Strathcona Resources announced yesterday that it has reached an agreement with Pipestone Energy to acquire the company in an all-share deal which would make it the fifth largest liquids producer in Canada. After closing, Strathcona will become a public company with pro forma current production of ~185,000 boe/d. The company will be ~70% weighted to oil/condensate, and will have a 78% liquids weighting overall. See the Pro Forma corporate presentation here.

Over the last 3 and a half years, Strathcona has complemented its organic growth with an agressive counter cyclical acquisition strategy, premised on taking advantage of the post COVID oil and gas downturn. While many companies were only focused on survival, Strathcona was able to build its empire during those down years, acquiring or combining with Pengrowth, Cona, Osum, Caltex, Serafina as well as the Tucker asset from Cenovus. In hindsight, these acquisitions that began in January 2020 were very well timed as the industry has seen a sharp recovery from those COVID lows. Pipestone is the latest piece of the puzzle that will see Strathcona become a public company and will open it up to new potential shareholders.

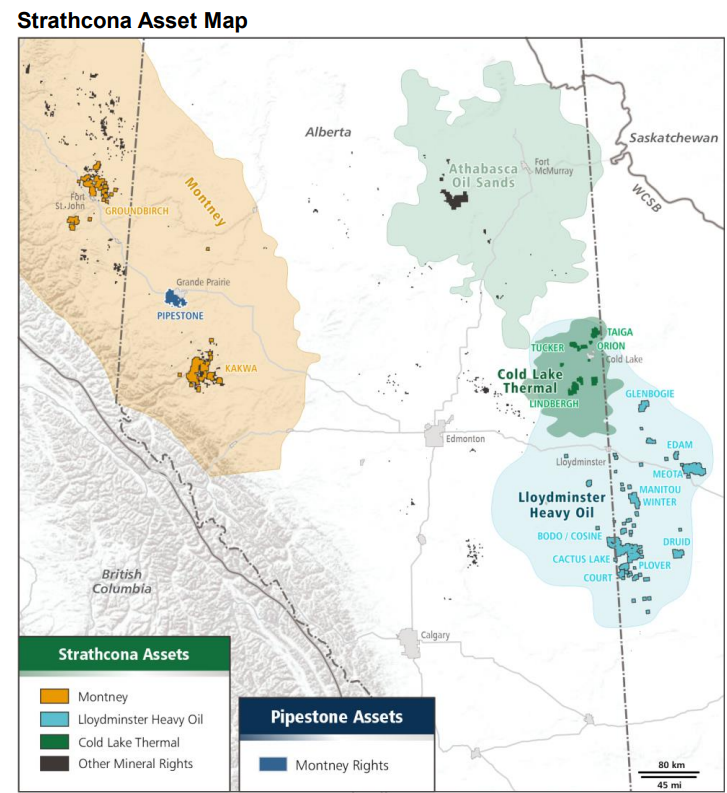

The new Strathcona will be unique among Montney companies in that it also has conventional heavy oil assets and thermal oil assets as well. In a sense, the Montney assets can act as a bit of a hedge to condensate and natural gas used in its thermal assets. Those assets also add a short cycle option for Strathcona to be more flexible with its capital program and to adjust to fluctuating commodity prices. Pictured below is Strathcona’s asset map from the acquisition presentation, with the Pipestone assets added in.

Figure 1

Source: Strathcona Resources Ltd. (squarespace.com)

The Montney continues to be one of the most sought after plays in Canada, and comes right on the heels of the Athabasca Montney disposition announced Monday night. It also follows only four months after Crescent Point acquired Montney assets from Spartan Delta and a year after Whitecap bought XTO for its Montney and Duvernay assets. Those transactions are summarized below in Figure 2. See BOE Intel’s M&A database for more historical transactions. Note that no mention of deal value, production or liquids were part of the acquisition announcement, so these numbers, while based on publicly available sources, are ballpark figures and not from either company in regards to this transaction.

Figure 2 – recent comparable Montney transactions

| Announce Date | Acquirer | Target | Deal Value ($) | BOE/d | Pct Liquids | Value per BOE/D ($) |

|---|---|---|---|---|---|---|

| 2022-06-28 | Whitecap Resources | XTO Energy Canada | 1,900,000,000 | 32,000 | 30 | 59,375 |

| 2023-03-28 | Crescent Point | Spartan Delta Corp. | 1,700,000,000 | 38,000 | 55 | 44,737 |

| 2023-07-31 | Athabasca Oil Corporation | 160,000,000 | 3,000 | 45 | 53,333 | |

| 2023-08-01 | Strathcona Resources | Pipestone Energy Corp. | ~920,000,000 | ~35,000 | ~41 | ~26,286 |

