Vermilion Energy announced this morning that it will acquire Westbrick Energy for $1.075 billion. The company will acquire production volumes of 50,000 BOE/d in Alberta’s Deep Basin, where Vermilion will add 700 drilling locations.

Please see the official press release here.

Vermilion also put out an acquisition presentation which readers can access here.

Figure 1 below shows some comparable transaction metrics for recent Deep Basin M&A.

Figure 1 – Comparable M&A transactions (turn sideways to view on mobile)

| Date | Acquirer | Seller | Value ($) | Region / Play | Production (BOE/d) | % Liquids | $/BOE/d |

|---|---|---|---|---|---|---|---|

| 2024-12-23 | Vermilion Energy | Westbrick Energy | 1,075,000,000 | Deep Basin | 50,000 | 25 | 21,500 |

| 2023-10-16 | Tourmaline Oil Corp. | Bonavista Energy Corporation | 1,450,000,000 | Deep Basin | 60,000 | 36 | 24,167 |

| 2023-09-06 | Peyto Exploration & Development | Repsol Canada Energy | 636,000,000 | Deep Basin | 23,000 | 25 | 27,652 |

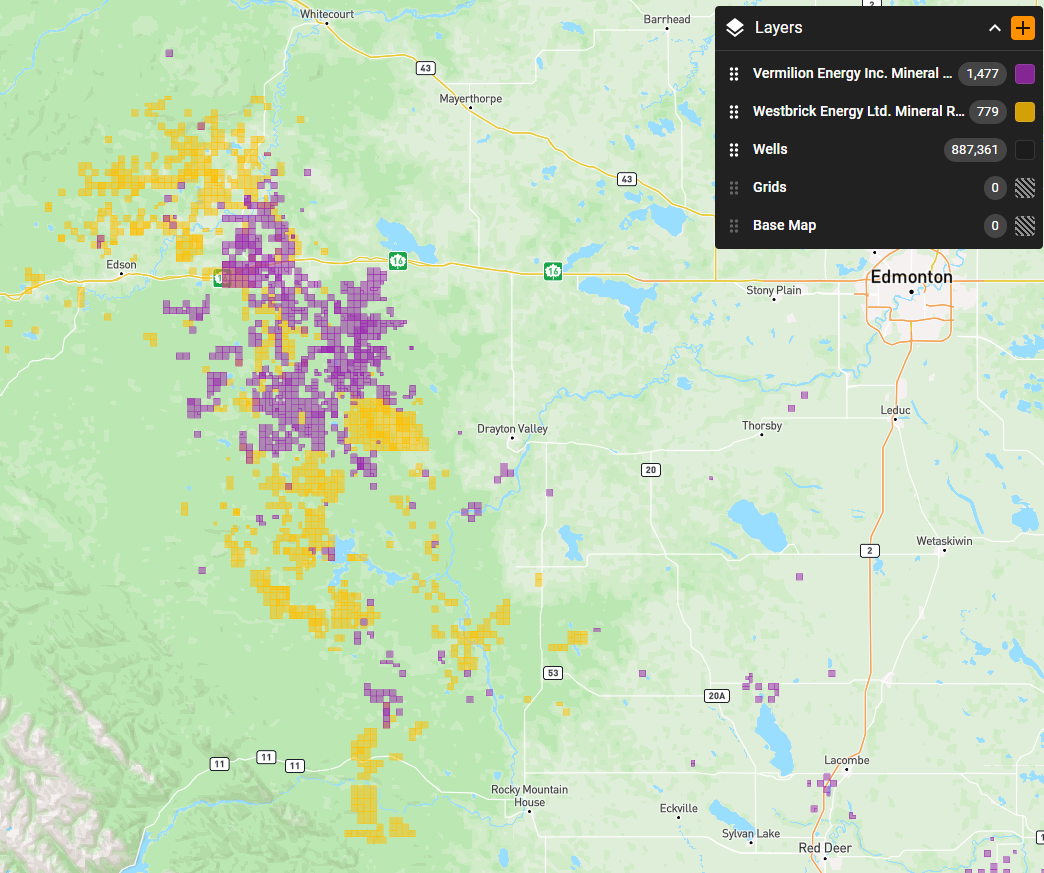

The existing mineral rights for both companies are shown below in Figure 2.

Figure 2 – Crown Mineral Rights Held By Vermilion (purple) and Westbrick (yellow)

