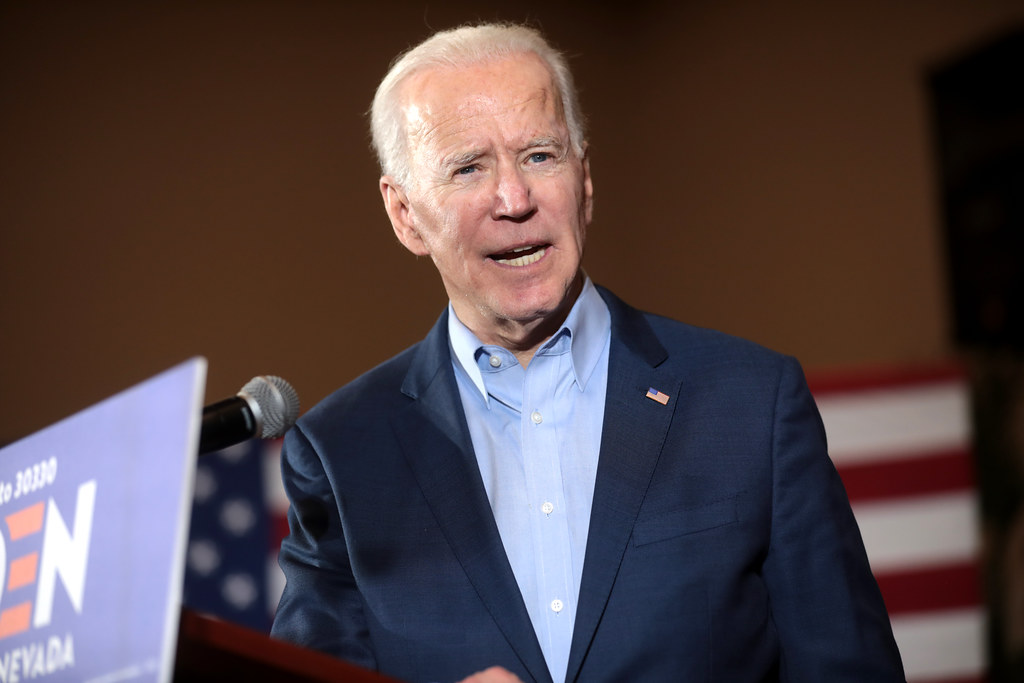

U.S. President Joe Biden has called on Saudi Arabia and other Gulf producers to increase their oil output to help stabilise prices, which have surged as a result of a strong rebound in consumption after the pandemic and now sanctions on Russia.

But Saudi Arabia and the other Gulf Cooperation Council (GCC) members probably do not have much spare capacity to raise output by a significant amount for more than a few months.

Previous appeals to Saudi Arabia to secure production increases and lower prices in 2008 by President George W Bush and in 2000 by President Bill Clinton were essentially fruitless; Biden is unlikely to be any more successful.

Middle East missions make good diplomatic and political theatre but they have not lowered oil prices (“Oil politics – a history of petroleum”, Parra, 2010).

Under the OPEC+ production agreement, Saudi Arabia is already scheduled to increase output to 11.0 million barrels per day (bpd) in August.

This would be the third-highest monthly amount the country has produced since at least 2002 based on government figures submitted to the Joint Organisations Data Initiative (JODI) ().

Saudi Aramco says it has a maximum sustainable capacity of 12 million bpd and has plans to raise this to 13 million bpd by 2027 (“Aramco to complete 1 million bpd oil capacity expansion by 2027”, Reuters, Oct 4, 2021).

But the country’s maximum demonstrated production over one-month so far has been 12.0 million barrels in April 2020 and over three months 10.8 million between October and December 2018 (“World oil database”, JODI, 2022).

Saudi Arabia’s maximum demonstrated output over a full year has been 10.5 million bpd in 2016 (“Annual Statistical Bulletin”, OPEC, 2022).

The kingdom has always been secretive about the details of its reserves and production so it is impossible to know for certain how much spare capacity it holds.

But there is no evidence it could raise production by a further 1 million bpd from the August level and keep it there for 6-12 months or more to lower oil prices or offset the loss of oil from Russia hit by sanctions.

The kingdom might be able to sustain output at this level, but we do not know, because the kingdom has never done it before.

FLEXIBILITY

The country could increase the volume supplied (rather than produced) by discharging crude from stocks it controls in the kingdom and at tank farms near customers in Europe and Asia.

In the short term, the country could also surge production by opening the chokes on existing wells and re-starting old wells that have been closed to rest fields and preserve pressure.

Over a slightly longer timeframe, it could boost output by drilling more wells within existing fields and accelerating development of new pools.

But so far Saudi Arabia’s top leaders have reiterated their commitment to the OPEC+ production agreement with Russia.

Involving Russia and other major non-OPEC producers in output limits has been a cornerstone of the kingdom’s strategy since the 1990s.

There is no sign the country is ready to sacrifice its long-sought relationship with Russia for the short-term diplomatic gains of being seen to respond to the U.S. president’s request for more oil.

Even if the kingdom’s leaders were ready to risk breaking their relations with Russia, they probably cannot offset a significant loss of Russian exports until well into 2023 or 2024 at the earliest.

If the Biden administration hopes its diplomatic activity in the Middle East will result in a substantial increase in production and lower prices, it is likely to be disappointed.

Oil prices will fall if, and only if, sanctions are relaxed on Russia, Iran or Venezuela, or the global economy enters a slowdown and oil consumption growth slows.

John Kemp is a Reuters market analyst. The views expressed are his own.