These are tough days for us that loathe politics, and loathe discussing them even more. How to empty a coffee shop. Oh, please, tell us how angry you are. Dying to know. Hmm, how odd, no one seems to be changing their minds even when someone goes to the bother of pointing out how stupid they are. Better try more decibels. And the nasty memes! Well done. KO’ed that guy! Look at you, ripping through the doom-scroll like Conan with a broadsword.

I’ve been drawn into that crap before, and not going back.

It’s bad enough when it’s just one’s own country. But now we are all caught in a web of political angst that is almost inescapable. You can come to blows with your neighbour over Gaza or Ukraine or tariffs, and this is on top of the standard “I hate you because” nature of modern politics.

It is difficult to remain objective through it all, to adopt some Zen-like awakening and enlightenment when we’re all in a rage. But we should try. And luckily some do, and share their thoughts. It is possible.

I came across several examples on X the other day, a few powerfully-minded people that dispassionately dissect what is going on, laying a credible and rational framework for what is going on. Reading coldly logical thinking is like Advil.

A lot of context is necessary here, big picture stuff, to capture the view of the tectonic plates that are moving, that aren’t as visible from ground level when we’re yelling and hurling feces at all the stupid people.

Starting in what seems like an odd place, but not really. Not long ago, a lot the world’s geopolitical shifting was created by the fight against climate change. The financial world was ‘somewhat’ stable, interest rates were low, economies were humming, wars were few, and there was a political-class consensus that the world needed to be rewired to a new energy source, immediately.

That’s gone off the rails because it was a task whose simplicity was grossly oversold, and most of the world is quietly shifting their focus to ‘energy security’, which is no surprise in these parts, but still, that is a major global shift underway.

But now there are many big shifts underway of course – the Middle East, Russia/Ukraine, etc. – but the biggest centres around, obviously, Trump’s tactics. Here, we need to be thoughtful instead of just shouty, because we need to thoughtfully work backwards to what he is trying to accomplish. It seems indecipherable (and enraging to many) when looking at the individual pieces, but the two aforementioned commentators provide excellent analysis about two separate but intertwined shifts that explain a lot of the mayhem.

Austrian geopolitical analyst Velina Tchakarova put out a video entitled “Trump, the DragonBear, and the New Global Order: Why the World is Splitting in Two”. It is dispassionately excellent. She starts off: “If your geopolitical lens is still stuck in the pre-pandemic, pre-Ukraine war and pre-DragonBear [China-Russia alliance] world, you are missing the plot. The global system has changed dramatically and if you are still clinging to outdated paradigms, it is no wonder you are struggling to understand what Trump or the broader US administration is really trying to do.” She calls it a strategic recalibration where the US is reorienting itself to face a new challenge – the Russia/China alliance, DragonBear as she calls it, because those two countries working together is much more than the sum of the two working alone. The geopolitical clout and ambition is multiplied.

Russia on its own is a huge, resource-rich, slightly crazy and prickly global power with an odd inferiority complex – it wants to flex it’s military might for historical reason that I can’t be bothered spend tine on; the fact is that that is what they do. Their national preoccupation seems to be centered around this need to make sure everyone knows just how great Russia was and will be again. Or at least that’s what their leader projects to the world as his message. So, a military threat, and expansionist trouble for neighbours, but since their loss in the cold war, not a major geopolitical threat. Russia does not seem to strive to dominate global economies, or dominate culture, or anything except wear wife beater shirts and point at their guns.

China is a different beast. It has faux-humbly acted as a developing nation, absorbing global technology and capital on strictly controlled terms, in order to build a global economic powerhouse. Their main preoccupation is controlling citizens and making sure they have enough food, because 1.4 billion starving citizens equals loss of control, to put it mildly.

Now those two entities have been forced together to some extent, and it is a beast to be reckoned with. Russia has the natural resources China needs, including energy; China has the tech and capital that Russia needs.

Together, as Velina says, they are combining forces to challenge and replace the western-led order. The attack on Ukraine, in her view, was strategic: Russia destabilized Europe, and China stood by and observed just how the west reacts to such aggression.

