Each week, XI Technologies scans their unique combination of enhanced industry data to provide trends and insights that have value for professionals doing business in the WCSB. If you’d like to receive our Wednesday Word to the Wise in your inbox, subscribe here.

It’s no secret that this has been one of the hardest drilling seasons in recent memory. The combined crisis of COVID-19 and international price wars have led to dramatically slashed capital budgets, forcing many companies to reduce or eliminate their drilling programs.

But enough of the doom and gloom…operators continue to invest and develop their WCSB assets and are achieving impressive results! It’s that semi-annual time of year, when XI Technologies posts a series of Top 10 lists to showcase the successes among operators continuing to drill new wells and bring them on to production. Even with the challenges within the industry in 2020, we felt it important to continue to do so to both benchmark the state of the industry in comparison to the beginning of the year and also to dispel the notion that drilling is dead. The oil and gas drilling industry may be down right now, but it is certainly not out, as the following lists will show.

In our March 10th article, we pooled the data from all of 2019. This time around, we’ve pulled data to show you how the major players have performed in the first half of 2020, and how that compares to the drilling performance we saw in 2019. You may also want to compare this with our analysis of the first half of 2019, by finding our blog from last August.

Enjoy!

To find out how you can put this kind of drilling & production data to work for you, download a case study, or contact us for a quick demo of OffsetAnalyst and/or AssetBook.

