result of its relentless pursuit of lowering net debt levels over the last 4 years. The chart below from BOE Intel shows CNRL’s reduction in net debt from $22.8 billion at the end of Q2 2020 to $9.2 billion at the end of Q2 2024. Net debt levels will rise after accounting for this acquisition (roughly $8.87 billion purchase price in $CAD), although the company expects to maintain a strong financial position with debt to 12 month forward EBITDA at approximately 1.1x at year end 2024 and based upon USD$70/bbl WTI.

Figure 3 – Canadian Natural Resources net debt vs. corporate production – BOE Intel

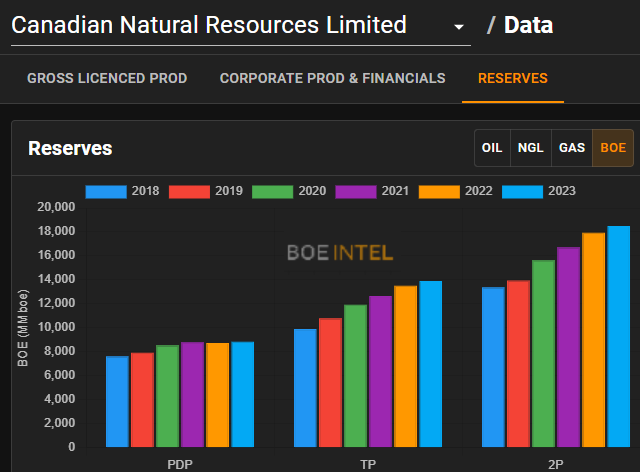

CNRL expects this acquisition to add approximately 1,448 MMBOE of Total Proved plus Probable reserves. Figure 4 shows the historical reserves reported by the company, which continue to show an upward trend.

Figure 4 – Canadian Natural Resources reserves – BOE Intel

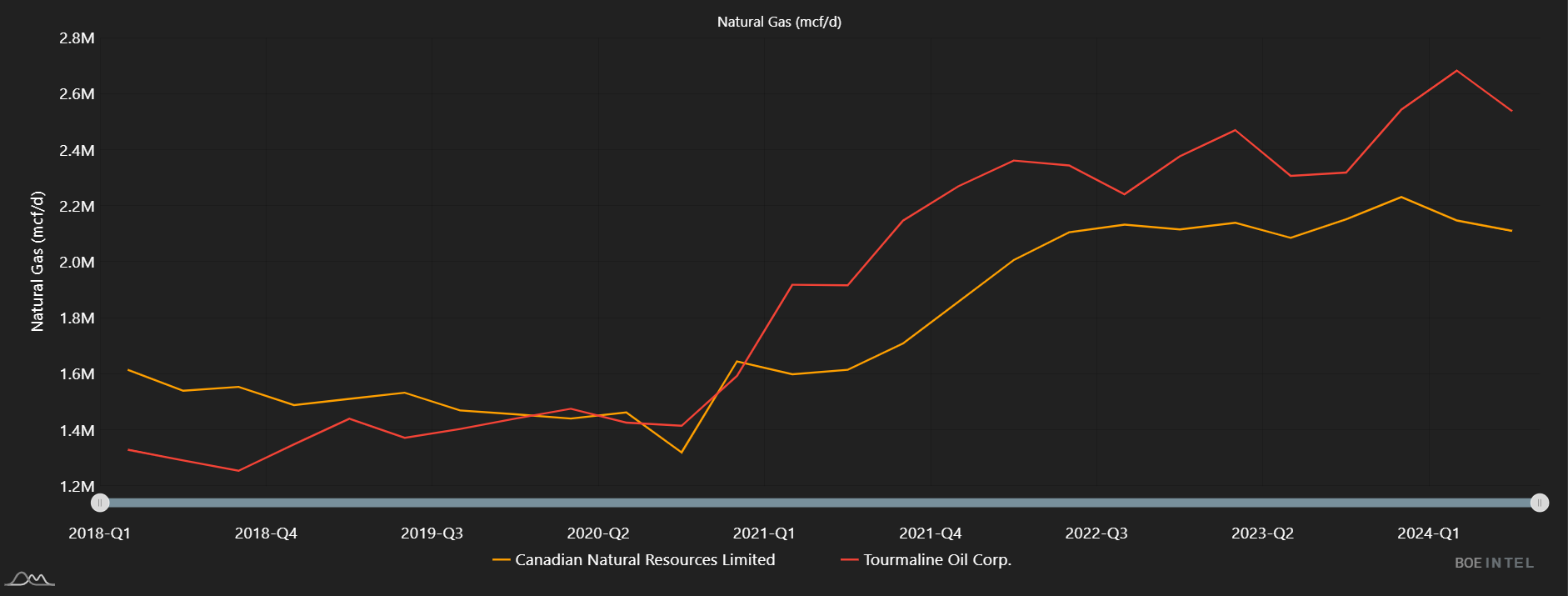

While certainly not the focus of this transaction, Canadian Natural will also acquire 179 mmcf/d of natural gas production in this acquisition. This isn’t quite enough to reclaim the title of top natural gas producer in Canada, particularly as Tourmaline’s recent acquisition of Crew Energy came with ~130 mmcf/d of natural gas production as well. Nonetheless, the natural gas market share in Canada owned by these two companies is notable given LNG Canada is set to begin exporting Canadian gas in the middle of 2025.

Figure 5 – Natural gas production by company – BOE Intel