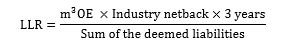

Alberta, British Columbia, and Saskatchewan each have very similar liability management programs and licensees are given a liability rating to determine if they are an at risk company. The licensee liability ratio is determined by dividing their deemed assets by their deemed liabilities. For licensees producing in Alberta, the LLR formula is as follows:

BC and Saskatchewan have subtle differences in their programs in comparison to Alberta, but all three provinces determine the asset values by assigning a common netback. The netbacks for each province is as follows:

- Alberta

- $236.54 / m3OE or ~$37.61/boe

- British Columbia

- $303.00 / m3OE or ~$48.1/boe

- Saskatchewan

- $148.98 / m3OE or ~$23.69/boe

Each province also has a conversion factor so companies can convert gas volumes to boe.

- Alberta

- 1.58 E3m3/m3 oil or (8.87 scf/bbl) or ~$4.25/mcf

- British Columbia

- 3.62 E3m3/m3 oil or (20.3 scf/bbl) or ~$2.37/mcf

- Saskatchewan

- 0.97 E3m3/m3 oil or (5.45 scf/bbl) or ~$4.34/mcf

It’s evident that the governing agencies are generous on assessing the deemed assets for licensees. As of October 21st, 2016 AECO gas closed at $3.23/mcf and WCS oil closed $48.43/bbl, which companies must still must pay royalties, operating costs, and transportation fees to get their product to market.

The regulatory bodies have difficult decisions on how to address the changes in commodity prices. Assuming the average netback in Alberta is in fact 50% of the posted $37.61, then nearly 300 licensees in Alberta would be issued notice to post further security. This would be a major blow to the industry to which many companies couldn’t withstand. As mentioned previously, a low LLR doesn’t always represent a company in financial distress incapable of meeting their asset retirement obligations.

Lighthouse Liability Solutions Inc. is a team of professionals who understand the system as we have both regulatory and direct industry experience. We assist companies in all aspects of the regulatory system and are capable of cheaply reducing liabilities for companies seeking assistance. We are in the process of removing millions of dollars in unnecessary liabilities and assisting companies looking to divest/acquire assets

Patrick Gratton, P.Eng

President

587-999-0339

lighthouseliabilitysolutions.com

gratton@lighthouseliabilitysolutions.com