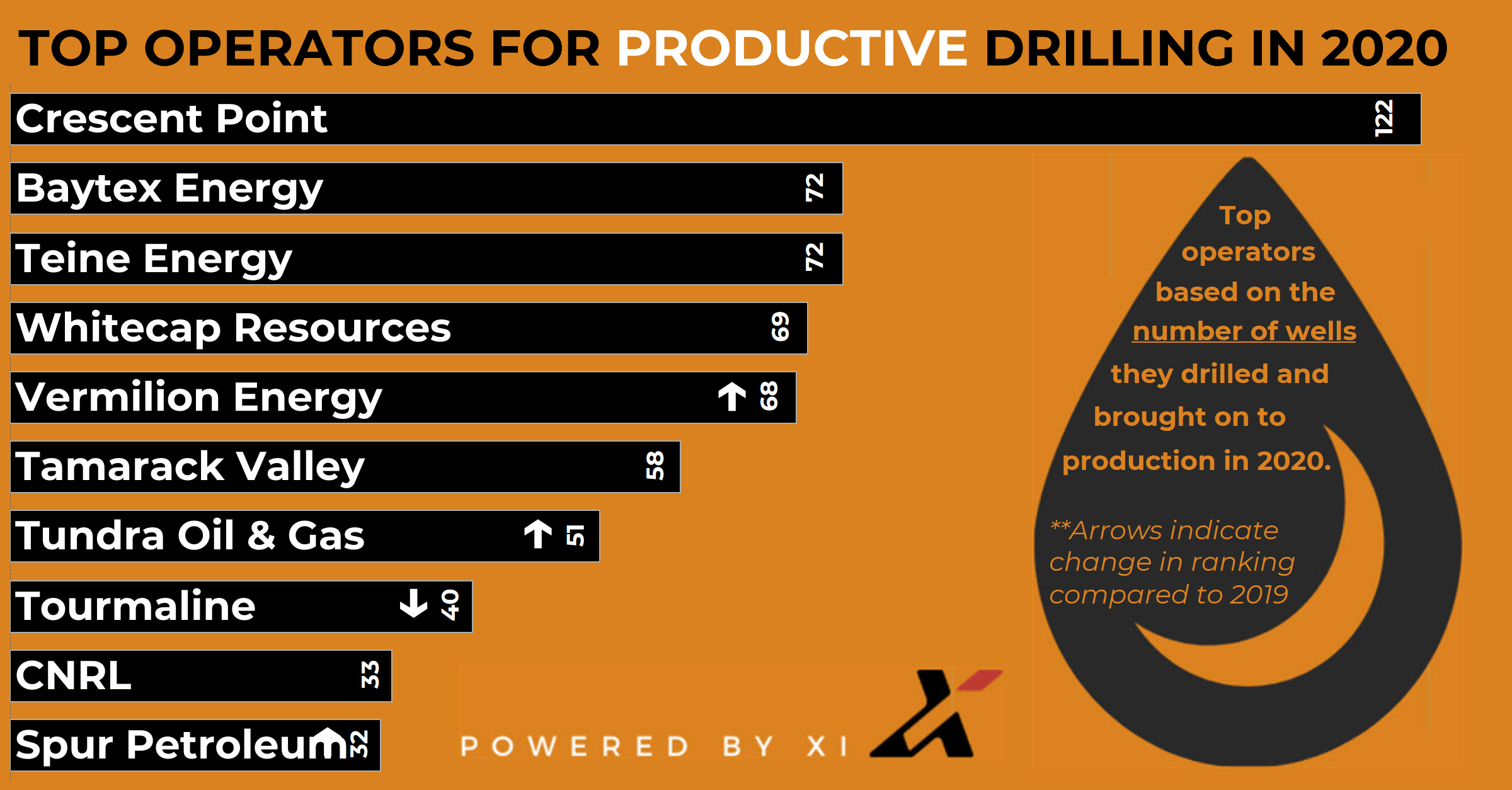

Top operators for “productive” drilling

More important than the number of wells drilled is how much production you achieve with those wells. Crescent Point and Baytex Energy hold the top two spots on this chart for the year so far. Arrows indicate other companies who were on the list for all of 2019, and whether they moved up or down in the rankings. Tundra Energy and Spur Petroleum is new to the top 10 in 2020 in comparison to 2019.

Top operators for new well production

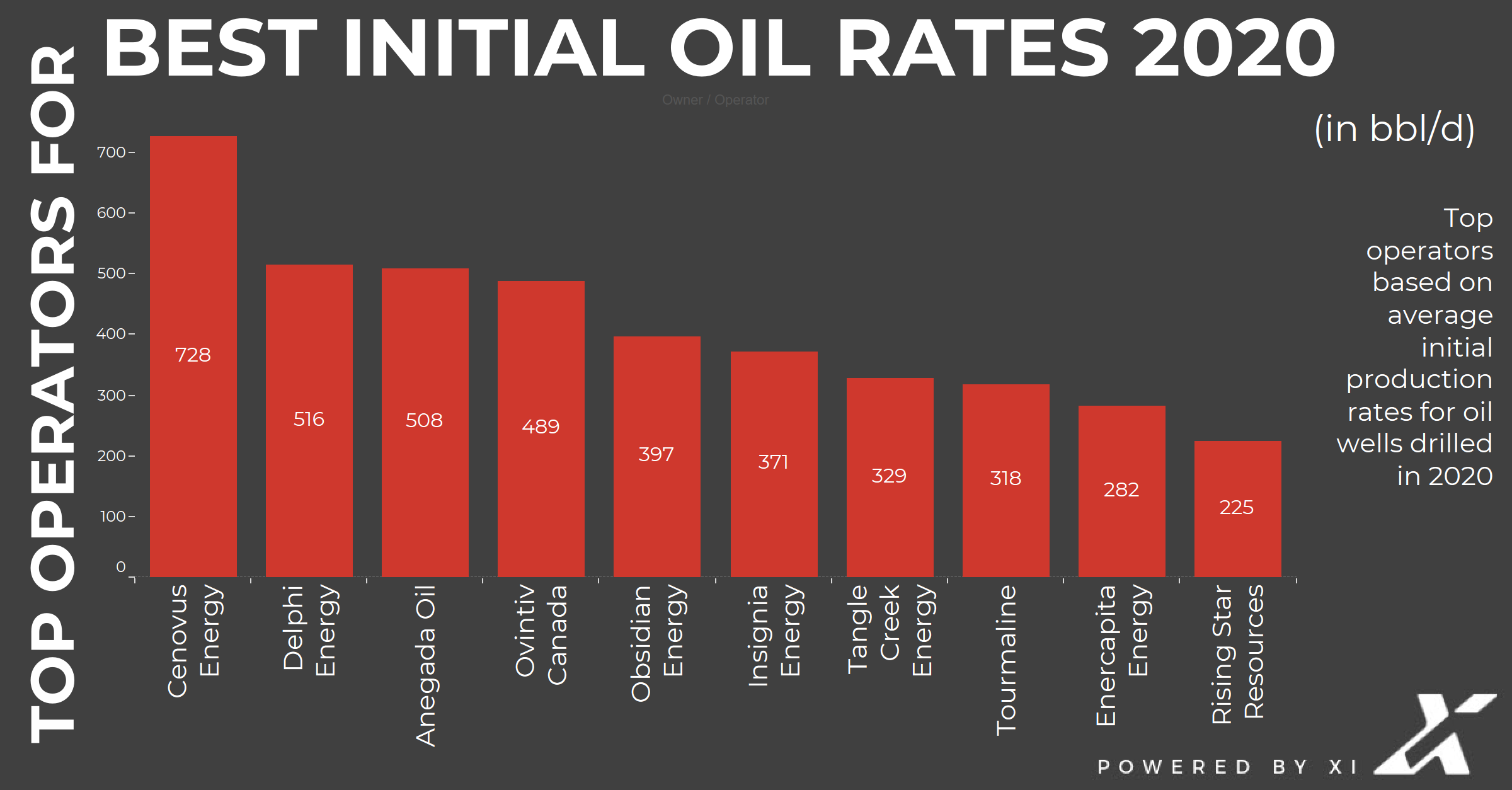

Achieving a high initial production rate can have a significant impact on the overall ROI for a well or drilling program.