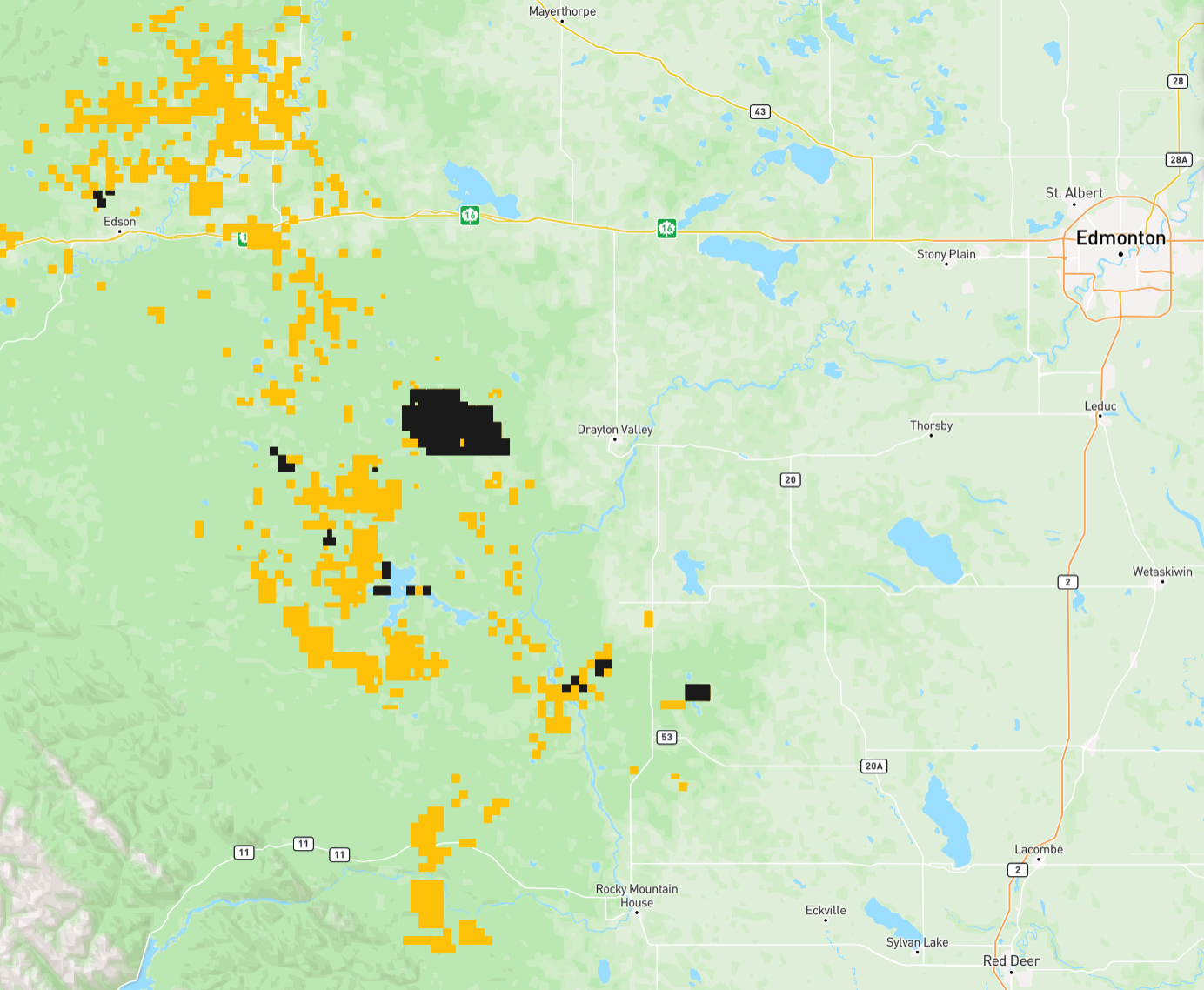

Not included in this transaction are Westbrick’s Duvernay assets. Shareholders of Westbrick will retain the Duvernay rights on approximately 290,000 net acres of land. Figure 3 below shows the locations where Westbrick holds Duvernay rights.

BOE Intel’s production by formation tool suggests that Westbrick’s gross Duvernay volumes were ~900 BOE/d in October 2024.

Figure 3 – Westbrick Mineral Rights (yellow) – Westbrick Duvernay rights (black)

