Founded in 2015, Artis Exploration is a pure play Duvernay producer with a unique asset base. Averaged over the last 6 months, Artis is the 2nd largest producer of oil and the 10th largest producer of natural gas in the Duvernay producing formation (please note that much of the liquids produced from the Duvernay come in the form of condensate, for which public data is not available at the well level). The company drew headlines after receiving a $180 million investment from private equity firm Warburg Pincus in May 2018. In order to give our readers a glimpse into Artis’ operations, we’ve conducted a review of the company’s recent well and transfer activities as well as its production levels.

Overview

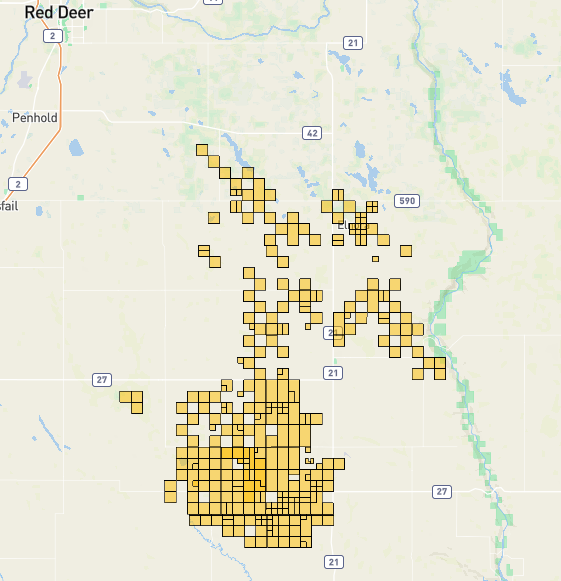

Artis Exploration has established a base of largely-contiguous rights within the Twining and Elnora fields of the Duvernay East Shale Basin. In contrast to many producers in this region, who largely prioritize the Belly River and other producing formations, Artis is a pure-play Duvernay company. We think the pure-play label is actually underselling the niche that the company has carved for itself though, as Artis controls the vast majority of Duvernay wells in its area; as demonstrated below, there are only 16 Duvernay wells in range of Artis’ assets that it does not control. This is not to say that the region isn’t active, however, as there are hundreds of nearby wells targeting the Belly River formation alone. Artis appears to be unique in the sense that the company is targeting the Duvernay formation in a region where few have tried before.

Artis Existing Mineral Rights (as of June 19, 2023)

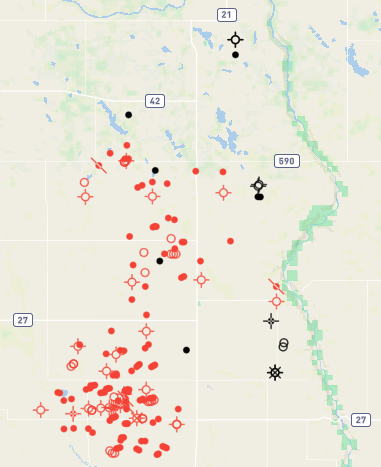

All Duvernay Wells (Artis wells in red, all others in black)

Duvernay Wells Near Artis’ Land Position (Artis wells in red, others in black)

Transfer Activity – Last 2 years

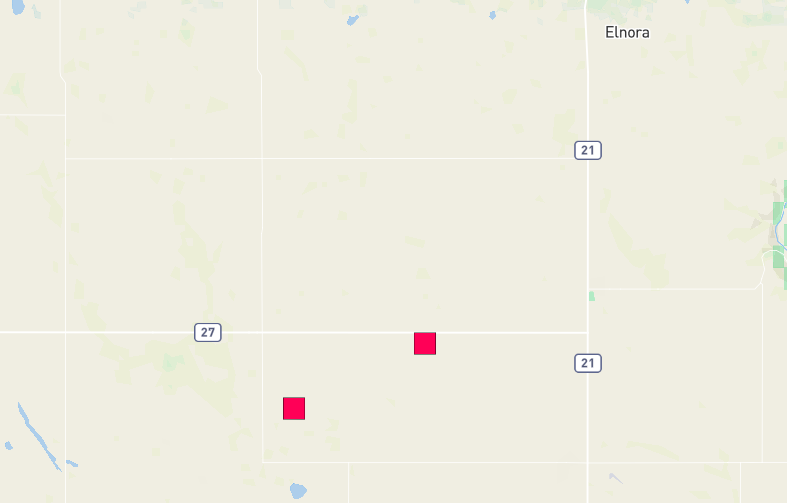

According to our data from the Alberta Energy Regulator, Artis has not been active with respect to asset transfers; in the past two years, the company has only transferred a single pipeline asset in January 2022.