In the graphic below we’ve looked at IP 90 rates for new gas wells and oil wells drilled in 2020. Congratulations to Husky Energy and Saguaro Resources for topping the list so far this year.

Which operators achieved the best rates from their best oil wells drilled during the same time frame? So far, Cenovus Energy and Delphi Energy top the field.

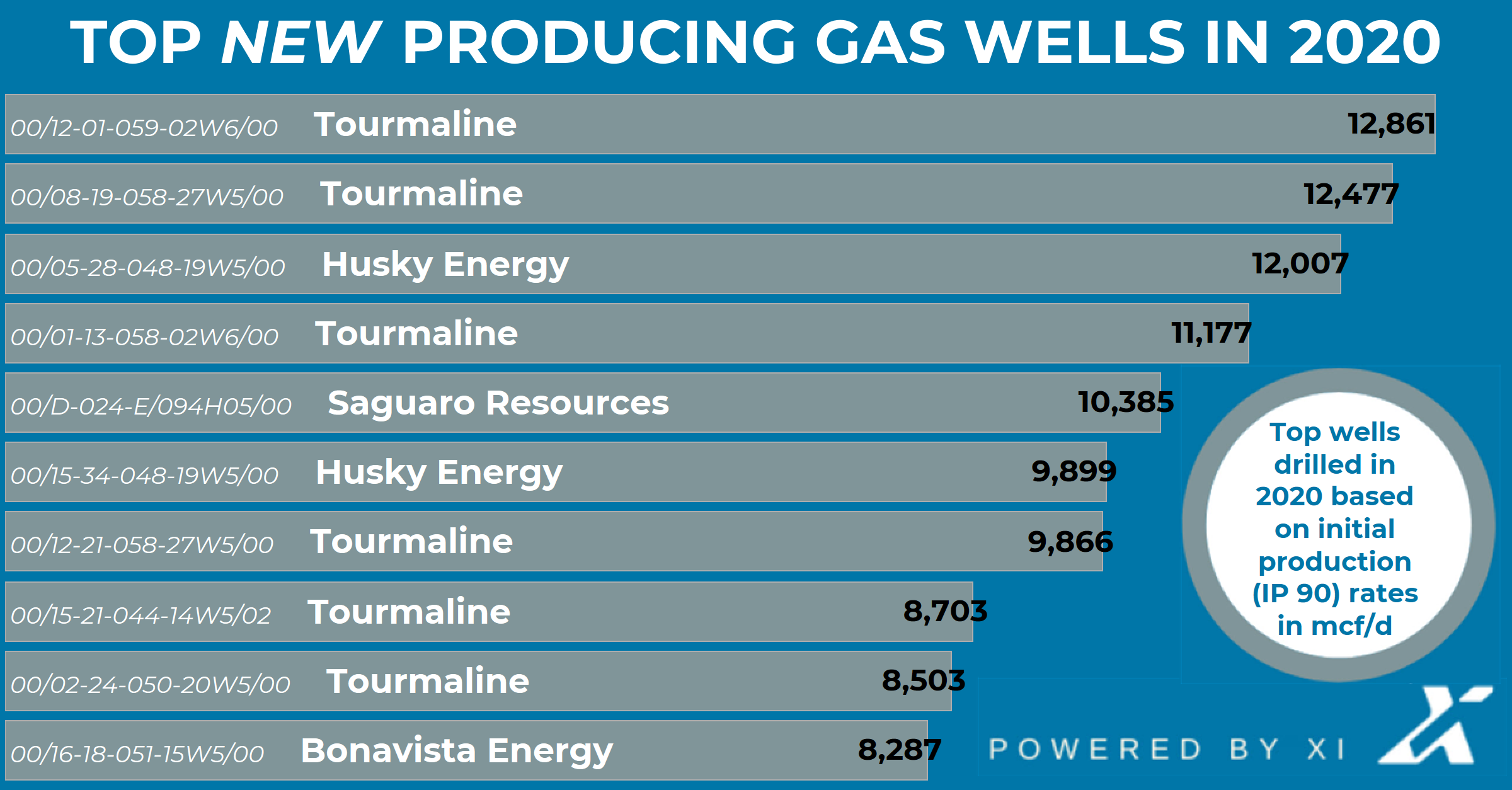

Top 10 new producing gas wells

Based on the data, while Tourmaline Oil Corporation drilled the two most successful gas wells in 2020, with 6 of the top 10 performing wells in this list.

