The month of May was a difficult one for many oil and gas producers in Western Canada as a result of the early start to wildfire season. Canadian producers did an excellent job ensuring the safety of people and operations, although many producers had to curtail volumes in May. While we should get public data updates from BC soon, we do have the public well data for Alberta and Saskatchewan already and so can view monthly production figures for the companies operating exclusively in those two provinces.

Keep in mind that these production figures are “gross licensed” production for each company, so would only account for wells licensed to the company and would assume 100% working interest. While the numbers won’t always line up perfectly with corporate production, they are often quite close and certainly will provide direction versus prior months. It’s also worth pointing out that condensate and NGLs are not well recorded at the well level in Alberta, but will get stripped out of natural gas volumes.

BOE Intel users can access monthly production results for all public and private companies with a single click, but we will just provide a glimpse into a few that were noteworthy. To gain access to this tool and many others, contact us for a BOE Intel demo.

To give readers a sense of the challenges facing the industry in May, we did a sum total of the following 13 producers in the graph below (the point was to mostly obfuscate the individual results of the 13). Those randomly selected 13 producers with production in Alberta and Saskatchewan saw volumes drop in total from 576.7 mboe/d to 487.4 mboe/d, a drop of 89.3 mboe/d or 15.5% from April volumes.

Some producers were impacted more than others. Here are a few examples:

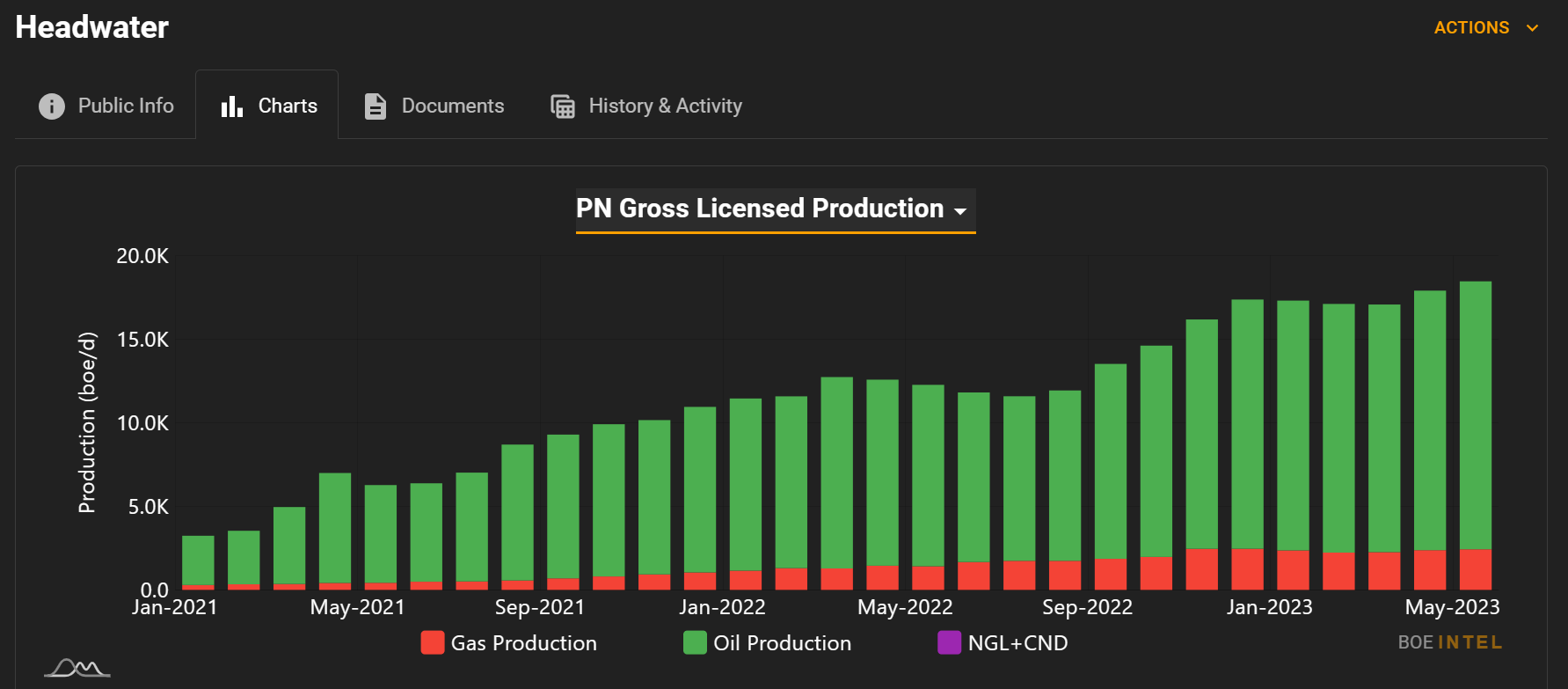

Headwater

- Seems like Q2 is shaping up nicely. April gross licensed production was a record, and May is up again to a new high. Keep in mind we can’t see public data production results for the company’s New Brunswick natural gas assets, but it is the Clearwater oil that is the main focus anyways.

MEG

- It is turnaround season again for MEG, as April and May volumes have dropped off sharply, following a similar pattern from the spring of 2022. May volumes on a gross licensed basis were down 34% from March volumes. This is a planned turnaround of Phase 1 & 2 facilities, which was incorporated into the company’s 2023 capital budget and operations guidance.

Advantage

- May gross licensed production was down 39% versus April levels as a result of wildfires, unplanned downtime, and third-party pipeline outages, as well as a planned “major 14-day turnaround at the Glacier Gas Plant in May”. Despite all of these challenges, Advantage did say in its press release last week that it “remains on track to meet its capital and production guidance” (see Advantage press release here). The company also released positive drill results in that same update.

- Spur has been the class of the Clearwater for some time now, and Q2 volumes look good. April production on a gross licensed basis hit a record high of 37,703 boe/d, and while May dipped slightly it was still the 3rd highest production month ever for the company.