Each week, XI Technologies scans its unique combination of enhanced industry data to provide trends and insights that have value for professionals doing business in the WCSB. If you’d like to receive our Wednesday Word to the Wise in your inbox, subscribe here.

Before a well can be drilled in Alberta, operators must submit an H2S Release Rate Assessment to the Alberta Energy Regulator (AER) in accordance with Directive 056. This week, we’ll use our data to help illustrate the importance of due diligence, for the sake of compliance AND public safety.

The AER lays out its requirements for an H2S release rate assessment in Section 7.7.15 of Directive 056: Energy Development Applications, explaining its reasoning with this statement:

The AER requires the applicant to conduct an H2S release rate assessment for each category C, D, or E well to ensure public safety when developing projects containing H2S gas. The H2S release rate assessment determines the minimum EPZ for the proposed project and dictates the minimum radius used in the applicant’s participant involvement program.

For years, operators have had to grapple with, plan for, and mitigate the risk of encountering sour gas. With AER’s guidance and data/research tools like XI’s H2SReports, industry professionals can take responsible steps to properly assess the risk of H2S exposure.

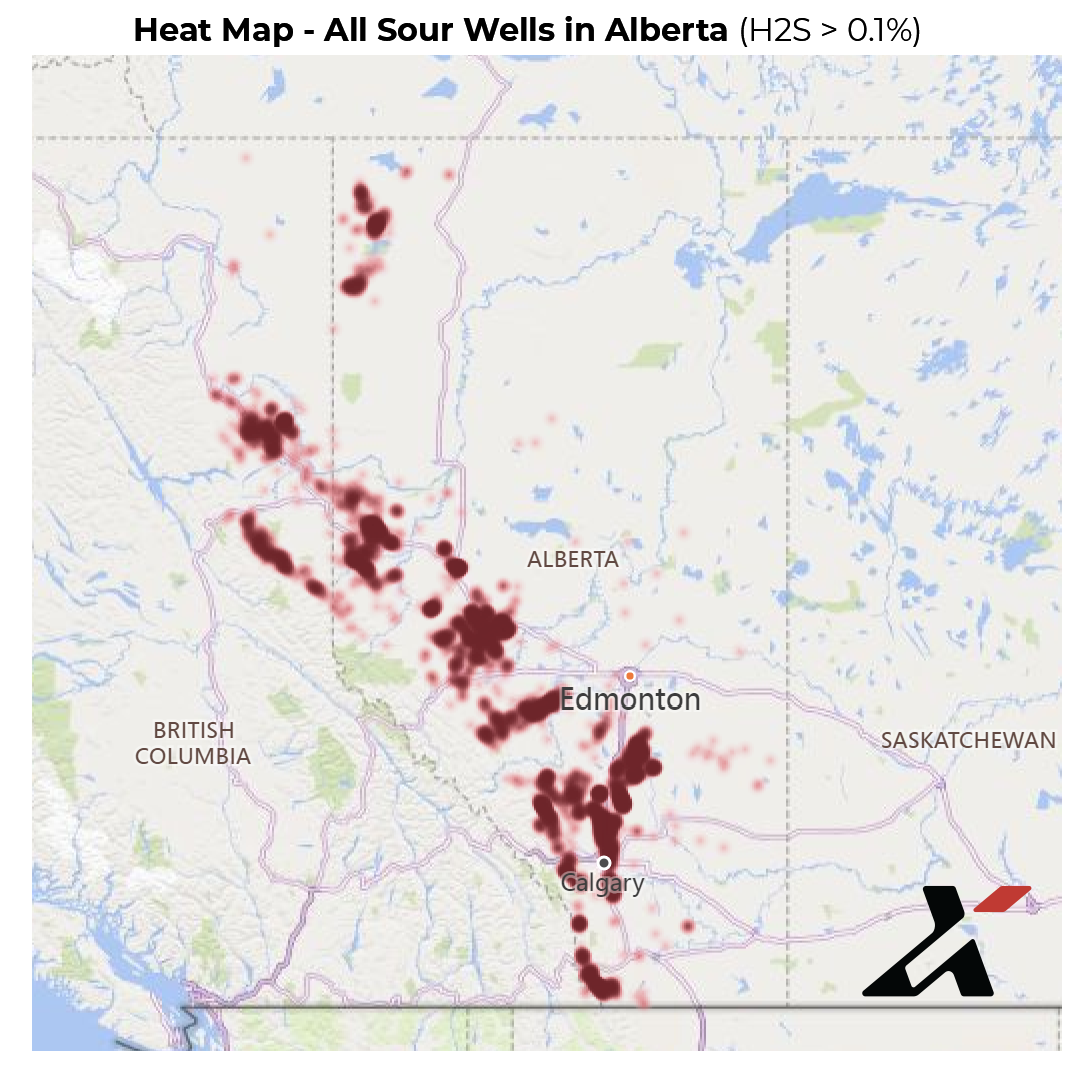

A look into the prevalence of sour gas wells in Alberta proves the necessity of this requirement. Using data pulled from XI’s H2SReports software, we see how common an issue potential H2S release can be when drilling throughout the WCSB:

Figure 1 – Heat map of all sour wells in the WCSB.

