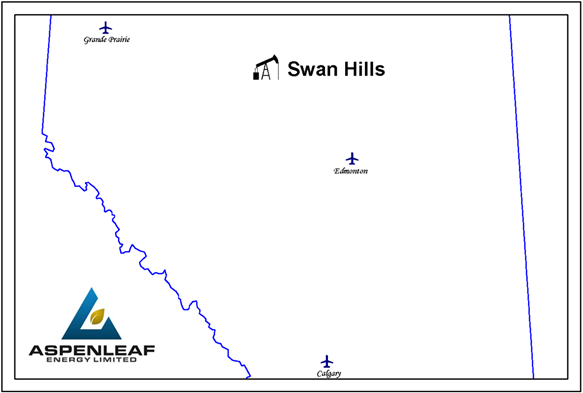

Aspenleaf Energy Limited (“Aspenleaf” or the “Company”) has engaged Sayer Energy Advisors to assist the Company with the sale of its non-core oil and natural gas interests located in the Swan Hills area of Alberta defined as Area 1 – Swan Hills Minors and Area 2 – Section 02-068-09W5 (the “Properties”). Aspenleaf is entertaining separate offers for the individual areas.

The Properties consist of light, sweet oil production with low-decline (approximately 15%) and include 23 booked drilling locations. The Properties are mainly 100% working interest, operated production.

Average daily production net to Aspenleaf from the Properties for the quarter ended December 31, 2021 was 256 barrels of oil and natural gas liquids per day and 70 Mcf/d of natural gas (268 boe/d).

Operating income from the Properties net to Aspenleaf for the quarter ended December 31, 2021 averaged approximately $200,000 per month, or $2.4 million on an annualized basis. There is an existing waterflood in the Morse River Unit No. 1 with a current recovery factor of 22%. Aspenleaf has identified un-booked upside in future re-activations and development to increase possible recovery in the Unit to 30%+ based on analogue pools.

The Properties are surrounded by Swan Hills production from several offsetting operators including Canadian Natural Resources Limited, Crescent Point Energy Corp., Razor Energy Corp. and Ridgeback Resources Inc.

GLJ Ltd. (“GLJ”) prepared an independent reserves evaluation of the Properties (the “GLJ Report”). The GLJ Report is effective December 31, 2021 using GLJ’s January 1, 2022 forecast pricing. GLJ estimated that, as of December 31, 2021, the Properties contained remaining proved plus probable reserves of 5.0 million barrels of oil and natural gas liquids and 1.2 Bcf of natural gas (5.2 million boe), with an estimated net present value of $46.6 million using forecast pricing at a 10% discount.

As of March 5, 2022, Aspenleaf’s net deemed asset value for the Properties was $4.3 million (deemed assets of $10.1 million and deemed liabilities of $5.8 million), with an LMR ratio of 1.75.

Summary information relating to this divestiture is attached to this correspondence. More specific information is available at www.sayeradvisors.com. A package of more detailed confidential information will be sent to any party executing a Confidentiality Agreement (copy attached).

Cash offers relating to this divestiture will be accepted until 12:00 pm on Thursday, May 12, 2022.

For further information please feel free to contact: Ben Rye, Grazina Palmer, or Tom Pavic at 403.266.6133.