A woman sees a man walking down the street carrying a long pole. She stops him and asks, “Excuse me, are you a pole vaulter?”

The man answers, “No, I’m Ukrainian, but how did you know my name vas Valter?” (old joke told by one of my comic (Ukrainian) heroes, latest in my running salute to the wonderful sense of humour of the Ukrainian people)

Something equally mystifying showed up in my inbox this past week, a nugget the likes of which I’ve never seen before. It was an earnest little thing, looking to tap an audience for useful information in a very quiet way.

We all know that messages now move at the speed of light; the world has a billion tiny little reporters linked live to global platforms, like a near-infinite number of little periscopes and microphones live and at the ready. When someone wants something to be known, it happens fast. If it’s relevant, it spreads much faster than wildfire.

The email seemed to be trying to gingerly step around that fact, not easy given the startling nature of the information request. It sought input through a third party, on behalf of the federal agency Natural Resources Canada, to gather feedback “in consideration of changes to narrative and government policy to support increased growth of Canada’s oil and gas production and assist access to market access.”

How long I lay passed out on the floor I cannot say, but upon awaking I was hungry and needed a shave, for what that’s worth. The note came via a highly relevant institution, and since it is neither Halloween nor April 1, I am assuming it is what it appears to be.

Well then. Where to start. First off, I would say: Awesome! This is great news indeed. It’s all the petroleum industry has been waiting for. We don’t mind developing new energy solutions, we don’t mind working on emissions reduction technologies; we are proud to be part of making our industry better. As the first sentence on the back of my book says, everyone knows hydrocarbons’ dominance won’t last forever. What’s been missing in the national dialogue though is the fact that at present petroleum keeps the world alive, and that any energy transition must begin with the hydrocarbon system, not replace it.

There is a perplexing structural problem though that appears insurmountable from over here: given the strength and consistency with which the previous anti-hydrocarbon narrative has been maintained with rock solid consistency, how does the federal government plan to undo all that? Is anyone going to buy it? How will all the marshalled troops take it when you tell them to turn around and point the guns the other way?

When you promote a Greenpeace activist to a position of importance, we all hear you. We know what Greenpeace says about the petroleum industry, and we take investment cues accordingly. When you march with Greta and the accompanying signs claiming that fossil fuels are killing the planet, we hear you, and act accordingly – potential oil/gas investors pledge never to spend a nickel in Canada.

When you enact a west coast tanker ban but not an east coast one, we hear you – and no one believes you are taking market access seriously. When you tacitly support an endless stream of pseudo-scientific analyses from blinkered think-tanks designed to convince the public and policy-makers that fossil fuels are non-competitive/last century’s fuel/dirty/soon obsolete, hydrocarbon industry workers hear that, and choose to leave the industry rather than face a duped but hostile public.

Every time federal officials have said “We need to move away from fossil fuels”, people have heard you. The messaging has worked, from the pressure on students to avoid petroleum programs to the message to investors that banks and money managers should move funds to green initiatives.

But hey, we hear your request, and it is in the right direction, so let’s see what we can do. We’re here to serve, we’re fuel providers come what may, and you’ve asked if we can increase production in the next half year, and if not, why not. So we’ll tell you what you need to know.

Let’s start with the high level challenge, some of it you’ve no doubt figured out by yourself – the challenges of building hydrocarbon infrastructure. Isn’t it amazing how the tab for Trans Mountain Expansion ballooned so quickly from an estimated $7 billion when the feds bought it to a present $21 billion, with the in-service date pushed back yet again.

We’ve been there – do you get it now? And many projects do not even get off the drawing board because the challenges of building new hydrocarbon projects are now legendary (in Canada, Teck walked away from $1 billion invested after Ottawa gained veto power over such projects; in the US, owners of the proposed Atlantic Coast pipeline had full Supreme Court approval to construct but chose to abandon the project despite unrecoverable losses of over $3 billion “due to regulatory uncertainty”).

TMX has persevered, but has yet to tackle those last few kilometres, which are going to be earned millimetre by millimetre. All those ENGOs you’ve tacitly supported have developed remarkably into the very forces that can and do prevent “significant increases in production over the next 3-6 months.”

Because oil/gas infrastructure is a task few will undertake, it is a sidebar (though an important one) to the question of what producers can do to elevate oil and gas supply. Here comes the bad news. There are plenty of other reasons as to why it is not practical to expect material increases in hydrocarbon output any time soon.