Artis Pipeline Asset Transfer (2 impacted locations)

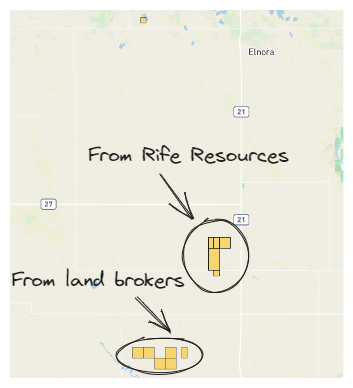

With respect to mineral rights transfers, the company has been slightly busier. In total, Artis has been the buyer in 4 mineral right transfers totaling just over 2,500 net hectares. The largest of these was a 1,088 hectare transfer from Rife Resources that we observed in our data on February 9 2023. In keeping with the company’s primary area of focus, these rights cover the full Duvernay formation. The other transfers were from brokers, although it would appear that these rights also cover the Duvernay.

Well Activity

Artis has been active in developing new wells in the past year. The company has spud 19 wells in the past 12 months, all of which target the Duvernay formation. 14 of these wells are classified as active and 10 have recorded recent oil/gas production. The company’s most recent well (UWI: 100102703025W400) was spud on June 12 2023.

Artis Wells Spud in the Past 12 Months (as of June 19, 2023)

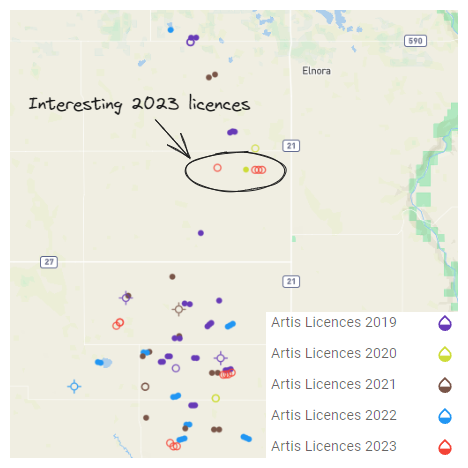

We also examined Artis’ licensing activity to determine whether there have been any changes over time. Artis has been fairly consistent, with the bulk of its activity taking place in the southern portion of the Twining field along with a handful of wells spread further north. Having said that, a number of licences from 2023 do stand out as signaling a potential shift in focus. There have been 4 wells licensed so far in 2023 (circled below and listed on Petro Ninja here) in an area that has seen no licensing activity since 2020. Whether this indicates a shift in direction or not may be determined as the year progresses.

Artis Licences By Year

Production

Ignoring a peak in early and subsequent decline 2021, Artis has demonstrated a gradual upward trend in gross licensed production (which differs from corporate production in that it only accounts for wells licensed to the company and assumes 100% working interest) over the past few years and reached 9,300 BOE/d in December 2022. While the company’s natural gas production has remained relatively constant since September 2020, its oil production has fluctuated heavily. Note that this data does not show any condensate or NGL production which is not registered at the well level in Alberta.

With respect to individual wells, we’ve identified the company’s top 5 wells by recent production (last 30 days on prod with available data). A notable observation is the recency of these wells; all of Artis’ most productive wells by recent production were spud within the past 12 months.

| UWI | Spud Date | Formation | Field | Recent Oil (BBL/d) | Recent Gas (mcf/d) | Recent Equivalent (BOE/d) |

| 102013403025W400 | 2022-08-02 | Duvernay | Twining | 327.64 | 344.55 | 385.06 |

| 100142503525W400 | 2022-12-29 | Duvernay | Huxley | 321.45 | 151.26 | 346.66 |

| 100030103125W400 | 2022-10-01 | Duvernay | Twining | 287.59 | 239.55 | 327.52 |

| 102043503025W400 | 2022-07-02 | Duvernay | Twining | 272.10 | 328.19 | 326.80 |

| 100020103125W400 | 2022-10-13 | Duvernay | Twining | 272.85 | 275.10 | 318.70 |

This analysis was made possible with data and tools provided by BOE Intel and Petro Ninja. For more information, please contact us.