Top 10 new producing oil wells

When it comes to initial production rates for oil wells drilled in 2020, Vermilion Energy top the list by a significant margin. Cenovus Energy is the only producer with multiple entries on this list with three of the top ten.

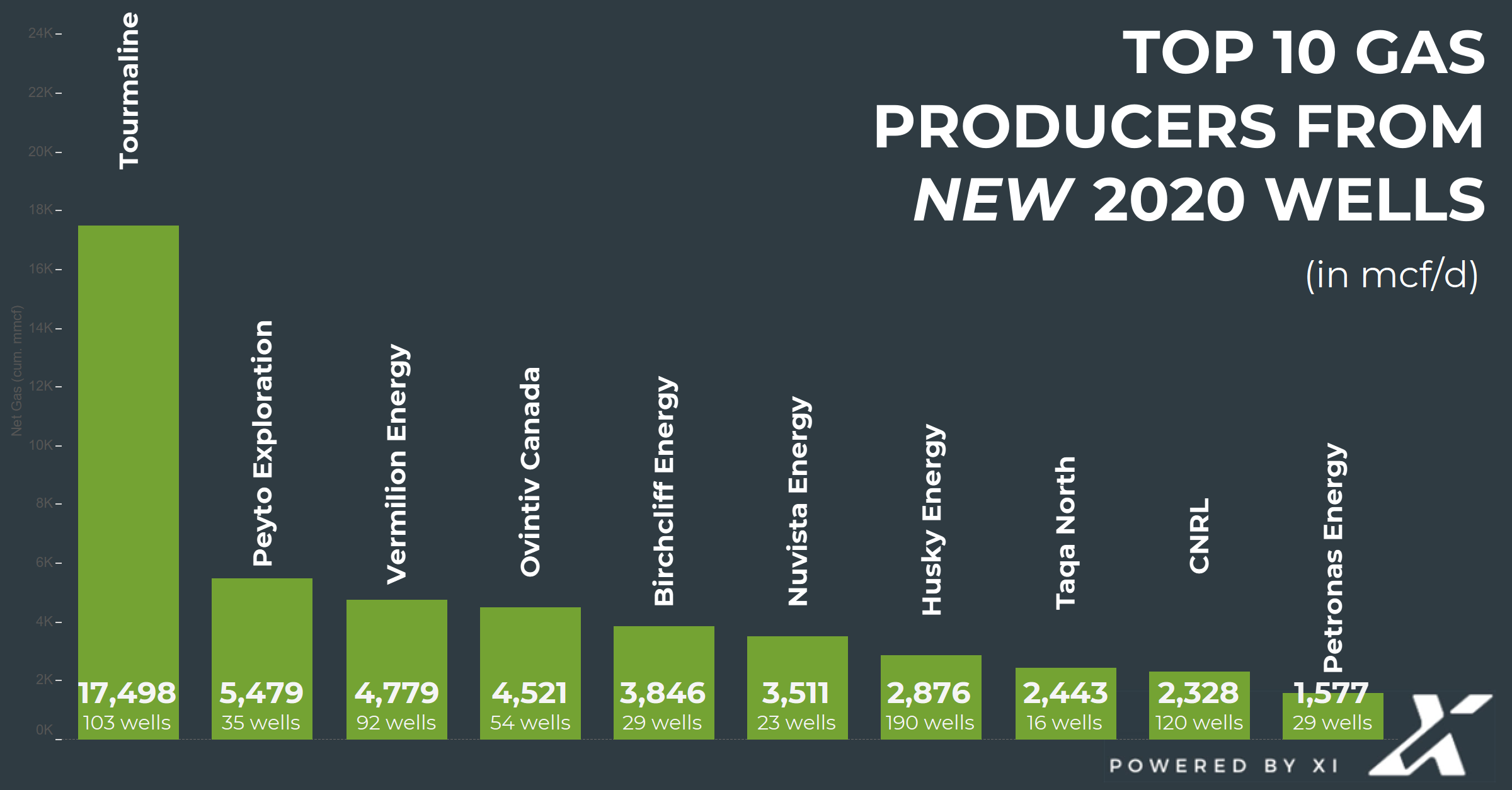

Top 10 operators for new gas production

Which operators achieved the greatest gas production (in mmcf) from wells drilled in the WCSB in 2020? Tourmaline stays in the top position it held throughout 2019, with Peyto Energy leaping into second after not ranking in the top ten in 2019.

