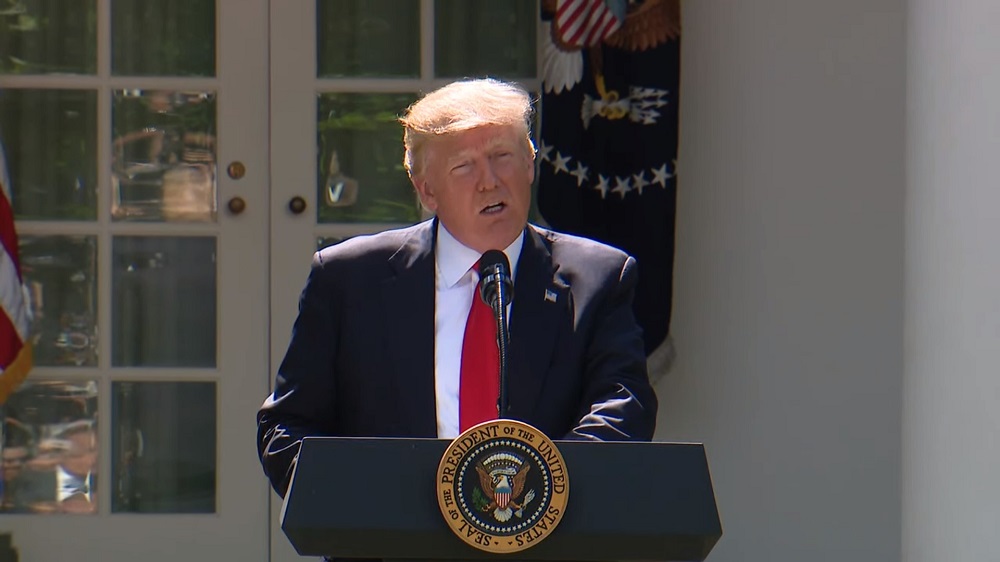

Oil prices climbed for the first time in three days on Thursday, with supply worries resurfacing after U.S. President Donald Trump announced a reversal of a license given to Chevron to operate in Venezuela.

Oil prices climbed for the first time in three days on Thursday, with supply worries resurfacing after U.S. President Donald Trump announced a reversal of a license given to Chevron to operate in Venezuela.

Brent crude oil futures rose 24 cents or 0.33% to $72.77 a barrel by 0328 GMT. U.S. West Texas Intermediate crude oil futures were up 18 cents or 0.26% at $68.80 per barrel.

A day earlier, the contracts settled at their lowest since December 10 due to a surprise build in U.S. fuel inventories that hinted at weakening demand and hopes for a potential peace deal between Russia and Ukraine. Both benchmarks have lost about 5% so far this month.

Trump on Wednesday said he was reversing a license given to Chevron to operate in Venezuela by his predecessor Joe Biden more than two years ago.

Chevron exports about 240,000 barrels per day of crude from its Venezuela operations, over a quarter of the country’s entire oil output. Ending the license means Chevron will no longer be able to export Venezuelan crude.

“The Venezuela news triggered unwinding after the recent sell-off amid Russian-Ukraine ceasefire talks,” said Hiroyuki Kikukawa, president of NS Trading, a unit of Nissan Securities.

“Potential buying from the U.S. Strategic Petroleum Reserve also supported the market since WTI was trading near its lowest level in over two months,” he said.

Last week, Trump said his administration would quickly fill up the SPR. He criticized Biden for tapping the SPR to bring down the price of gasoline.

Market participants remain focused on Trump’s Russian-Ukrainian peace talks. Trump said Volodymyr Zelenskiy would visit Washington on Friday to sign an agreement on rare earth minerals, while the Ukrainian leader said the success of the deal would hinge on those talks and continued U.S. aid.

U.S. crude oil stockpiles fell unexpectedly last week as refining activity ticked higher, while gasoline and distillate inventories posted surprising gains, the Energy Information Administration said on Wednesday.

“Since this is a seasonal off-peak period, with demand shifting from kerosene to gasoline, the sell-off driven by rising product inventories has likely run its course,” NS Trading’s Kikukawa said.

Separately, Goldman Sachs said in a note on Wednesday that the U.S. administration’s dual goals of commodity dominance and affordability reinforce the bank’s Brent $70-85 range baseline, a range that is conducive to robust U.S. supply growth.

(Reporting by Yuka Obayashi in Tokyo and Siyi Liu in Singapore; Editing by Edwina Gibbs)