The recent drop in oil prices bears similarities to the tremendous drop of 2008, possibly foreshadowing what’s to come in the new year.

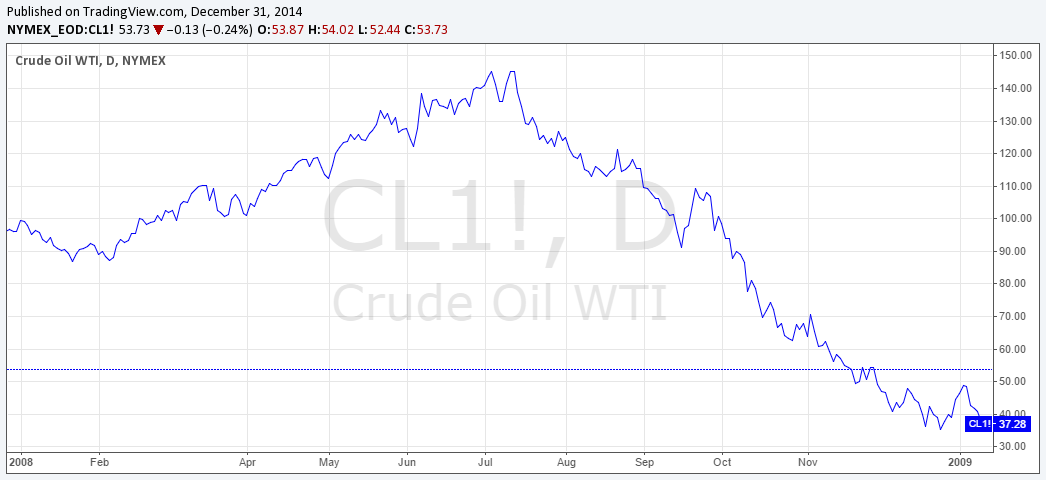

Let’s have a look back at the performance of crude oil in 2008:

Oil started the year around $100/bbl and quickly shot up to nearly $150 by June. The price then declined by over $110 and by December, WTI crude oil finished near $35/bbl.

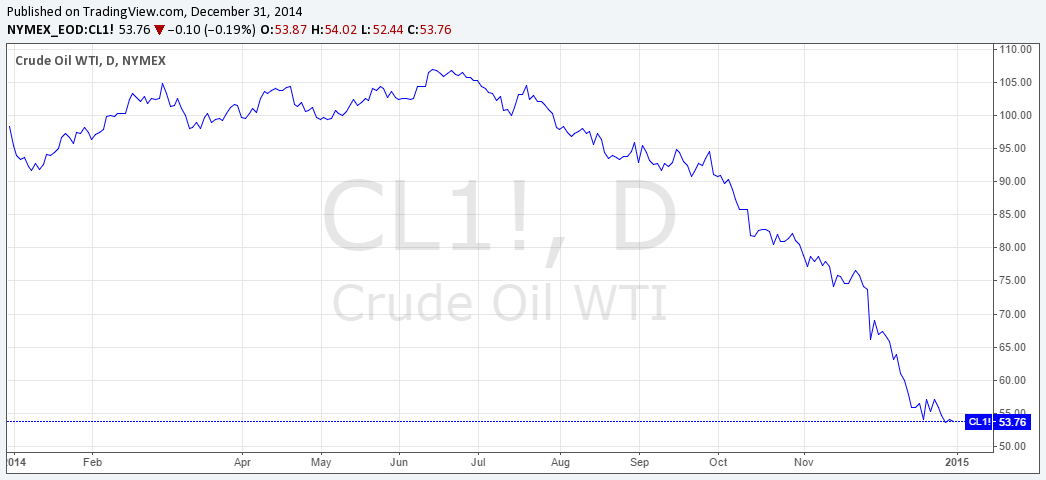

Although not as drastic, this year’s price drop is extraordinarily similar in terms of timing and suddenness:

Once again, oil started this year around $100/bbl. Although it lacked the significant price increase seen in early 2008, this year’s oil decline began almost at the same mid-way point of the year. 2014 ended with WTI down 48% to just above $50/bbl.

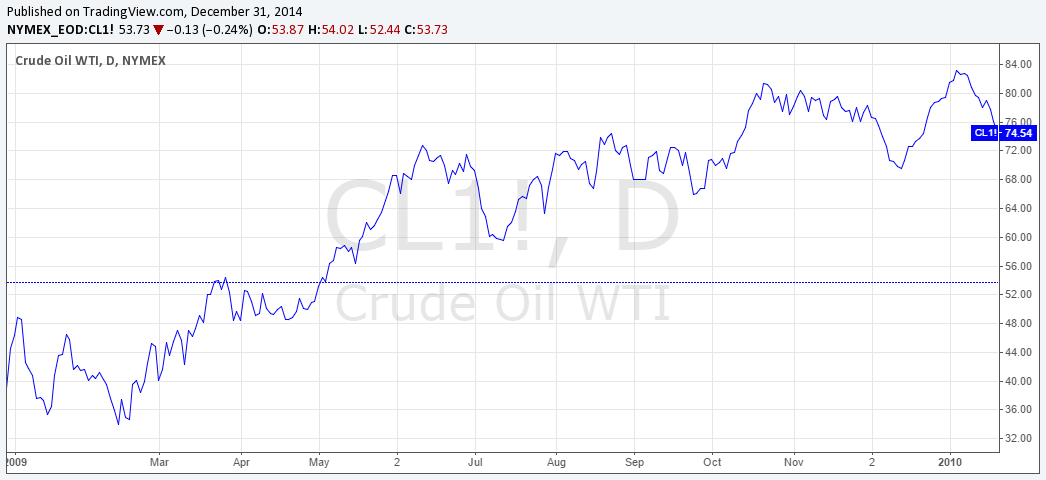

In 2009, however, the price rose nearly 100% to approximately $73/bbl. And although there were no geopolitical factors creating a supply glut, the world economy was tumultuous at best. Something to think about for 2015.

2009 crude oil price chart:

Happy new year from the BOE Report!