The Viking play in western Canada has become a staple for oil producers seeking low-cost, high-quality oil production.

Wells producing Viking oil can been drilled for as low as $620,000–in the case of Whitecap Resource’s Saskatchewan property. Typically, wells are drilled, completed and tied-in for $0.75 – $1.2 million. These low cost wells offer lower risk opportunities for producers compared to prolific tight oil plays which get higher production rates, but at much higher costs. Viking oil is also high quality with an API of 36-40 degrees.

These factors have kept drilling into this formation remarkably resilient during the oil price downturn. So far this year, over 1,000 Viking wells have been drilled. Teine Energy and Raging River Exploration have been dominant in the play, drilling over 300 locations each.

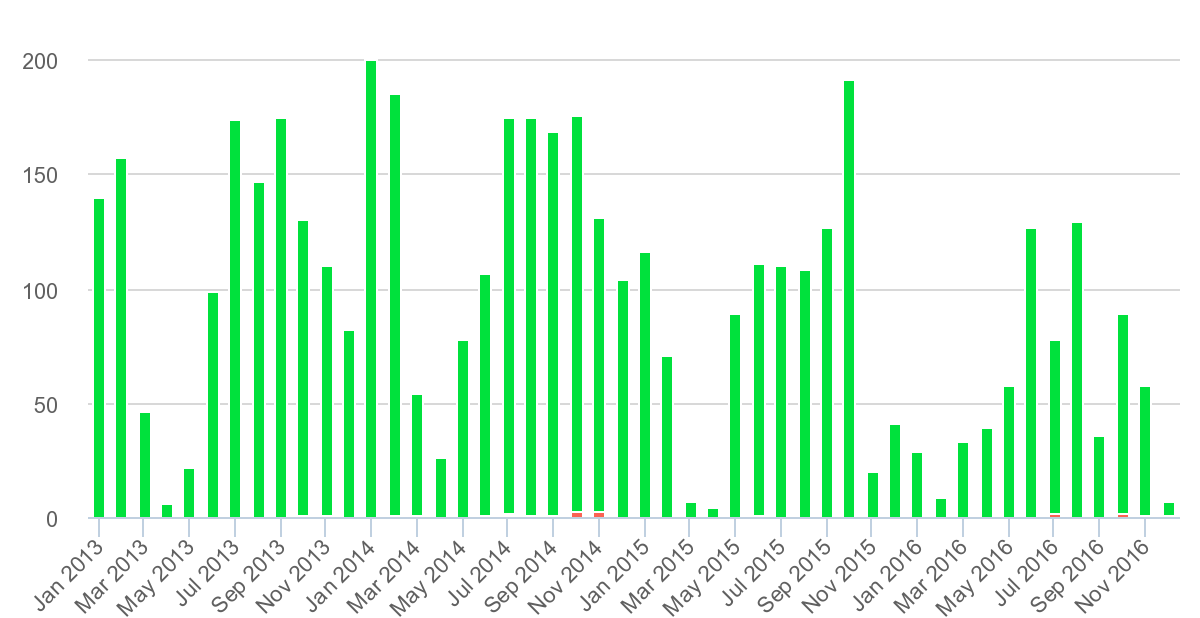

Viking wells drilled by month

The play has also experienced tremendous M&A activity with over $1.2 billion in transactions completed year to date. The average deal fetches a respectable $50,000-$60,000 per boe/d.

Data was gathered from the BOE Report Viking page and BOE Report Finance.