Today it was announced that Pipestone Energy shareholders approved the deal to be acquired by Strathcona Resources. It was a contentious few weeks amongst Pipestone shareholders as dissenting voices emerged, with both sides expressing strong opinions in the public forum.

Ultimately it seems like a big win for Strathcona and really adds to the company’s impressive reputation as a strong acquirer. Recall that since January 2020, Strathcona has been able to acquire or combine with Pengrowth, Cona, Osum, Caltex, Serafina, the Tucker assets from Cenovus, and now Pipestone Energy Corp. In hindsight, these acquisitions which began in January 2020 have been incredibly well timed. Consider that most of the Canadian energy industry was purely fighting for survival during 2020 when this string of acquisitions began.

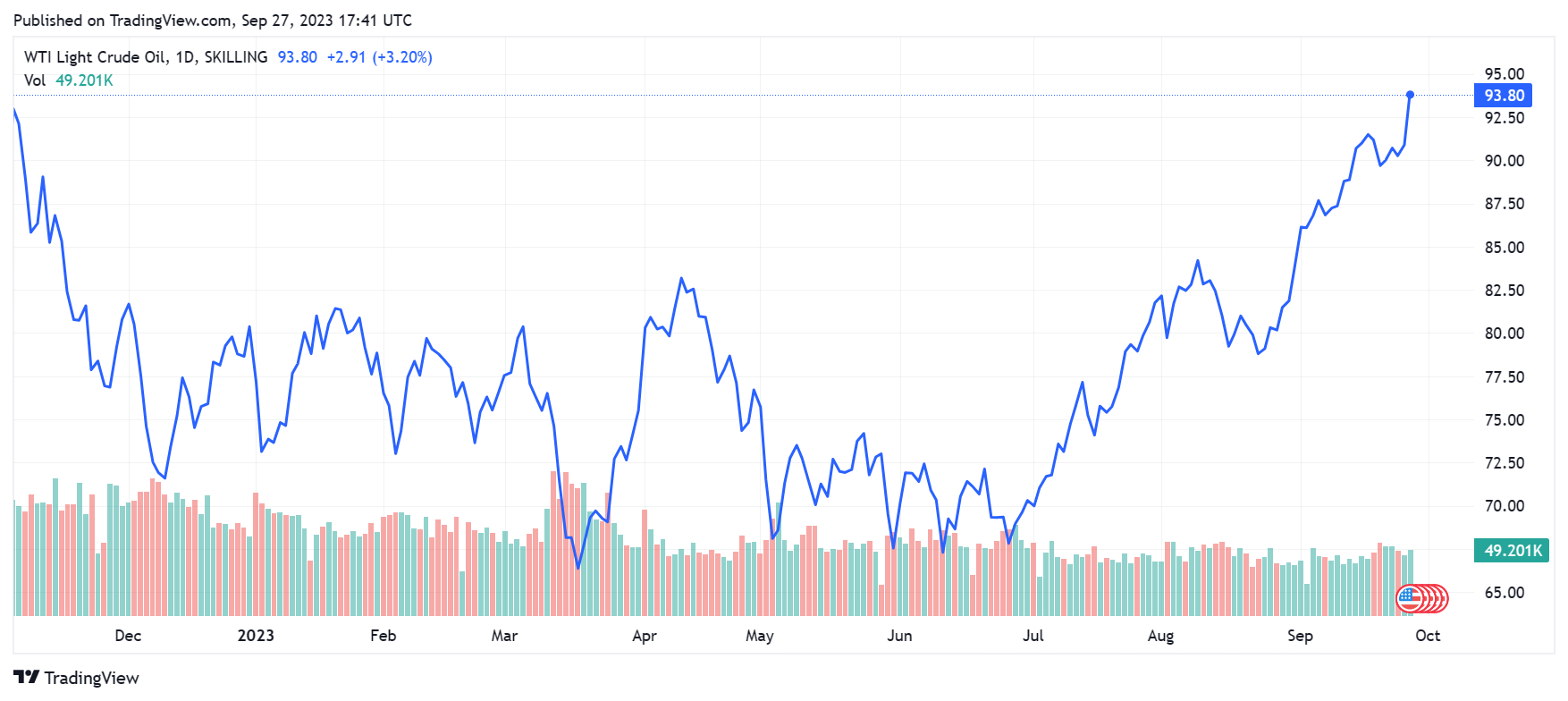

The latest acquisition of Pipestone Energy Corp. comes at an interesting time as well, with oil and condensate prices having added ~$10/bbl from when the acquisition was first announced on August 1, 2023.