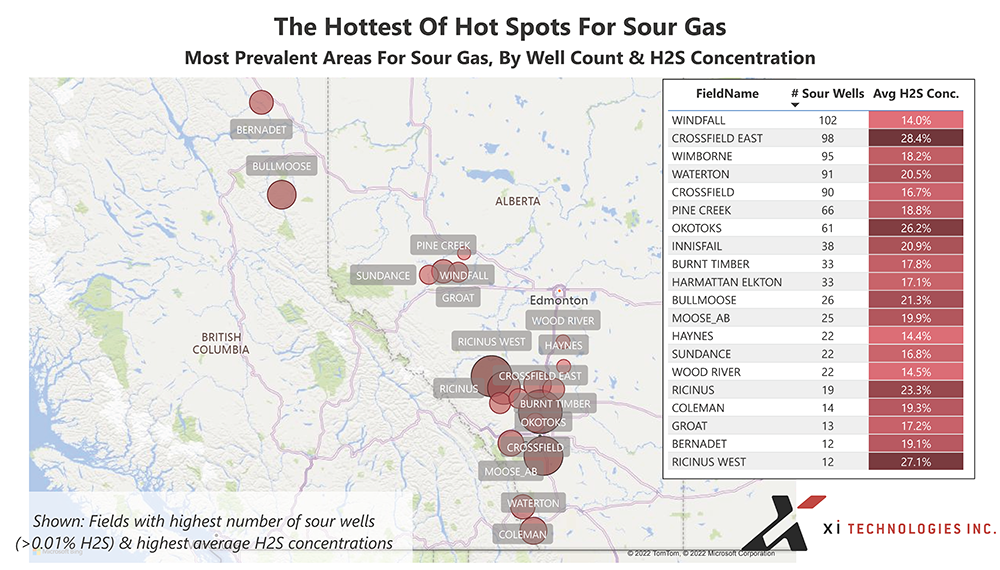

This heat map shows that sour gas is prevalent throughout Alberta and Northeastern BC. A deeper dive into the data reveals which fields have the most sour gas, by well count and H2S concentration. According to the data from our H2SReports product, the fields with the hottest hot spots of sour gas are Crossfield East, Okotoks, Ricinus, and Ricinus West, each with an average H2S concentration of over 23%.

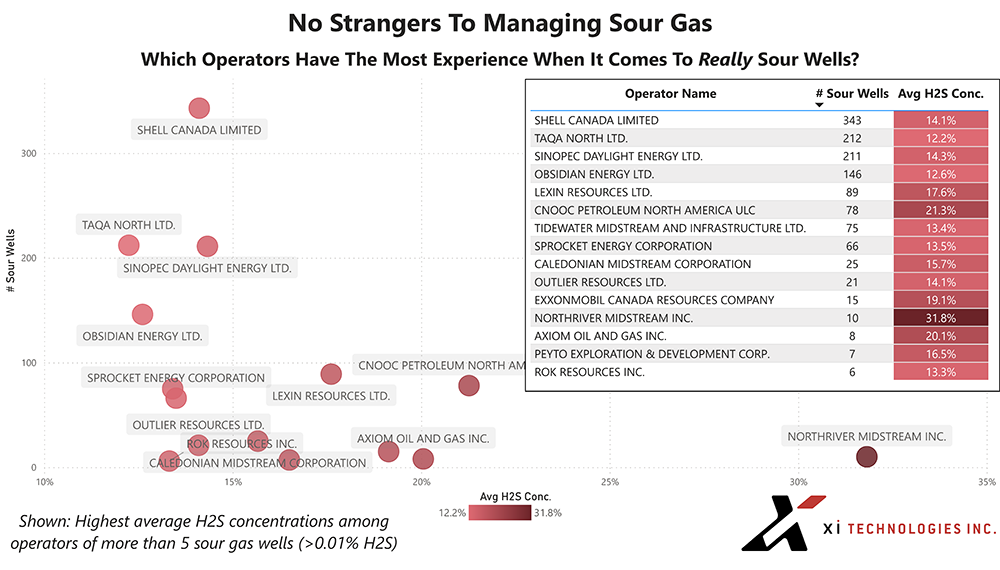

Which operators are most experienced in high H2S concentration sour gas wells? From the data below, we see that Shell Canada Limited and TAQA North Ltd currently operate the most sour gas wells across the WCSB, while CNOOC Petroleum North America ULC and Axiom Oil and Gas Inc operate sour gas wells are the producing companies with the highest average H2S concentration.

Click here to view the data in this article as an interactive dashboard.

Diving into this data shows that the requirement to submit an H2S Release Rate Assessment to the AER is no mere bureaucratic task; rather it is essential for safe risk mitigation. Sour gas wells are a common occurrence in our patch and pools can become sour as time passes. Because of this, reporting and preparing for H2S is a critical part of the drilling process in the WCSB every time you drill.

XI Technologies offers services to eliminate complexity and expense in pre-licensing research and reporting. File accurate, complete H2S release rate analysis with H2SReports – an interactive consoled that guides you through the process or have us prepare your report for you with our turnkey service, H2SComplete. Contact us today for more information.