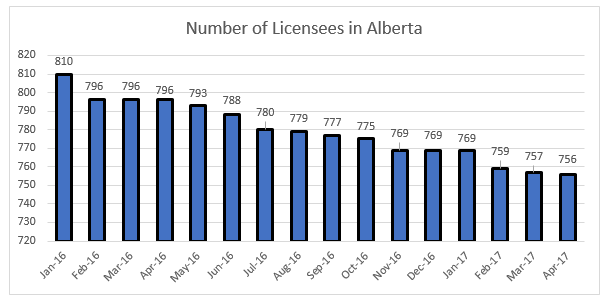

The economic downturn from the commodity price crash in 2014 has had a major impact on organizations relying upon the revenues tied to commodity prices like oil and gas. It’s no surprise that with low oil and natural gas prices, the number of licensees in Alberta has decreased. Simply put, the investment is shifting away due to lower returns. The total number of licensees over the past 16 months can be shown in the plot below:

The plot above indicates that there are more licensees leaving the Alberta oil and gas industry than joining. Below is a summary of the breakdown of these licensees compared to January 2016:

- 676 of the 810 licensees are currently still operating.

- 134 of the 810 licensees have dissolved, been acquired, or defaulted

- 80 new licensees have been created since January 2016

Of the original 810 licensees in January 2016, over 16% of these entities are no longer going concerns. The energy industry has many challenges, but lack of revenue from the underlying commodity will continue to challenge all entities; especially the small producers. Although the regulating agencies are faced with many challenges, hopefully they realize relief is sorely needed for the wider investment community to return to the province.

Contributed by Patrick Gratton, President of Lighthouse Liability Solutions Inc.

Lighthouse Liability Solutions Inc. is a team of professionals who financially forecast asset retirement obligations. We are a full-service liability management team with diverse experience abandoning wells, pipelines, and facilities throughout the basin and managing environmental reclamation projects. We strive to find solutions to reduce abandonment and reclamation costs for all those in the industry.