Drivers in California pay higher prices at the pump than any other state in the country due to supply issues, costs from environmental compliance and fuel requirements, and high state taxes and fees, the U.S. Energy Information Administration said on Monday.

Drivers in California pay higher prices at the pump than any other state in the country due to supply issues, costs from environmental compliance and fuel requirements, and high state taxes and fees, the U.S. Energy Information Administration said on Monday.

In March, costs from Californian environmental programs such as Cap-and-Trade and the Low Carbon Fuel Standard added as much as $0.54 per gallon, the latest data showed.

Consumers in California also pay around $0.90 per gallon in taxes and fees as of March, the highest in the country, the EIA said.

WHY IT’S IMPORTANT

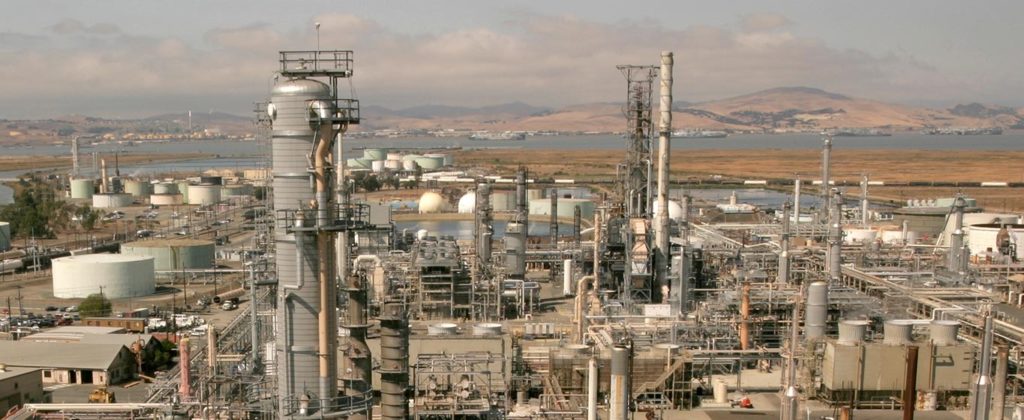

California is the largest U.S. gasoline market but several fuelmakers have ceased operations at less profitable facilities, citing regulatory challenges and market dynamics.

Six plants have shut since 2008, two of which have converted to producing renewable fuels.

The state will likely see even higher gasoline prices as refinery closures put pressure on fuel supply and force the state to rely more on imports from countries like India and South Korea.

Retail prices for regular grade gasoline in the state often exceed the national average by more than a dollar per gallon, the EIA said.

CONTEXT

In October, California Governor Gavin Newsom signed into effect ABX2-1, a bill designed to prevent fuel supply shortages in the state that gives regulators more control over inventory levels for refiners.

Shortly after, Phillips 66 announced plans to shut its large Los Angeles-area oil refinery in the fourth quarter of 2025.

Last month, Valero Energy announced plans to cease operations at its San Francisco-area oil refinery next year.

(Reporting by Nicole Jao in New York; Editing by Nia Williams)