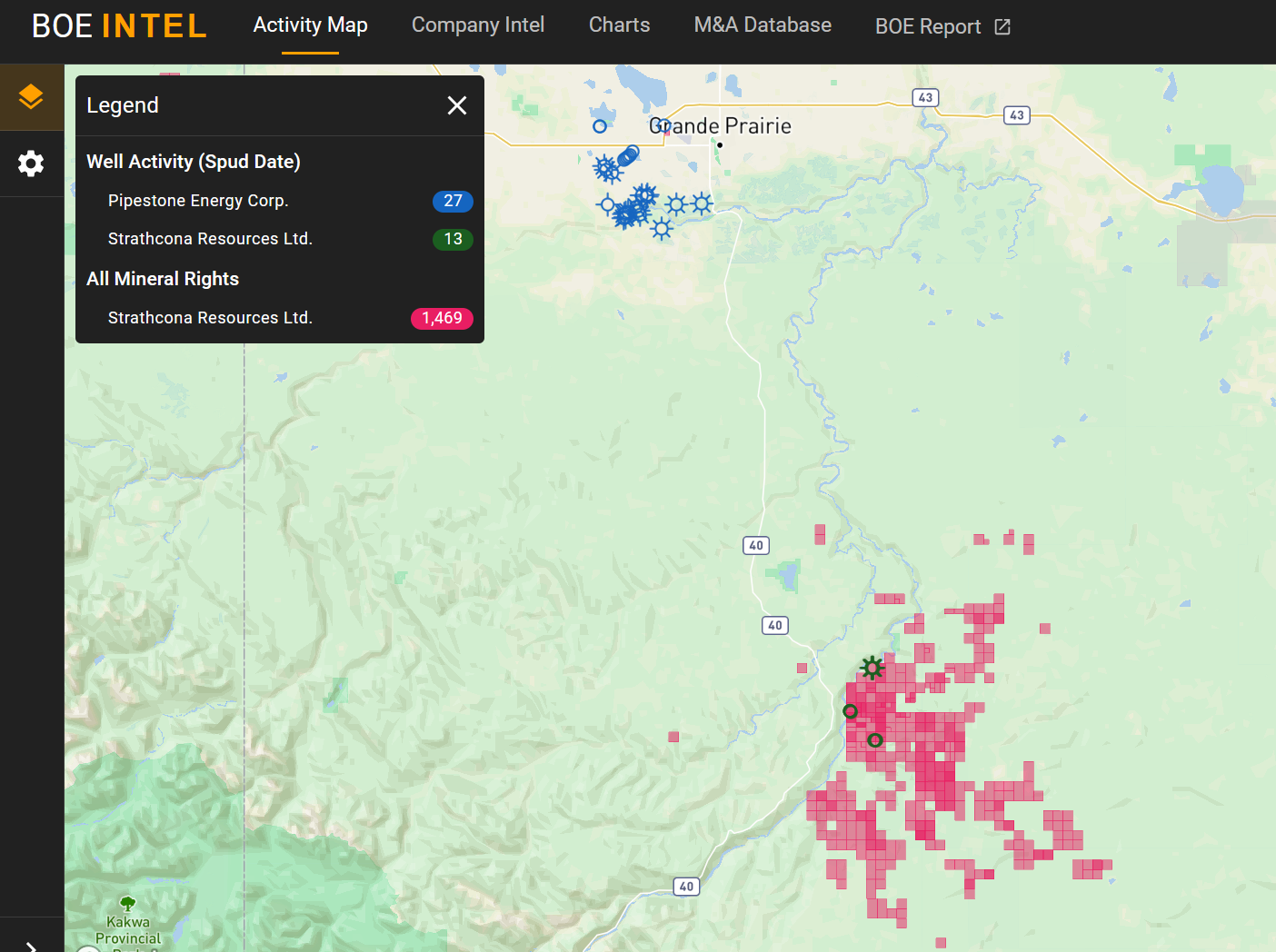

Isolating just the Alberta Montney assets on BOE Intel, we can see how Pipestone’s Montney will fit on the map with Strathcona’s Montney assets. Pictured below in Figure 3 we can see just the Montney well spuds over the last year, as well as crown mineral rights for Strathcona. During that time Pipestone has spud 27 Montney wells, and Strathcona has spud 13 Montney wells. To see the spuds over the last year on Petro Ninja, click the links.

Figure 3 – BOE Intel activity map

A number of the Strathcona spuds are recent and not on production yet, but we can see production data for 4 of those recent spuds, pictured below in Figure 4. Keep in mind that because of single stream reporting, we can only see the public data for the gas and not any associated liquids for these wells at the moment.

Figure 4 – production results for recent Strathcona Montney spuds

Similarly for Pipestone, many of these wells are yet to be put on production, but we can see production results for 15 of its spuds, with those wells pictured below in Figure 4.

Figure 5 – production results for recent Pipestone Montney spuds

Having put together a substantial asset base over a short period of time, Strathcona highlights the opportunity to grow to 325,000 boe/d in as few as eights years, supported by a low base decline rate (<25% overall and ~15% for its oil assets).