Source: TradingView — Track All Markets

Not only have oil prices recovered since the deal was announced, but the acquisition metrics looked quite cheap on comparable transaction metrics even before the recovery in oil prices. Of course keep in mind that the all stock transaction and Strathcona being (at least for now) private makes these comparables a little tricky. Also the official metrics were not part of the acquisition press release, so we used Pipestone’s Q2 average production figures. Note readers can turn your phone sideways to view the table on mobile.

See BOE Intel’s full M&A database here.

| Announce Date | Acquirer | Target | Deal Value ($) | BOE/d | Pct Liquids | Value per BOE/D ($) |

|---|---|---|---|---|---|---|

| 2022-06-28 | Whitecap Resources | XTO Energy Canada | 1,700,000,000 | 32,000 | 30 | 53,125 |

| 2023-03-28 | Crescent Point | Spartan Delta Corp. | 1,700,000,000 | 38,000 | 55 | 44,737 |

| 2023-07-31 | Cygnet Energy | Athabasca Oil Corporation | 160,000,000 | 3,000 | 45 | 53,333 |

| 2023-08-01 | Strathcona Resources | Pipestone Energy Corp. | 920,000,000* | 33,143* | 41* | 27,759* |

| 2023-08-03 | Cygnet Energy | Murphy Oil Company Ltd. | 150,000,000 | 1,700 | 39 | 88,235 |

