On September 24, 2025, Blue Sky Resources Ltd. (“Blue Sky” or the “Company”) filed a Notice of Intention to Make a Proposal pursuant to the Bankruptcy and Insolvency Act, RSC 1985, c. B-3, (the “NOI Proceedings”). KSV Restructuring Inc. (“KSV”) was appointed the proposal trustee (the “Proposal Trustee”) in the NOI Proceedings. On November 20, 2025, the Court of King’s Bench of Alberta granted an order to conduct a Sales and Investment Solicitation Process (the “SISP”). The Company has engaged Sayer Energy Advisors as sales agent to assist it with the SISP.

The SISP is intended to solicit offers for the business and the property of the Company, in whole or in part, or investments related thereto, subject to Court approval. The SISP is intended to find the highest and/or best offer for a restructuring and/or refinancing of the Company, a sale of the Company’s property on a going concern or piecemeal basis, or a combination thereof, or other similar transaction. A copy of the SISP is found on our website at www.sayeradvisors.com.

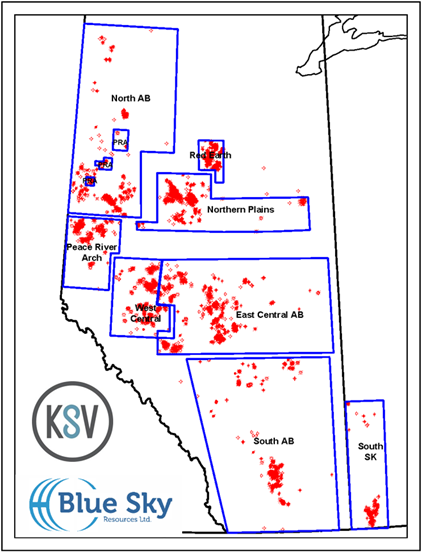

Blue Sky’s assets consist of both operated and non-operated interests located throughout Alberta and Saskatchewan (the “Properties”).

For this offering, the Properties are separated into the following geographical packages: East Central AB, North AB, Northern Plains AB, Peace River Arch AB, Red Earth AB, South AB, West Central AB and South SK.

Average production net to Blue Sky from the Properties for the first eight months of 2025 was approximately 2,800 boe/d consisting of 8.8 MMcf/d of natural gas and 1,332 barrels of oil and natural gas liquids per day.

As of November 28, 2025, the Alberta properties had a deemed liability value of $230.7 million. As of November 27, 2025, the South SK package had a deemed liability value of $156,900.

Sproule ERCE (“Sproule”) prepared an independent reserves evaluation of the Properties as part of the Company’s year-end reporting (the “Sproule Report”). The Sproule Report is effective December 31, 2024, using an average of GLJ Ltd., McDaniel & Associates Consultants Ltd. and Sproule’s December 31, 2024 forecast pricing. Sproule estimated that as at December 31, 2024 the Properties contained remaining proved plus probable reserves of 14.0 million barrels of oil and natural gas liquids and 66.9 Bcf of natural gas (25.2 million boe), with an estimated net present value of approximately $298.7 million using forecast pricing at a 10% discount.

Summary information relating to this divestiture is attached to this correspondence. A package of more detailed confidential information will be sent to any party executing a Confidentiality Agreement (copy attached).

Offers as outlined in the SISP relating to this process will be accepted until 12:00 pm on Thursday, January 29, 2026.

For further information please feel free to contact: Ben Rye, Sydney Birkett or Tom Pavic at 403.266.6133.