To be clear, there are vast amounts of hydrocarbons available, and the higher the price, the more that is economically recoverable. We have the talent and capability to develop and produce those resources, for now anyway, though the talent pool is drying up. But there are even bigger challenges than that.

Hydrocarbons flow out of the ground only under a certain set of circumstances. It takes a lot of effort to make it happen, and all sorts of risks need to be evaluated. In the old days, risk was mainly geological, and operational, and to some extent, price. If investors were comfortable with these risks, the result was that capital would flow to increase hydrocarbon production. The results were usually remarkably successful, given the depth of our world-class talent pool.

But new, huge overarching risks have developed over the past few years that dwarf the geological challenges. These new risks flow directly from government policies and actions. These risks are ominous and unknowable. Legislation can, with the stroke of a pen, place insurmountable future burdens on producers. In a world of ever-increasing activist legislation all we have to go on are clues provided by federal leadership, and frankly the clues are chasing capital away, not attracting it.

Maybe the words of one of the Liberal elite will resonate in Canada’s power centre. Former Prime Minister Jean Chretien once said, “Nothing is more nervous than a million dollars.” Truer words were never spoken.

Before investors will support any growth in hydrocarbon production – and they will not at present under any circumstances, since investors are demanding cash be returned to shareholders first and foremost, a sign that investors want money removed from the industry – but assuming they would support production growth, producers must address the following risks.

Will the global market want more production, both now and in the medium/long term? This risk is critical, because wells earn their keep over a long time period. No one drills wells because prices are high for a few months. We have heard a lot about how petroleum demand will decline rapidly due to government attempts to force a quick energy transition; the word “stranded assets” has entered the lexicon. What has the federal government contributed to that argument – has it endorsed it, or tried to moderate it? Because investors vote decisively on it.

Next, at least here in North America, producers must consider the ability to get product to market. Some NA prices are disconnected from global ones, particularly for natural gas and certain grades of oil, because not all products can get to the markets where they are needed most.

Why would investors plunk their million dollars into increasing production when roadblock after roadblock has been thrown up to prevent that product from reaching desperate markets? And what of the regulatory landscape, where projects can take so many years to get federal approval that investors simply give up? See a dozen west coast LNG export terminals as examples. And that’s just the tip of the iceberg, the visible part – you can’t count capital as lost when it doesn’t even show up at the starting line.

Finally, as sort of a collective challenge, investors must look to Ottawa and ask: will a government that puts a Greenpeace anti-oil activist in charge of the environment/climate file be sincere in this newfound support for the hydrocarbon industry? Or is this a reflexive reaction to Putin’s war, and will the affection fade just as rapidly as it arose once the Ukrainian devastation ends?

You want more oil and gas? Hear this clearly: There are plenty of natural resources – oil, gas, and other – readily accessible in various parts of Canada. The key to getting them to desperate markets lies in Ottawa. Almost every action over the past five years has been to thwart production, not increase it. Almost all legislation has been pro-renewable and anti-hydrocarbon.

The cultural inertia to disavow hydrocarbons in the central Canadian elite is formidable, but it is what you have built. If you somehow reverse that malignant attitude, maybe more hydrocarbons will appear. We welcome signs that you are trying, but the road back to credibility with investors is not going to be easy. Given Prime Minister Trudeau’s recent European comments, where he met European requests for more hydrocarbons with a pledge to help them develop renewable energy, it is not clear exactly how Ottawa intends to even begin navigating this road.

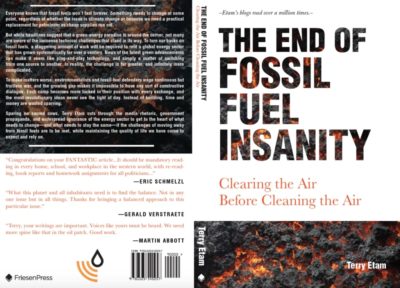

Slava Ukraini! Find out how the world got into such a calamitous energy state, and how to get out – pick up “The End of Fossil Fuel Insanity” at Amazon.ca, Indigo.ca, or Amazon.com. Thanks for the support.

Read more insightful analysis from Terry Etam here, or email Terry here. PS: Dear email correspondents, the email flow is wonderful and welcome, but am having trouble keeping up. Apologies if comments/questions go unanswered; they are not ignored.