Rake Resources Ltd. (“Rake” or the “Company”) has engaged Sayer Energy Advisors to assist it with a sale of the shares of the Company.

Rake is a private company with over 30 years of history operating oil and natural gas properties in southeastern Saskatchewan. Rake has one shareholder, no severance obligations, no employees and a minimal office lease obligation.

Rake currently has approximately $350,000 in positive working capital. Additional corporate information relating to Rake will be provided to parties upon execution of a confidentiality agreement.

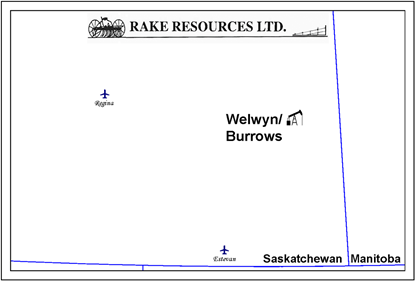

The Company’s operations are focused in southeastern Saskatchewan near the Manitoba border. Rake’s oil properties are located six kilometres northwest of Wapella in the Burrows area, also 12 kilometres northwest of the town of Moosomin in the Welwyn area of Saskatchewan (the “Properties”). Rake’s Properties are in close proximity to the TransCanada highway. The distance between Burrows and Welwyn is approximately 22 kilometres.

The Properties are 100% operated by Rake. The Company’s wells are all vertical wells which are unfracked. The Company believes there is upside potential in completing the vertical wells and in drilling horizontally.

Current production net to Rake from the Properties consists of approximately 11 barrels of oil per day from six producing oil wells. Earlier this year, the Company shut-in production with the onset of the COVID-19 pandemic. Prior to the shut-in, average daily production net to Rake from the Properties in January 2020 was approximately 22 barrels of oil per day.

As of September 28, 2020, Rake’s net deemed asset value was ($120,452) (deemed assets of $472,748 and deemed liabilities of $593,200), with an LMR ratio of 0.80.

Summary information relating to this divestiture is attached to this correspondence. More specific information is available at www.sayeradvisors.com. A package of more detailed confidential information will be sent to any party executing a Confidentiality Agreement (copy attached).

Proposals relating to this process will be accepted until 12:00 pm on Thursday, December 10, 2020.

For further information please feel free to contact: Ben Rye, Grazina Palmer or Tom Pavic at 403.266.6133.