U.S. energy firms kicked off the new year by continuing to add oil and natural gas rigs this week after increasing the rig count in 2021 after two years of declines.

U.S. energy firms kicked off the new year by continuing to add oil and natural gas rigs this week after increasing the rig count in 2021 after two years of declines.

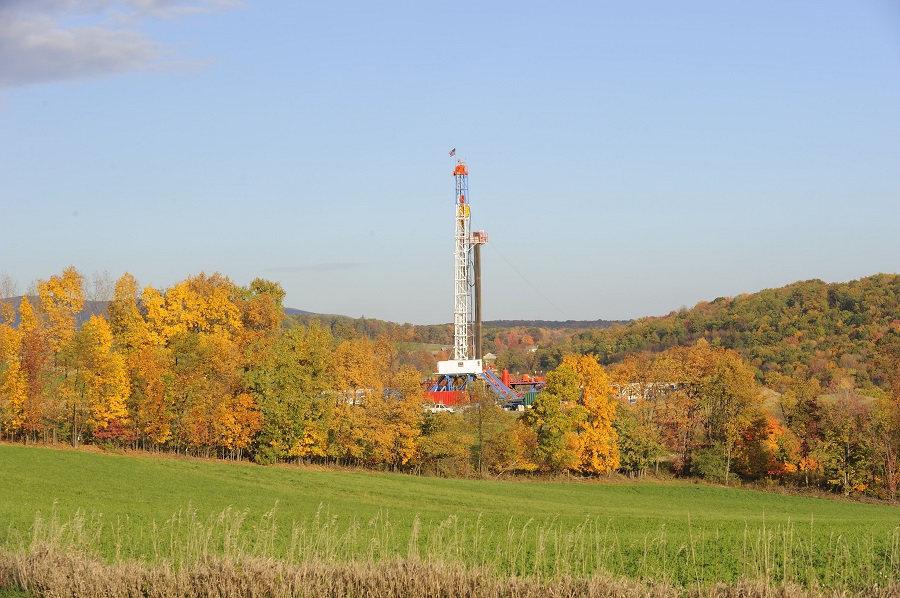

The oil and gas rig count, an early indicator of future output, rose two to 588 in the week to Jan. 7, its highest since April 2020, energy services firm Baker Hughes Co said in its closely followed report on Friday.

Even though the rig count has been rising for a record 17 months in a row, analysts noted production was still expected to ease in 2021 as some energy firms continue to focus more on returning money to investors rather than boosting output.

The total rig count was up 228 rigs, or 63%, over this time last year.

U.S. oil rigs rose one to 481 this week, their highest since April 2020, while gas rigs rose one to 107, their highest since March 2020.

U.S. crude futures were trading below $79 per barrel on Friday, putting the contract on track to rise for a third week in a row for the first time since October.

But with oil prices up about 5% in the first week of the year after soaring 55% in 2021, a growing number of energy firms said they plan to raise spending for a second year in a row in 2022 after cutting drilling and completion expenditures in 2019 and 2020.

As a result, the combined count rose 235 last year after declines of 454 rigs in 2020 and 278 rigs in 2019.

The spending increase in 2021, however, was small and much of it went toward completing wells drilled in the past, known in the industry as drilled but uncompleted (DUC) wells.

“Roughly 25% of recent well completions draw upon the non-renewable source of DUCs, implying a continued recovery in the rig count may be needed in 2022 to sustain recent well completion rates,” analysts at EBW Analytics Group said in a note.

Looking forward, U.S. financial services firm Cowen & Co said the independent exploration and production (E&P) companies it tracks plan to boost spending by about 13% in 2022 versus 2021 after increasing spending about 4% in 2021 versus 2020.

That follows a drop in capital expenditures of roughly 48% in 2020 and 12% in 2019.