Baytex announced this morning that it is disposing of some of its Viking assets, specifically at Plato and Forgan. The company press released that it would receive approximately $153.8 MM for 4,000 BOE/d of production in the area.

The assets are located southeast of the larger Dodsland Viking area, and would’ve been originally acquired via the Raging River merger in 2018. Note that the Viking assets being sold represent only a portion of what was received in the Raging River transaction. Metrics for the initial transaction, and the disposition being announced today are included in the table below (tilt phone sideways to view the full table on mobile).

Figure 1 – M&A transactions metrics

| Date | Type | Acquirer | Target | Deal Value | BOE/d | % liquids | $/BOE/d |

|---|---|---|---|---|---|---|---|

| 2018-06-18 | Corporate | Baytex Energy | Raging River Exploration | $1,906,000,000 | 24,118 | 92 | 79,028 |

| 2023-11-27 | Asset | ? | Baytex Energy | $153,800,000 | 4,000 | 100 | 38,450 |

While the exact wells and licences that are to be transferred are not known at this point, the public data gross production from this group of wells licensed to Baytex is shown in the embedded chart below from Petro Ninja. Those wells would represent a decent guess as to the licences that might be involved in the disposition given the geographic area.

Figure 2 – Production profile for wells licensed to Baytex near Plato and Forgan (hover over chart to see details)

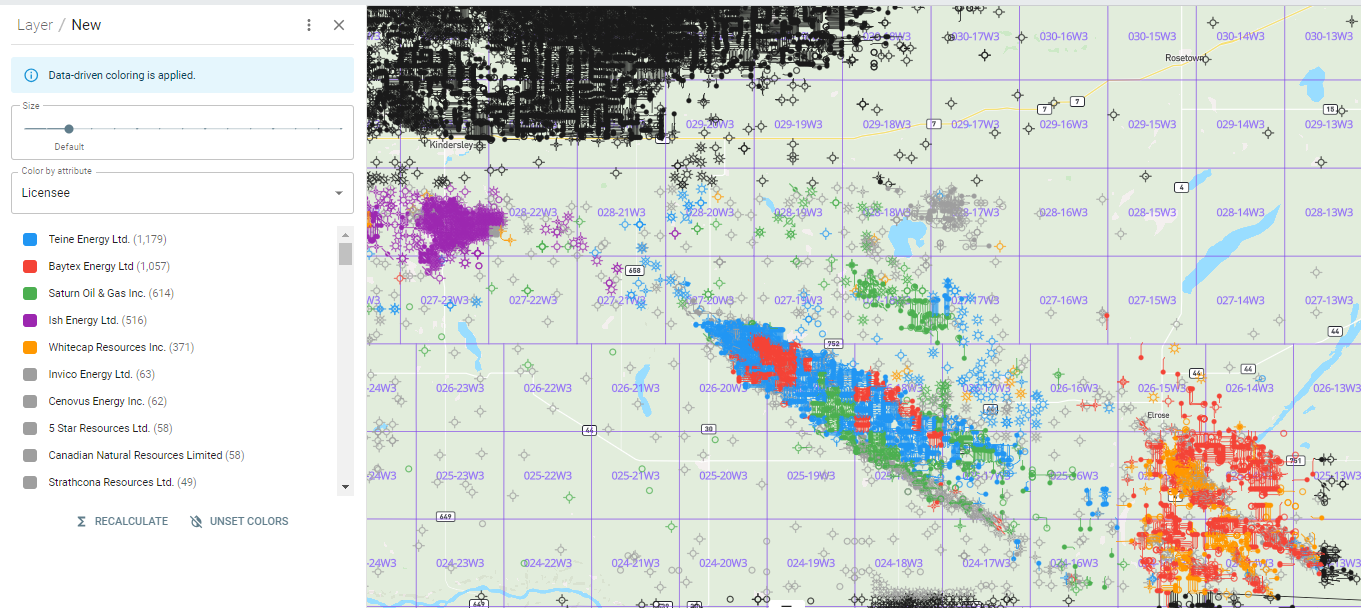

The buyer was not press released at this time, however BOE Intel users will be notified as soon as the mineral rights transfer or well licence transfer goes through. Using Petro Ninja’s new data-driven colouring effects, it is easy to spot who the other main producers are in the area. Teine, Saturn, and Whitecap have the largest number of licensed wells in the disposition area, while Ish Energy also has some licensed wells although not in the Plato and Forgan area.

