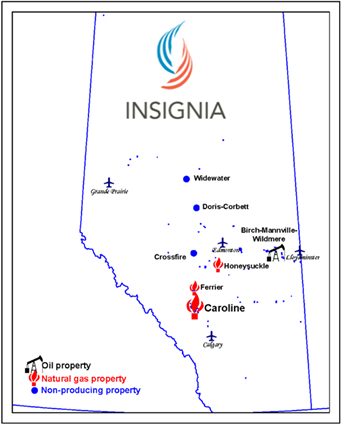

Sayer Energy Advisors has been engaged to assist Insignia Energy Ltd. (“Insignia” or the “Company”) with the sale of its non-core oil and natural gas properties located in the Caroline, Ferrier, Honeysuckle, Birch-Mannville-Wildmere, Crossfire, Doris-Corbett, and Widewater areas of Alberta as well as minor interests in various additional areas of Alberta (the “Properties”).

Total production net to Insignia from the Properties has averaged approximately 307 boe/d, consisting of 1.6 MMcf/d of natural gas and 46 barrels of oil and natural gas liquids per day.

Recent net operating income from the producing properties has averaged approximately $225,000/month or approximately $2.7 million on an annualized basis.

As of July 2, 2022, the Properties had a deemed net asset value of ($2.1 million) (deemed assets of $3.7 million and deemed liabilities of $5.9 million), with an LMR ratio of 0.64.

McDaniel & Associates Consultants Ltd. (“McDaniel”) prepared an independent reserves evaluation of the Properties (the “McDaniel Report”) as part of its year-end reporting. The McDaniel Report is effective December 31, 2021 using an average of McDaniel, GLJ Ltd. and Sproule Associates Limited (“Jan 2022 Consultant Average”) forecast pricing as of January 1, 2022. McDaniel estimated that as of December 31, 2021, the Properties contained remaining proved plus probable reserves of 16.4 Bcf of natural gas and 467,000 barrels of oil and natural gas liquids (3.2 million boe), with an estimated net present value of $12.0 million using forecast pricing at a 10% discount.

Summary information relating to this divestiture is attached to this correspondence. More specific information is available at www.sayeradvisors.com. A package of more detailed confidential information will be sent to any party executing a Confidentiality Agreement (copy attached).

Cash offers relating to this divestiture will be accepted until 12:00 pm on Thursday, October 13, 2022.

Preference will be given to offers to acquire all of the Properties; however, offers will be considered for individual properties.

For further information please feel free to contact: Ben Rye, Grazina Palmer, or Tom Pavic at 403.266.6133.