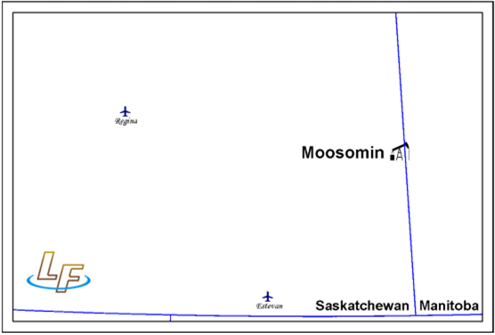

Long Fortune Petroleum (SK) Corporation (“Long Fortune” or the “Company”) has engaged Sayer Energy Advisors to assist the Company with the sale of its oil and natural gas interests located in the Moosomin area of southeastern Saskatchewan (the “Property”).

Daily production net to Long Fortune for the second quarter of 2022 was approximately 14 barrels of oil per day.

Operating income net to Long Fortune for the second quarter of 2022 averaged approximately $32,700 per month, or approximately $392,400 on an annualized basis.

At Moosomin, Long Fortune holds a 100% working interest in the 111/09-14-014-30W1/0 and 121/09-14-014-30W1/0 oil wells which produce from the Gravelbourg Formation and the suspended oil well 101/10-14-014-30W1/0. Long Fortune also holds a 20% working interest in the 131/05-13-014-30W1/0 oil well operated by Dawn Energy Inc. which produces oil from the Gravelbourg Formation at a rate of approximately six barrels of oil per day gross.

Long Fortune holds a 100% working interest in the water disposal well Long Fortune Moosomin 121/15-14-014-30W1/02. The Company injects salt water at a rate of approximately 400 barrels of water per day into the Mannville Group.

Long Fortune estimates the Bakken Formation at Moosomin to contain over four million barrels of oil reserves with estimated recoverable reserves of about 1.2 million barrels of oil. All four of Long Fortune’s wells have been drilled through the Bakken Formation showing large net pay and a significant natural gas indicator.

As of August 28, 2022, Long Fortune’s net deemed asset value for the Moosomin property was ($24,656) (deemed assets of $288,504 and deemed liabilities of $313,160), with an LMR ratio of 0.92.

Summary information relating to this divestiture is attached to this correspondence. More specific information is available at www.sayeradvisors.com. A package of more detailed confidential information will be sent to any party executing a Confidentiality Agreement (copy attached).

Cash offers relating to this process will be accepted until 12:00 pm on Thursday, November 17, 2022.

For further information please feel free to contact: Ben Rye, Grazina Palmer, or myself at 403.266.6133.