A consequence, and a learning for both parties, was that Europe is becoming inconsequential, in large part by abandoning its own energy sources and relying on cheap Russian gas, at the same time they ‘lowered emissions’ by deindustrializing and farming that all out to China. So…put Russian and China together and guess how much clout Europe has against that entity?

All that’s left is NATO, which again was provoked into a state of panic by China/Russia. NATO has been underfunded by Europeans (and Canadians), with the US picking up the tab, and it is not hard to see how that alliance becomes fractured under Trump.

Velina’s last key point is that the developing world is evolving into something much more powerful, and capable, and independent, to an extent – many developing nations in Africa, southeast Asia, and South America are working with both the US and China or China/Russia. They are hosting US military bases and trading with China, for example, enjoying new influence and in some ways shopping for the best deal. Or, they were.

At the same time, Trump landed in office with a few very major problems to deal with. The biggest in his mind, and logically so, is that the US debt is on an absolutely unsustainable trajectory. It is growing by a trillion dollars every few months, and every month of debt growth makes the US more dangerously exposed to any sort of higher interest rates. They simply can’t handle them, because interest payments plus social obligations (medicare, social security, military) combined cost more than the government takes in. If interest rates go up, something has to give, and voters will not vote for someone that cuts critical social programs.

So what to do? That’s where the other thread I found was so valuable. It actually makes sense of what Trump is doing. A public policy analyst named Tanvi Ratna did a great job of unemotionally sizing up Trump’s Tariff gambit. The full analysis is here, which I’ve summarized below.

First off, $9 trillion of US debt needs to be refinanced in 2025. If rolled into 10-year bonds, a percentage drop in 10 year rates would save the US $1 trillion/year. So: Interest rates must fall! But how?

A plausible theory put forward by Ratna is that great way to get interest rates to fall is to create uncertainty. Massive, semi-random tariffs spook markets, capital exits the stock market, and buys up US treasuries as a safe haven, pushing down yields, just in time for a refinance.

If this theory is correct, the instability is the desired outcome.

But wait, you say, Trump cares about the stock market as much as anything. Yes he does. But he also knows what will happen when he lifts tariffs or renegotiates them down to de minimus levels: stocks will soar.

And that is also why he is choosing this very moment in time to totally upset the apple cart and ruin everyone’s day. Trump is less than 3 months into his presidency. US midterms are 18 months away, and campaigning begins less than twelve. Shock and awe, summer 2025: blast out destabilizing tariffs, refinance debt, renegotiate deals with most global trading partners on more favourable terms, hit 2026 with things sailing.

But what about the huge US debt? Still a millstone, obviously? Ah, there’s a solution for that also, all to unfold before next winter.

Trump’s US immigration gold card might be the master stroke of this whole scheme. It is being designed to be irresistible to the world’s wealthy, offering them instant US residency for $5 million US. If the US sells a million of these, not a crazy assumption given the number of wealthy people in the world that might be interested in the US safe harbour in times of trouble, the US could raise $5 trillion in short order, knocking something like 20 percent off US federal debt. It wouldn’t solve the problem, but would make a serious dent in it, and, if the US can get anywhere near a balanced budget, the debt crisis might be abated within a year. Furthermore, an argument can be made, as Stanley Druckenmiller did, that tariffs are in effect a consumption tax, and perhaps rampant consumerism – the relentless onslaught of cheap crap that fuels entire chains – will bear the brunt of reduced trade, and that that isn’t the end of the world. Who really needs a 75-inch TV for six hundred bucks? Oh the horrors, maybe they’ll have to make do with a 55-inch.

If it does work, the US will wind up with lower interest rates, greater internal fiscal discipline, greatly improved international trade terms, and a ton of US direct investment.

But. If it doesn’t work, there will be significant, prolonged inflation, global trade wars if everyone retaliates instead of cutting deals, and likely failure in mid term elections.

And there are other problems. Trump’s gambit is centred on the desire to bring investment back to America. But what about US industries that are primarily, or largely, exporters? Do they just go out of business? If they’re exporting now, presumably there’s not a big enough market at home, so…how would that improve? And how can US (or global, for that matter) plan anything with such uncertainty?

