How are commodity prices forecast? How do forecast prices differ from strip pricing? Why do these forecasts not always change in response to market variations? These are just some of the questions that arise time and time again throughout the reserves process.

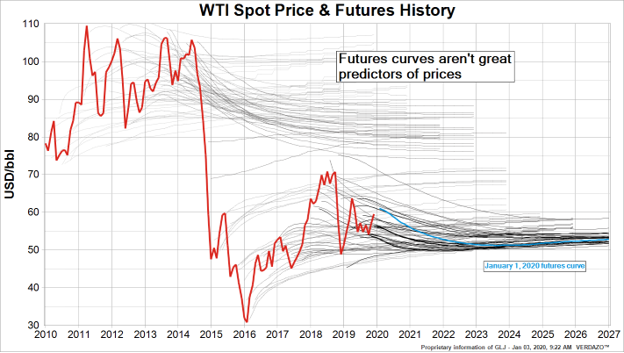

Futures, or forward curves are not truly spot price forecasts

In addition to market expectations of future prices related to supply and demand, a variety of other factors can influence futures curves including, but not limited to, interest and inflation rates, storage costs and availability, liquidity, insurance, portfolio effects, speculation, hedging, position changes or geopolitics. These factors combine differently every day, creating swings in futures curves that may not otherwise occur in an efficient market.

Evaluator forecasts serve a specific purpose

In evaluating reserves, a commodity price forecast must be used to determine the value of an asset throughout its remaining life, often spanning beyond the futures markets trade settlement dates. With this in mind, there is reason to have a more consistent anticipated long-term price based on underlying market fundamentals. Long-term market projections should stay relatively unchanged by swings in near-term prices unless there has been a major fundamental change to the marketplace.

Realized prices will deviate from forecasts in some aspects, however, the goal is to mitigate these differences as much as possible over the remaining life of assets based on currently available market data and other supporting information.

The logic behind our forecasts

Any single source of data is generally insufficient as a predictor of future prices. Therefore, when building a forecast, it is important to consider a wide variety of information sources. GLJ forecasts short-term pricing (first 12-18 months) to be relatively aligned with recent historical prices and futures markets data, while also considering immediate market trends. Medium to long-term predictions draw insight from industry and government publications, as well as other proprietary data, with the expectation that supply and demand will move toward a balance in both local and global markets.

When creating a price forecast for reserves evaluations, the goal is to appropriately account for short-term market changes while not allowing this volatility to affect our long-term prognosis.

GLJ’s January 2020 Price Forecast

GLJ’s recently released January price forecast has been revamped to include a variety of global oil and natural gas benchmarks, as well as other products relevant to the energy industry. The updated forecast has WTI and Edmonton Light long-term prices of 66.00 USD/bbl and 78.70 CAD/bbl, respectively (in real 2020 dollars), with Henry Hub and AECO long-term forecasts at 2.90 USD/MMBtu and 2.60 CAD/MMBtu, respectively (in real 2019 dollars).

Justin Mogck is GLJ’s Director of Commodities Research