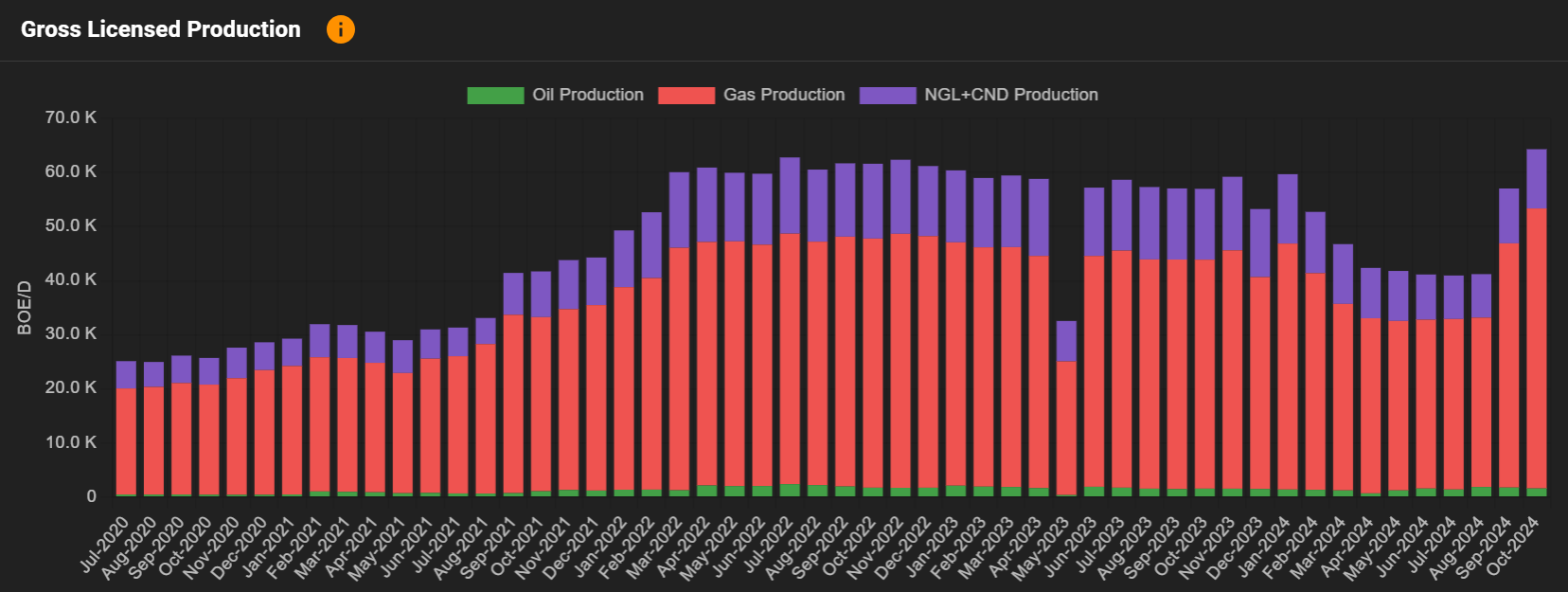

The public data production picture for Westbrick is interesting. While gross licensed production volumes (aggregation of all wells licensed to the company at a theoretical 100% working interest) spent several months hovering around the 41,000 BOE/d mark, the most recent two months of production in the public domain show dramatic increases. In fact, October 2024 production was the best month for production in the company’s history. October 2024 gross licensed volumes exceeded 64,000 BOE/d. For what it’s worth, Vermilion has quoted volumes as “stable production base of 50,000 BOE/d with plans to increase to 60,000 BOE/d within 5 years.”

Figure 4 – Westbrick Energy Gross Licensed Production

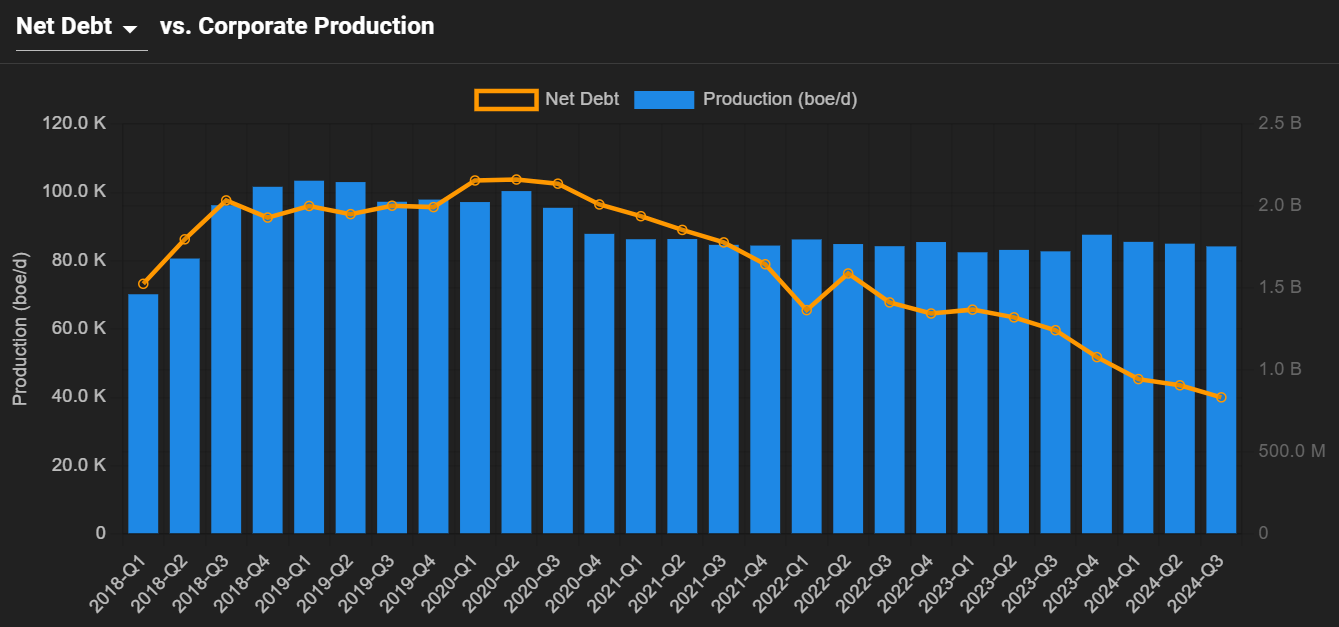

Vermilion will use unused credit capacity to fund the acquisition, which it was able to use as a result of a strong commitment to lowering net debt over the last few years (Figure 5).

Figure 5 – Vermilion net debt