Another major headache that could unfold from the tariff strategy: Many countries might be pushed into the warm embrace of the DragonBear, the China/Russia alliance, which is a formidable economic and natural resource powerhouse in its own right. China’s Belt & Road Initiative is designed to draw in other nations, and it might find more willing participants who find themselves shut out of the US market. Trump has singled out China for special attention, and is now as of this week threatening to double their tariffs to truly insane proportions. Two titans squaring off, and neither will back down.

Whatever. Who knows. What we do know is this. There are many and various takes on the Tariff gambit, most of which devolve into “this is too crazy to be actually happening” if one weighs them at more granular levels, like pointing out that parts move across borders many times, or that the tariff formula is odd/unfair/overly simplistic. Those are minutiae. What is being pursued is a global architecture realignment.

The climate change/forced energy transition wars taught us one thing: “Too crazy to be actually happening” is not a hindrance in the slightest to those that hold the levers of power, and the greater the ‘moral imperative’ they feel, the farther they will go.

Understanding what is happening and where it might go requires parking value judgements about whatever we think of the character implementing them. Look at the problem they are trying to solve; look at their strategy; look at whether it can work. The climate war was defined by a group of people that viewed hydrocarbon usage as existentially threatening to humanity; their strategy was to stop hydrocarbon usage; we could all assess whether they would succeed or not. And now we know.

Donald Trump views, not incorrectly imo, that the US debt/deficit problem is an existential threat to the US. He is compelled to act as in an emergency, and is doing so. Will it be successful? Every thoughtful analysis I’ve seen says there is no clear way to know, but that the view that only doom is coming is .

We have seen this before. Trump shredded NAFTA, calling it an unfair abomination, and renegotiated a deal that he viewed as better.

This time, he’s slapped crazy big tariffs on everyone. There is no point in getting crazed about the methodology, they are here, and the numbers are derived as much from a philosophical point of view as from a mathematical one. This is Trump’s modus operandi – aim for the moon, destabilize everything, sit down for negotiations, carve a better deal, move on.

Word so far, as of this past weekend, is that more than 50 countries have reached out to negotiate better tariff agreements. Musk has said the US and EU should negotiate an agreement. Major trading partners like India and Japan are seeking talks or sending delegations to negotiate, and the Trump team appears triumphant. Secretary of Treasury Scott Bessent said of the Japanese outreach: “Following a very constructive phone discussion with the Government of Japan, @POTUS has tasked me and @USTradeRep to open negotiations to implement the President’s vision for the new Golden Age of Global Trade.” Bessent knows the rule book, he says only exactly what he is allowed and supposed to say. The fact that he capitalized the “Golden Age of Global Trade” means it is a buzzword coming from the top and we are going to hear a lot more of it. The tariff wars are indeed wildly unpredictable, but if a critical mass of nations heads for the negotiating table – which is the true home of Trump – then peace may reign sooner than later. [Less than 24 hours later, Bessent’s total was 70 countries that had called to negotiate.]

I’d venture a guess as to where Canada fits in this, but I have no idea. A lot will depend on our election, and on our appetite for picking a trade fight with our biggest customer. While there is national conciliatory noise, it scarcely seems believable; I’ll believe new pipelines when I see them going in the ground.

The US is seeking to reengineer more than half a century of geopolitics within a few months, almost all of which is through economic levers and not guns.

Love him or hate him, that is the plan, it is being implemented, and we will know within twelve months how well it worked. It’s going to be wild.

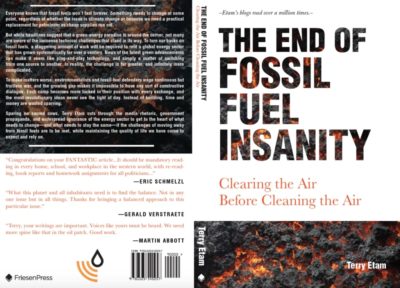

Hey look everyone loves pipelines now. Find out why that was inevitable in The End of Fossil Fuel Insanity – the energy story for those that don’t live in the energy world, but want to find out. And laugh. Available at Amazon.ca, Indigo.ca, or Amazon.com.

Read more insightful analysis from Terry Etam here, or email Terry here.