Maple Leaf 2013 Oil & Gas Income LP (“Maple Leaf 2013”) and Maple Leaf 2015 Oil & Gas Income LP (“Maple Leaf 2015”), (collectively “Maple Leaf” or the “Company”) has engaged Sayer Energy Advisors to assist it with the sale of the royalty interests held by the Company.

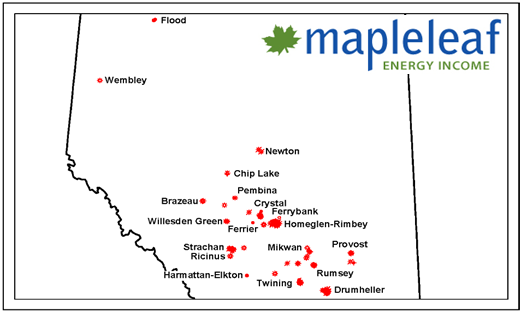

The Company holds royalty interests in properties located in the Drumheller, Twining, Rumsey, Harmattan-Elkton, Provost, Mikwan, Ricinus, Strachan, Ferrier, Ferrybank, Homeglen-Rimbey, Crystal, Willesden Green, Brazeau, Pembina, Chip Lake, Newton, Wembley and Flood areas of Alberta (the “Properties”).

Maple Leaf 2015 only has a royalty interest in three wells at Willesden Green. The remaining Properties are held under Maple Leaf 2013. The royalty interests associated with Maple Leaf 2015 will require a separate bid as these are held in a separate fund.

Production net to the Company in 2019 was approximately 48 boe/d (179 Mcf/d of natural gas and 18 bbl/d of oil and natural gas liquids per day).

Royalty income from the Properties was approximately $380,000 in 2019.

Sproule Associates Limited (“Sproule”) prepared an independent reserves evaluation of the Properties as part of the Maple Leaf 2013’s year-end reporting (the “Sproule Report”). The Sproule Report is effective December 31, 2019 using Sproule’s December 31, 2019 forecast pricing.

Sproule estimates that as of December 31, 2019, the Properties contained remaining proved plus probable reserves of 64,000 barrels of oil and natural gas liquids and 598 MMcf of natural gas (163,000 boe), with an estimated before tax net present value of approximately $2.7 million using forecast pricing at a 10% discount.

There is no current reserve report for the Maple Leaf 2015 royalty interests.

Summary information relating to this divestiture is attached to this correspondence. More specific information is available at www.sayeradvisors.com. A package of more detailed confidential information will be sent to any party executing a Confidentiality Agreement (copy attached).

Sayer Energy Advisors is accepting cash offers to acquire the Properties until 12:00 pm on Thursday, June 25, 2020.

Click here to access the full package on Sayer’s website.

Tom Pavic, CFA

President

SAYER ENERGY ADVISORS

1620, 540 – 5th Avenue SW

Calgary, Alberta T2P 0M2

P: 403.266.6133 F: 403.266.4467

C: 403.681.8109

www.sayeradvisors.com