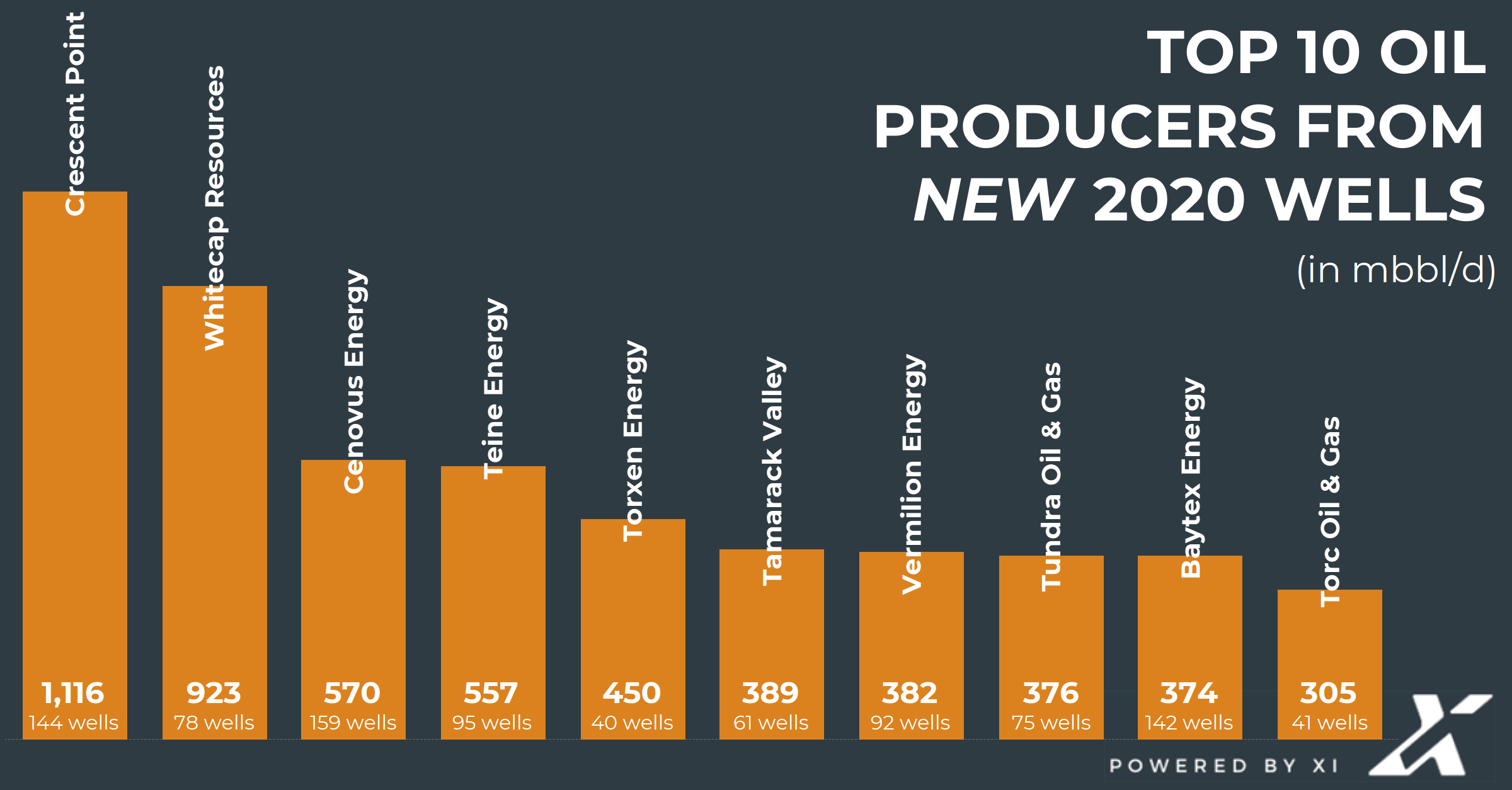

Top 10 operators for new oil production

Which operators added the highest cumulative total oil production (in mbbl) from wells drilled in the WCSB in 2020? Crescent Point is once again at the top of the list, as it was last year. They’re followed by Whitecap Resources, Cenovus Energy, and Teine Energy.

Congratulations to all our WCSB operators and producers. The last few years have been challenging and difficult for all of us, but the Canadian energy industry continues to exhibit a commitment to innovative, responsible production that rivals that of any producing nation. Want to be able to easily pull stats and other market intelligence like the ones shown here? Contact XI Technologies for a demo or trial of OffsetAnalyst.