As we launch into a new year and contemplate implementing renewable sources of energy in Canada, it’s important to identify which of those sources are critical. Just last year, Canada designated lithium as a critical mineral in a very insightful move. We’ve lived a few years with the adage “Data is the new oil” but increasing it is becoming apparent that perhaps we should change that saying to “Lithium is the new oil”.

Analysts are identifying conditions that are making lithium a severely critical resource in Canada and North America. Traditional lithium batteries now consume over 70% of global lithium production according to United States Geological Survey (USGS) research.

EV surge makes lithium the new oil

Electric vehicle (EV) sales are surging according to analysts and since EV batteries use large quantities of lithium, lithium demand is growing fast with reports that “demand is set to explode as much as 1000% by 2030” and possibly more according to the Energy Information Administration, as countries in North America and the EU continue to enact policies to encourage the adoption of electric vehicles and renewable energy battery storage. The IEA is not showing signs of slowing their encouragement of EV adoption with leaders like Fatih Birol, Exec Director of the IEA endorsing them in the IEA’s Global EV outlook, saying “While they can’t do the job alone, electric vehicles have an indispensable role to play in reaching net-zero emissions worldwide”.

100 years of oil and gas exploration expertise

Canada, and specifically the prairie provinces are rich in natural sources of lithium, from both hard rock sources that can be mined and also from saltwater brine aquifers deep in the subsurface. In the case of Alberta- 100 years of oil and gas exploration means we have a substantial mapping of subsurface formations and structures. In addition, Alberta has a developed regulatory environment, a robust industrial capability and an experienced workforce which means there is an opportunity for the development of ample domestic supply.

North American EVs crash into a wall of supply concern

Looking at where the current global supply is concentrated indicates looming supply uncertainty for North America. U.S. automakers aspire to make EVs 40% to 50% of new vehicle sales by 2030. This will result in a tremendous increase in North American lithium demand, no doubt in response to pressure from the Biden administration’s push for emissions rules to ensure that up to 60% of new passenger cars and trucks sold are zero-emission by 2030. In addition to EV demand, there is also growing demand from energy storage systems (ESS), 5G devices, and Internet of Things (IoT) infrastructure.

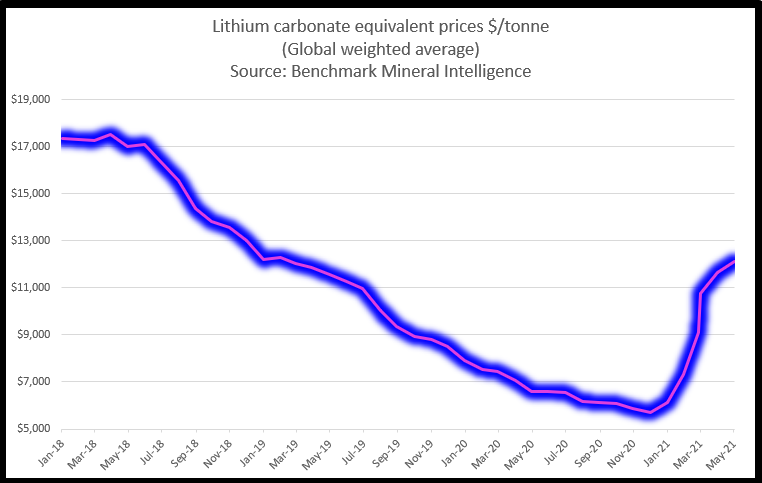

Simon Moores, CEO of Benchmark Mineral Intelligence has stated that the EV industry is already facing a shortage of battery-grade lithium, and could be facing years of price volatility.

“Raw material costs have been low, but what’s happened in the last year is raw material costs, especially lithium, are rising significantly. So lithium prices have gone up and they’re now impacting battery cells.”

He defines a short supply of lithium as a “structural shortage” – there’s literally not enough capacity in the industry to meet demand. After reports of lithium prices surging by over 400% in the last year, prices may rise sharply on supply shortage in 2022 and beyond.

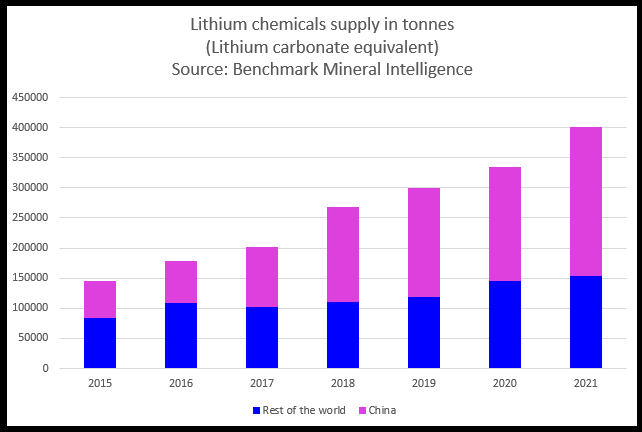

Asia is increasingly the source of lithium supply. As reported in Forbes magazine, China has become the 3rd largest lithium producer in the world, outproducing the U.S. in 2020 by more than a factor of 15. Currently, China dominates the lithium-ion battery supply chain. The chart below, also courtesy of Benchmark Mineral Intelligence, illustrates China’s dominance of the global lithium supply.

The growing storm is that the U.S. and Canada risk being overly dependent on supply from China which mirrors the conditions of the 1970s when an over-dependence on foreign OPEC oil created an energy crisis in both countries which was relieved by developing North American domestic supply. The 2021 BP statistical review reports China has 7.9% of the world’s lithium reserves while the U.S. has 4.0%.

Unusual recent development

In the face of the growing dependence on Chinese lithium supply, it is seriously short-sighted that the sale of major Canadian lithium development company Neo Lithium Corp. to Chinese state-owned Zijin Mining Group Ltd. was announced in 2021 and has gone without a formal national security review by Ottawa.

Since 2015, Neo Lithium has been developing a mine in Argentina to supply lithium to the EV industry for batteries and has achieved production of 99.9% purity lithium before the sale was announced in October 2021. As reported in the Globe and Mail, “All foreign takeovers of Canadian companies are subject to an initial security screening by Ottawa. If the government suspects the transaction could be a threat to national security, the deal undergoes a more thorough formal review under Section 25.3 of the Investment Canada Act, and could ultimately be blocked.”

There are calls for a formal national security review of this pending acquisition.

Enter the Alberta advantage

Chris Doornbos, president, and CEO of E3 Metals Corp, a lithium extraction firm located in Calgary, Canada, which plans to produce battery-grade lithium hydroxide from saline formation water sees opportunities in Alberta.

“It is estimated that the U.S. alone will need 500,000 metric tons per year of unrefined lithium by 2034 just to power EVs. The U.S. produces just a fraction of that today. The current global production of lithium in 2020 was about 440,000 metric tons of lithium carbonate equivalent (LCE, contains about 18% of pure lithium), and not all of that is in pure enough form for batteries”

E3 metals have prototypes and a pilot project in Clearwater Alberta to produce a product for the development of high purity lithium compounds used in Li-ion batteries. They have been working over the past five years in partnership with the University of Alberta, private labs, and now at their development facility in Calgary.

Maureen McCall is an energy professional who writes on issues affecting the energy industry