*assumed deal metrics based on public disclosure and best estimates

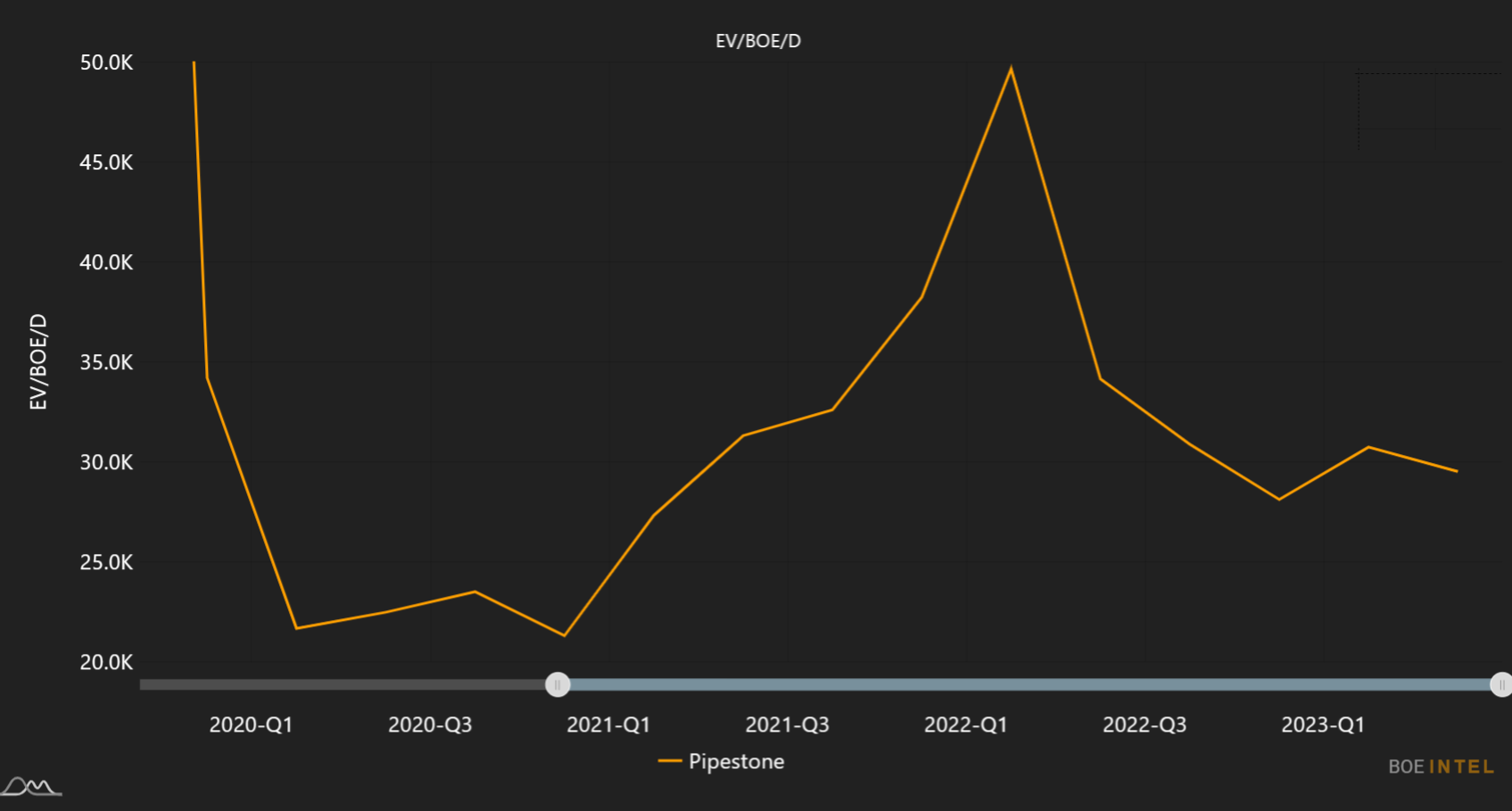

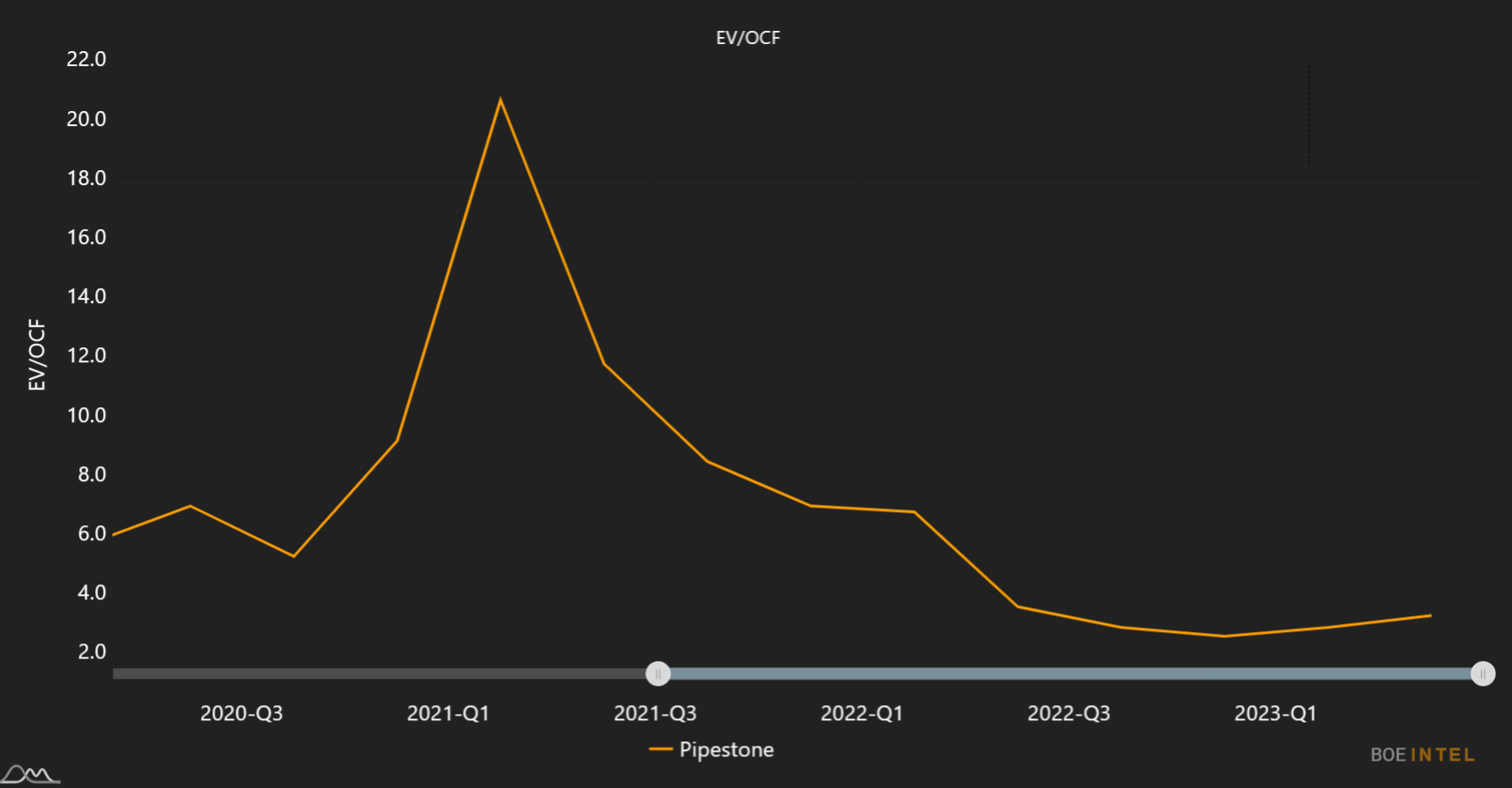

The following 2 charts from BOE Intel plot the evolution of Pipestone on flowing barrel metrics (EV/BOE/d) and as a multiple of cash flow (EV/OCF). The operating cash flow multiple in this case is on a trailing 12 month basis. In terms of waiting for the right time, it seems that Strathcona may have once again pulled the trigger at an opportune moment. Of course only time will tell.

Reach out here if you are interested in a demo of BOE Intel.