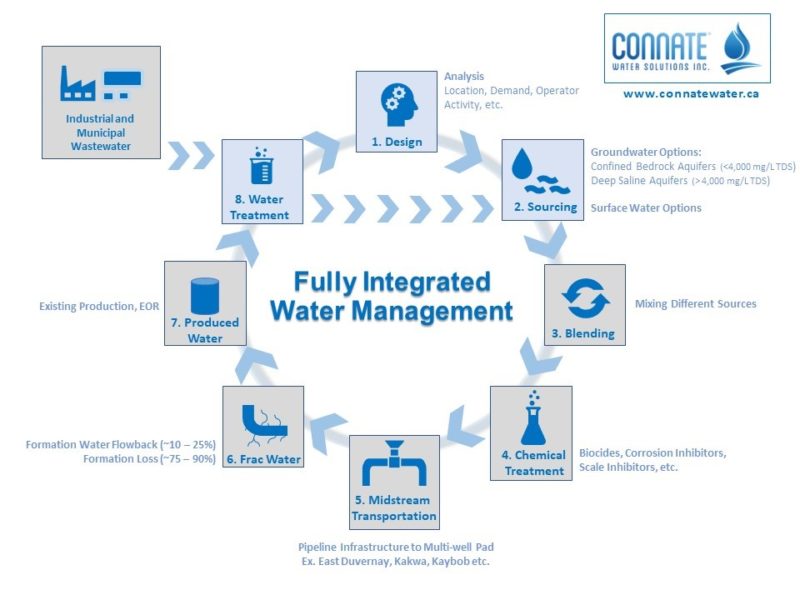

Figure 1: Fully Integrated Water Management Design with Midstream Transportation

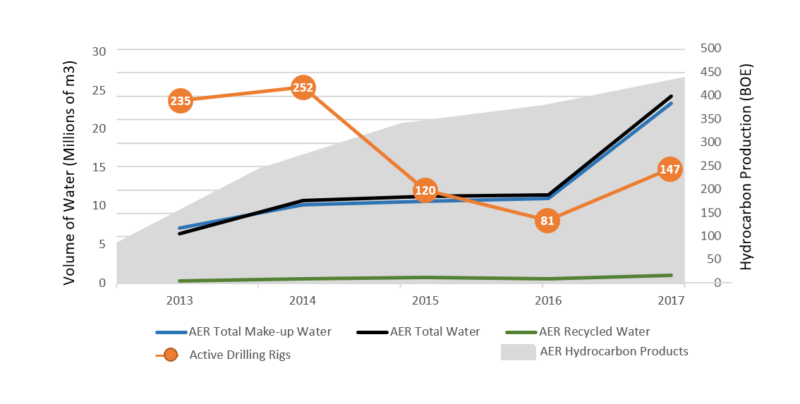

From 2013 – 2017, water usage intensity for hydraulic fracturing skyrocketed by over 250% (AER, 2019)! At the same time, the Alberta oil and gas industry experienced a bumpy 37% decrease in drilling activity. Winds of change surrounding the upcoming provincial and federal elections could result in a significant increase in drilling activity in the coming years. We believe the demand for hydraulic fracturing sourcing and water management solutions in Alberta will continue to soar!

Figure 2: 2013 – 2017 Alberta Hydraulic Fracturing Water Usage, Hydrocarbon Production vs. Drilling Activity (AER Water Use Performance Tool, 2019)

Connate Water Solutions Inc is actively working on the design and water sourcing options associated with the “Fully Integrated Water Management Model”. Currently, the major gap in the Alberta frac water market is: a midstream transportation solution within strategic locations such as the East Duvernay (Step #5 – Figure 1). In Canada, we seem to struggle with construction of pipelines to transport oil, natural gas and the newest midstream commodity: water. It is our opinion that key water sourcing components of a midstream solution will be a combination of: groundwater, surface water, industrial/municipal wastewater and produced water recycling.

The U.S. oil and gas industry spent $34 billion on water management in 2018, with $12 billion of that spent in the frothy Permian basin (IHS Markit, 2019). Private-equity firms in Texas and New Mexico are coming to the table to properly capitalize and seize this massive opportunity. Groundwater supply infrastructure similar to Figure 3 from Solaris Water Midstream will be instrumental roadmaps when midstream frac water supply comes to Canada. As they say: “imitation is the highest form of flattery”.

Figure 3 – Solaris Water Midstream – Midland Basin

Let’s start a conversation about your Groundwater Strategy.

Geoff Kovacik M.Sc. P.Geo.

Founder and Principal Hydrogeologist

geoff@connatewater.ca