Vermilion Energy Inc. announced overnight that its now owns 16.3% of Coelacanth Energy Inc., or about $49.2 MM worth based on today’s trading prices for Coelacanth (CEI.v).

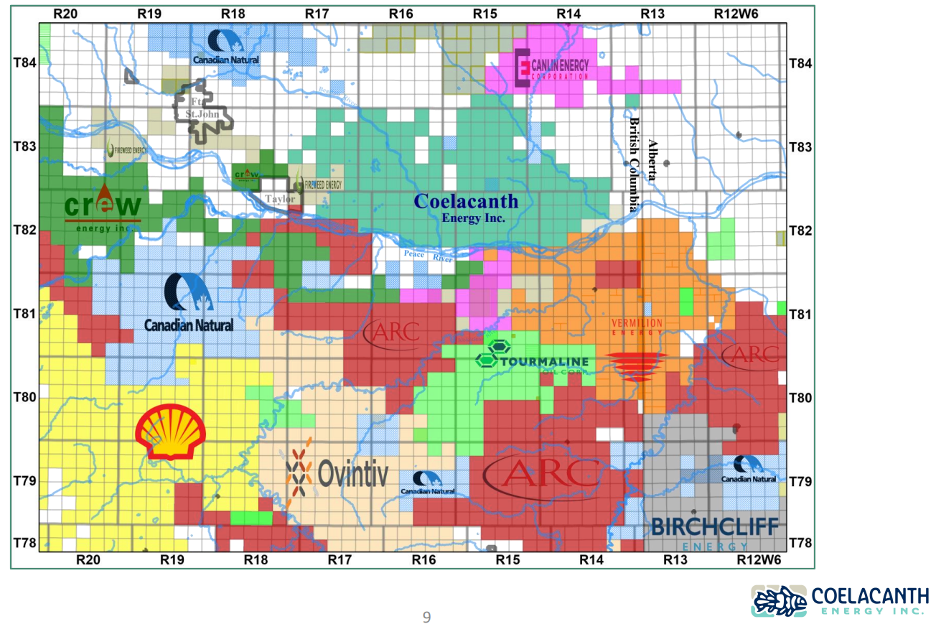

Coelacanth is the spinout from Leucrotta Exploration that was acquired by Vermilion back in the spring, and has a large contiguous block of (presumably) Montney exploration land north of the Peace River in NE BC. Given the moratorium on new well licenses in NE BC for most of the past year and change, we can’t see any well licenses for them at the current time, but perhaps now that permitting appears to have opened up again, we may see some going forward.

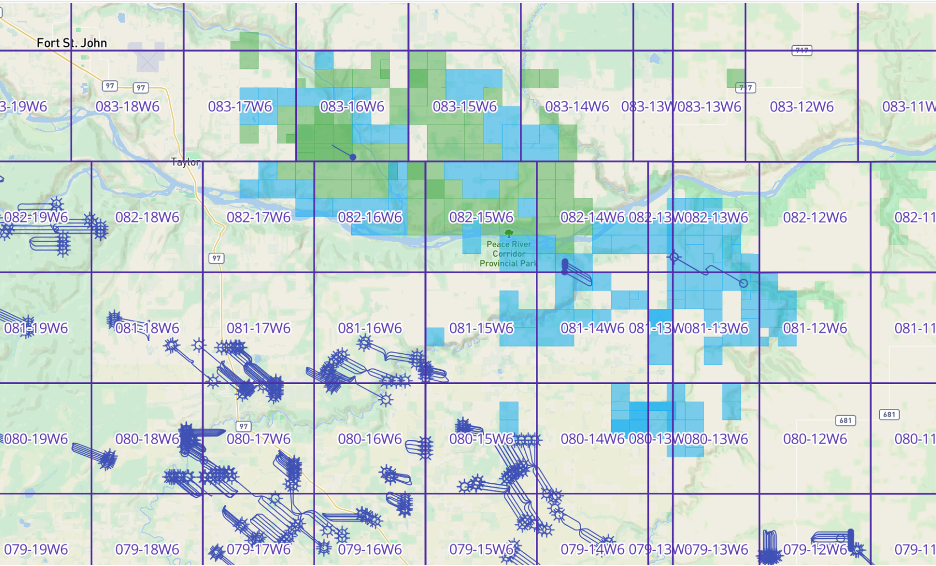

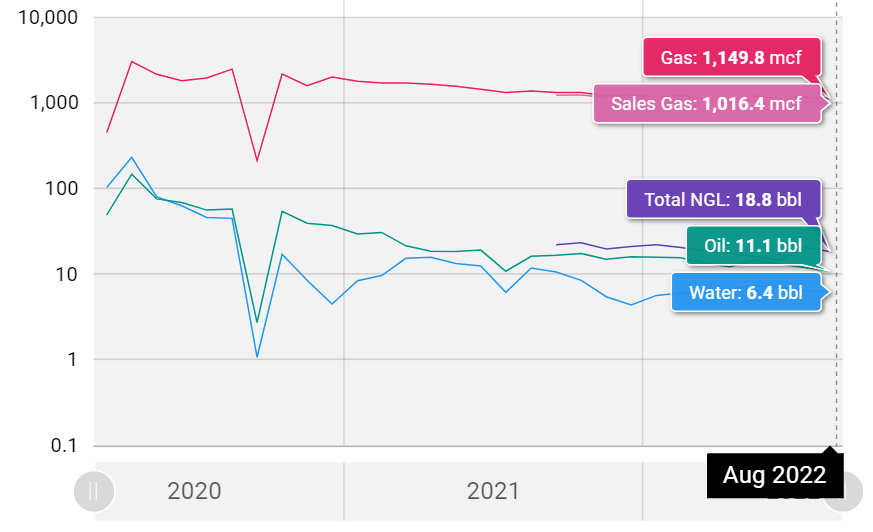

The map below shows the lands held by Leucrotta (now owned by Vermilion) in blue, and the lands held by Coelacanth in green. There is some working interest overlap between the two in spots. Also on the map you can see any Montney wells drilled in the last 3 years. There is one well that has been drilled into the Coelacanth lands in the last 3 years that we can see in the public domain (thanks Petro Ninja!), with the production history included below.

Source: Coelacanth Investor Presentation