Figure 3 – Licences by operator in Plato / Forgan area

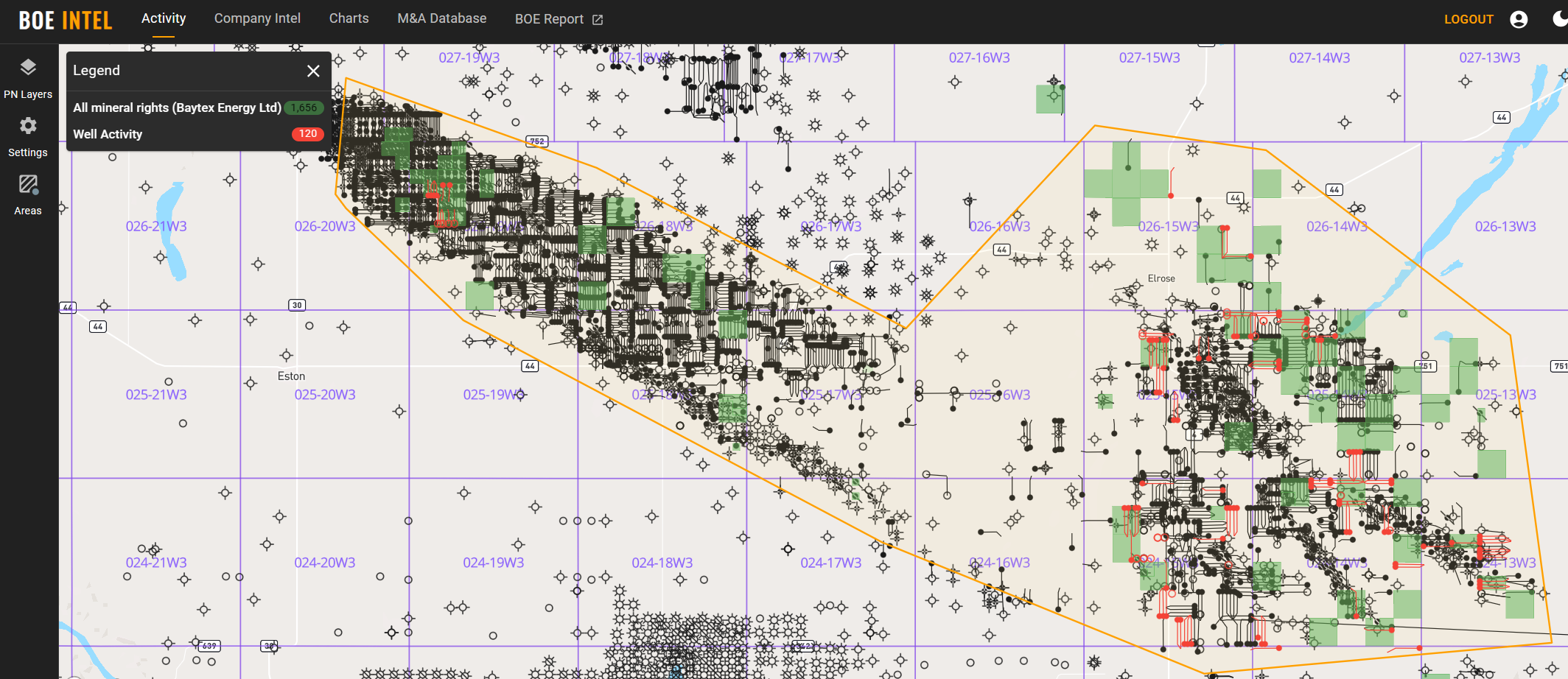

Using BOE Intel’s new “define an area” feature, we’ve drawn a polygon around the Plato and Forgan areas as depicted in Figure 4 below. Also shown are the Crown mineral rights held by Baytex (green), and spuds in that defined area by Baytex over the last three years in red (120 spuds).

