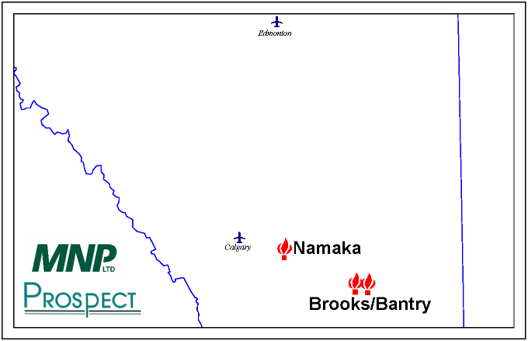

On January 23, 2025, Prospect Oil & Gas Management Ltd. (“Prospect” or the “Company”) filed an Assignment in Bankruptcy and MNP Ltd. (“MNP” or the “Trustee”) was appointed as Trustee of Prospect. Sayer Energy Advisors has been engaged to assist the Trustee with the sale of Prospect’s oil and natural gas properties located in the Brooks/Bantry and Namaka areas of southern Alberta (the “Properties”).

At Brooks/Bantry, Prospect holds various operated working interests in approximately 10 sections of land with P&NG rights from the top of the Medicine Hat Formation to basement. At Brooks, the Company’s working interests range between 50%-100% and at Bantry, the Company’s working interests are mainly 65.63%.

At Namaka, Prospect holds high working interests, generally between 90%-100% in approximately 13 sections of land with P&NG rights from surface to basement. Production at Namaka is from the Belly River, Ellerslie and Viking formations.

The Properties have been shut-in since September 2024.

Average daily sales production net to Prospect from the Properties for the nine months ended September 30, 2024 was approximately 140 boe/d, consisting of approximately 843 Mcf/d of natural gas.

Operating income net to Prospect from the Properties for the nine months ended September 30, 2024 was approximately ($81,000) per month, or ($972,000) on an annualized basis.

As of March 25, 2025, the Properties had a deemed liability value of $4.4 million.

Summary information relating to this divestiture is attached to this correspondence. A package of more detailed confidential information will be sent to any party executing a Confidentiality Agreement (copy attached).

Offers relating to this process will be accepted until 12:00 pm on Thursday, May 15, 2025.

For further information please feel free to contact: Ben Rye, Sydney Birkett or Tom Pavic at 403.266.6133.