Each week, XI Technologies scans its unique combination of enhanced industry data to provide trends and insights that have value for professionals doing business in the WCSB. If you’d like to receive our Wednesday Word to the Wise in your inbox, subscribe here.

Succeeding in oil and gas development comes down to how well and how quickly you can analyze potential opportunities. Once a month, XI Technologies will apply its evaluation tools to a currently available asset to give readers a sense of the opportunities available and how they can be evaluated for A&D purposes.

For this month, XI will examine the Briko Energy Corporation offering up for sale.

Potential Deals

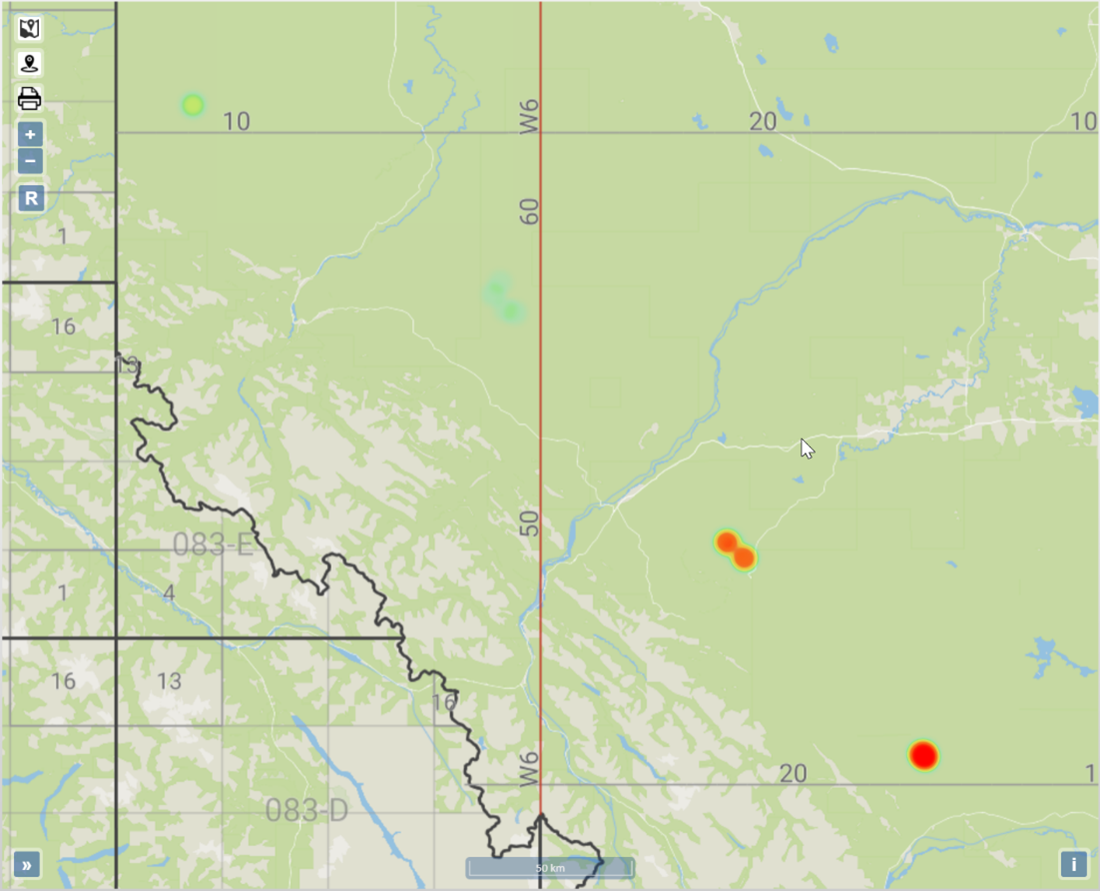

We quickly created a heat map of Briko’s production to get a visual sense of their core, given that they have assets spread across Alberta.

