The oil price collapse has wreaked havoc across the Alberta economy. Since it began many individuals have expressed their opinion that the end of the hydrocarbon era is upon us and that we need to diversify the provincial economy away from oil. Undoubtedly the government should seek to diversify its income; however it is premature to be writing off oil as an industry.

It is true that oil demand per unit of GDP has been falling across the OECD for decades and it is also dropping on a per capita basis. However the majority of the world’s population lives outside the OECD and as their standard of living rises, so too will their oil consumption. There is an irrefutable link there that is a generation or more away from breaking.

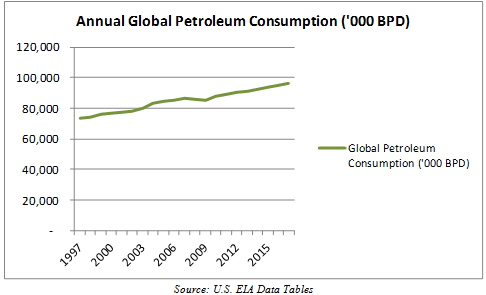

The Kyoto Protocol was adopted in 1997 and the world was consuming roughly 73 million barrels of oil per day. When it came in to force in early 2005 global consumption had reached more than 84 million barrels per day. As the Paris Accord was signed late last year the world was consuming more than 94 million barrels of day. The EIA and other agencies forecast that oil demand will continue to grow by more than 1 million barrels per day for each of the next five years and well beyond.

In addition to the growth in demand, producers must also replace volumes that have been lost to natural declines. This may be as much as 5 million barrels of oil per day every year. That means many billions will need to be invested. It will largely be invested where it receives the highest risk-adjusted rates of return.

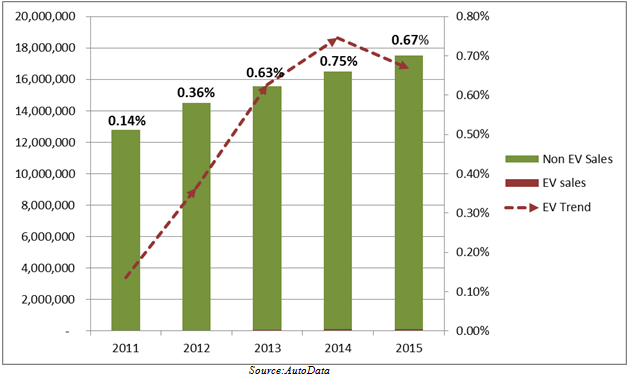

The transition away from an oil fueled economy is not happening at the rate most people have been led to believe. In 2008 Presidential candidate Obama pledged to have more than 1,000,000 electric vehicles on the road of the United States by 2015. The actual number was much closer to 400,000. Perhaps not surprisingly sales of electric and hybrid electric vehicles have fallen in the past year and amount to less than 1% of all the cars sold in the U.S. That is not the kind of progress that indicates the end of the hydrocarbon era is upon us.

The public needs to get real. During this week automobile manufacturers will turn out tens of thousands of cars that operate on gasoline. These vehicles will have operating lives of more than 20 years. At the same time Boeing, Airbus and Bombardier will turn out new aircraft running on aviation fuel that will have operating lives of more than 40 years. Military vehicles, long haul trucks, trains, ships and other transportation means are being manufactured every day and all will operate on oil derived fuels. The momentum for hydrocarbons is such that demand will grow for at least another 20 years and if it stops growing, it will slowly decline over many more decades and perhaps in to the next century.

Despite all of the angst, all of the protests and all of the money spent subsidizing alternative forms of energy, demand for oil continues to grow. This is because the energy density, the transportability and the industrial versatility of this non-renewable energy source has no equal as of today.

My career has afforded me the opportunity to visit North Africa, the Persian Gulf, Russia, Malaysia, Indonesia, Vietnam, Mexico and just about every jurisdiction that produces commercial volumes of oil. Alberta does not take a back seat to any of them when it comes to the professionalism of its operators and genuine care and concern for the environment. The world would benefit from more Alberta oil, not less.

To the opponents of Alberta oil and pipelines, if global demand continues rising where would you rather the world source the heavy oil it will need for the next 50 plus years?

David A. McLellan is the Senior Economist & Business Strategist at Packers Plus Energy Services (USA)