Figure 4 – Baytex spuds (last 3 years) and Baytex Crown mineral rights

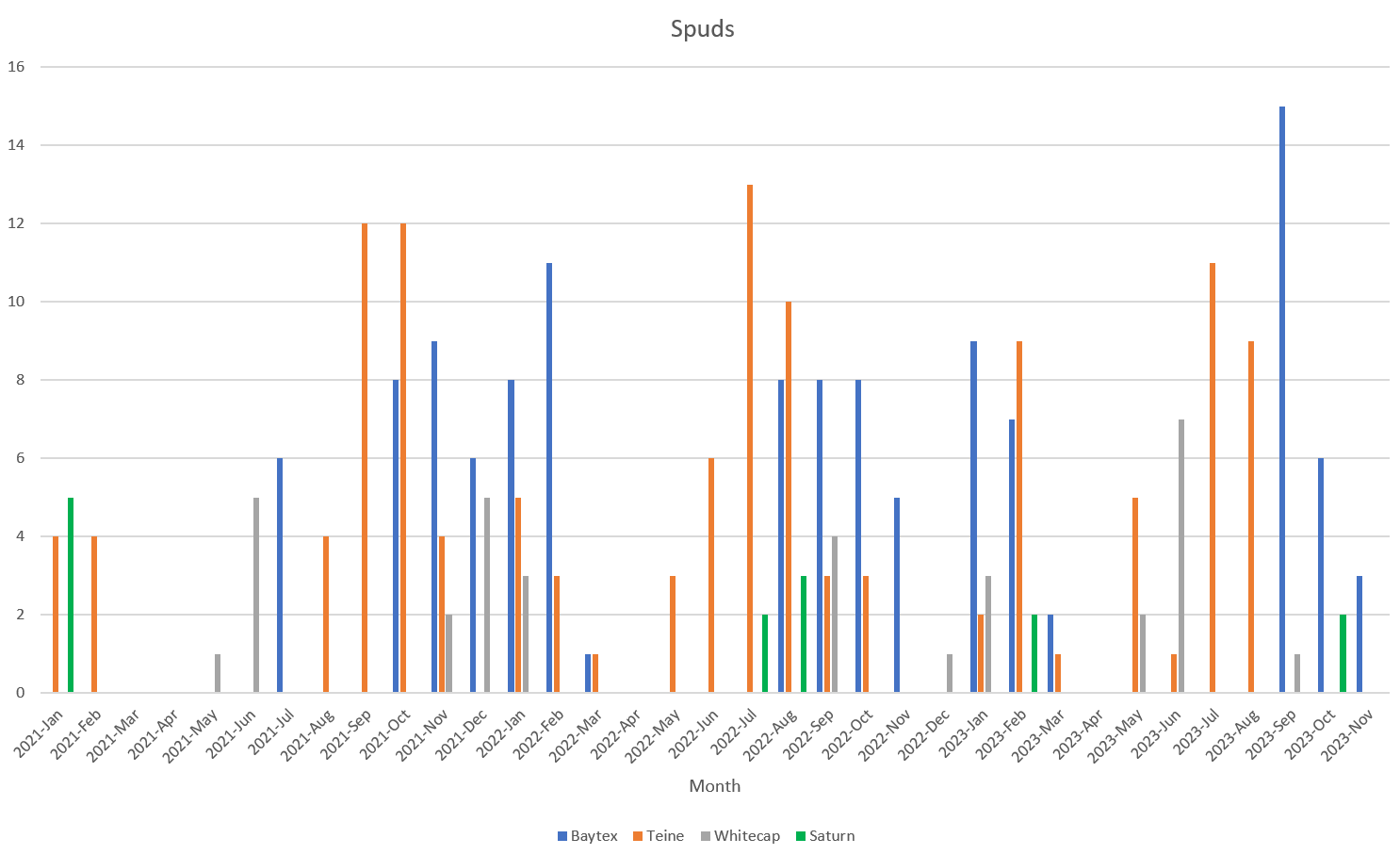

Using that defined area, we’ve calculated the number of spuds by operator and shown that activity in Figure 5 below. Teine had the most spuds over that timeframe at 125, followed by Baytex at 120, Whitecap (34) and Saturn (14).

Figure 5 – Monthly spuds by operator in defined area

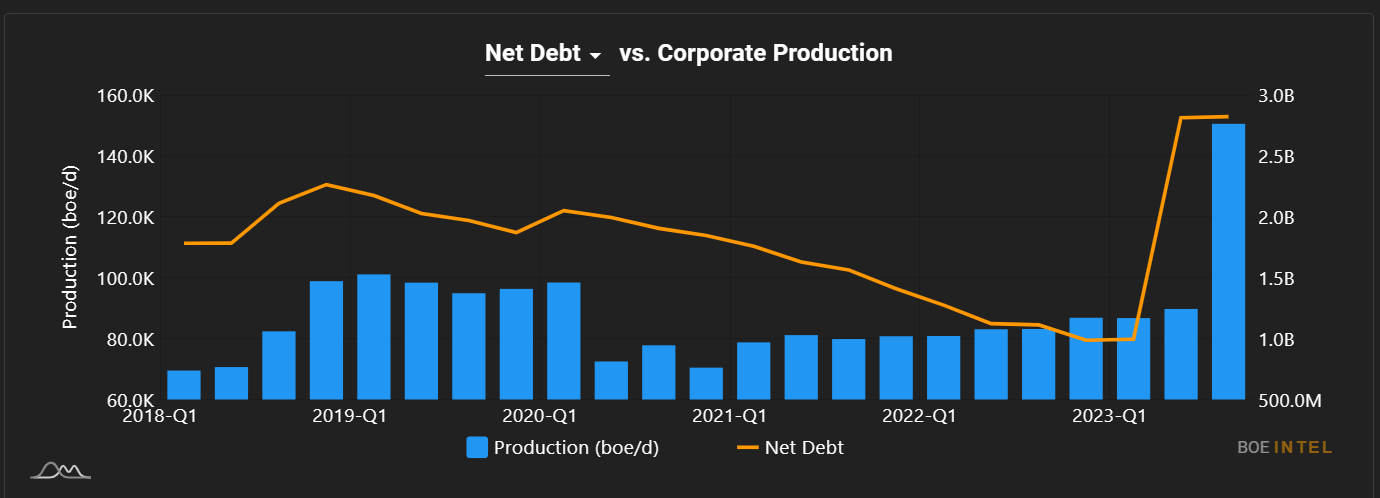

Baytex has stated that the proceeds of the disposition will be used to reduce net debt levels, which were ~$2.8 billion at the end of Q3. Pictured below are Baytex’s net debt levels relative to corporate production. Both show the effects of the recent acquisition of Ranger Oil.

Figure 6 – Baytex net debt relative to corporate production