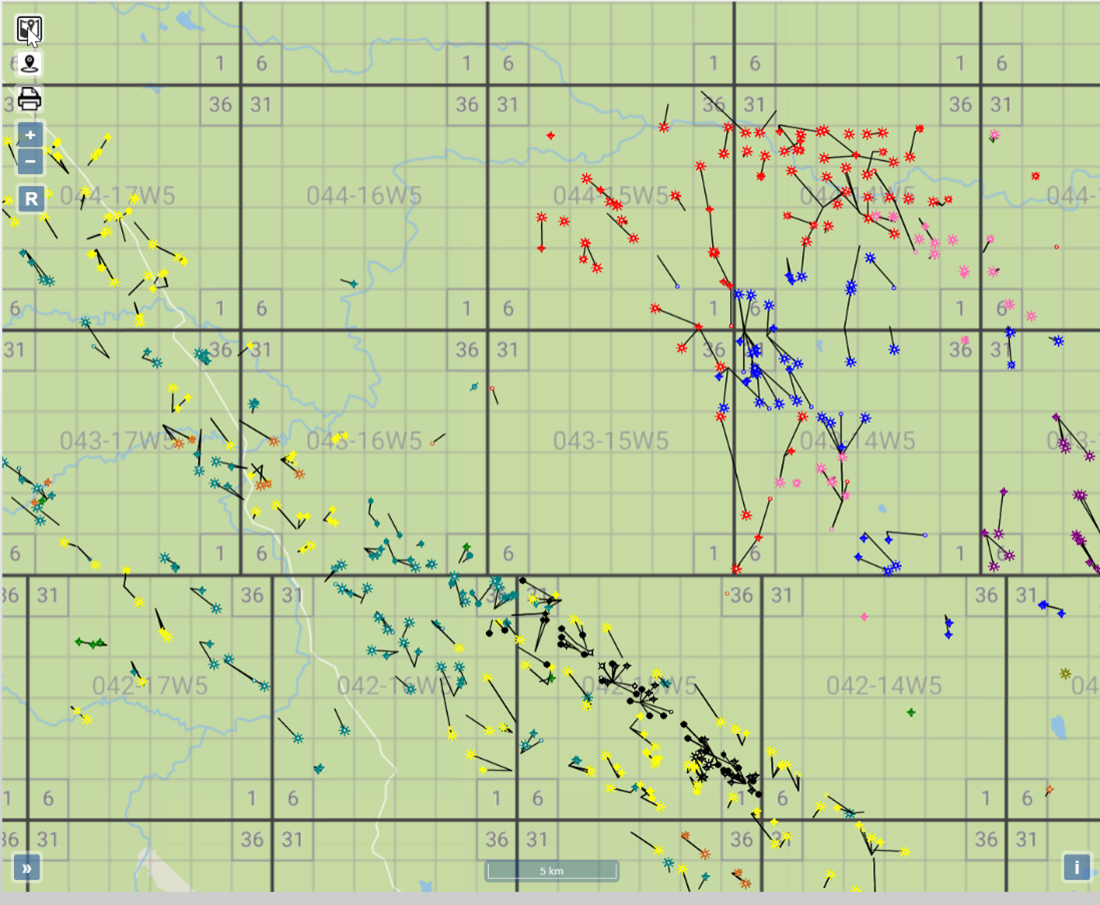

Focusing on their assets centred around 40-15W5 allows us to look at who the most likely bidders for the asset would be. The first thing to check for is who has a core interest in the area by running a quick search in the AssetBook. By expanding the area, we can see there are about 62 companies with interest in this area. Here is a map of the top ten companies wells and land in this area:

Click here to download a report on these companies.

Asset Liabilities

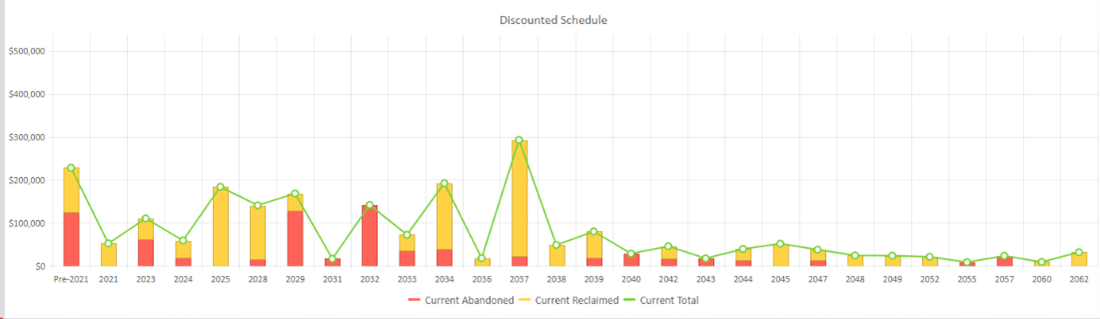

Another critical part of A&D research is to look at the liabilities carried by the asset. We can provide an ARO list for the well assets listed for sale. XI’s industry leading cost model estimates the discounted Working Interest ARO value to be within reason with the LLR values calculated on these Assets. We’ve run reports on the liabilities on these assets, to download them click the following links:

In addition to knowing an asset’s ARO numbers, it’s helpful to know the scheduling of those obligations and how they will fit into your company’s short, mid, and long-term planning. Here’s the discounted liability scheduling of these assets:

These are just a few quick ways to do A&D prospecting, using a real-world example that is currently available for purchase. If you’d like to learn more about how XI’s AssetSuite can analyze potential acquisitions, contact XI Technologies.