Sinopec Canada (“Sinopec” or the “Company”) has engaged Sayer Energy Advisors to assist the Company with the sale of certain of the Company’s non-core oil and natural gas gross overriding royalty (“GORR”) and working interest properties located in Alberta, British Columbia and Saskatchewan (the “Properties”).

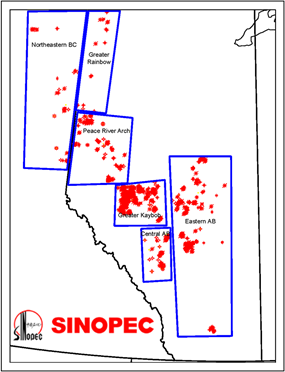

The Properties consist of GORR interests as well as operated and non-operated working interests which are located throughout Alberta, British Columbia and Saskatchewan. For marketing purposes, the Properties are separated into the following geographical packages for this offering: Central AB, Eastern AB, Greater Kaybob, Peace River Arch, Greater Rainbow and Northeastern BC. Sinopec’s strong preference is to sell the Properties in one transaction but will consider offers on individual properties or multiple properties thereof.

Average production net to Sinopec from the Properties in the second quarter of 2023 was 3,223 boe/d, consisting of 16.2 MMcf/d of natural gas and 527 barrels of oil and natural gas liquids per day.

Operating income net to Sinopec from the Properties for the second quarter of 2023 averaged $400,000 per month or $4.8 million on an annualized basis.

As of November 4, 2023, Sinopec’s net deemed asset value in Alberta was ($24.6 million) (deemed assets of $34.9 million and deemed liabilities of $59.5 million), with an LMR ratio of 0.59. Sinopec’s net deemed asset value in British Columbia was ($449,690) (deemed assets of $0 and deemed liabilities of $449,690), with an LMR ratio of 0.00. The interests held by Sinopec in Saskatchewan are non-operated.

McDaniel & Associates Consultants Ltd. (“McDaniel”) prepared an independent reserves evaluation of the Properties as part of the Company’s year-end reporting (the “McDaniel Report”). A number of the Properties were evaluated by McDaniel, while some Properties were evaluated by the Company and audited by McDaniel. The McDaniel Report is effective January 1, 2023, using McDaniel’s January 1, 2023 forecast pricing. McDaniel & Sinopec estimated that as at January 1, 2023 the Properties contained remaining proved plus probable reserves of 1.9 million barrels of oil and natural gas liquids and 61.3 Bcf of natural gas (12.1 million boe), with an estimated net present value of approximately $99.8 million using forecast pricing at a 10% discount.

Summary information relating to this divestiture is attached to this correspondence. More specific information is available at www.sayeradvisors.com. A package of more detailed confidential information will be sent to any party executing a Confidentiality Agreement (copy attached).

Cash offers relating to this process will be accepted until 12:00 pm on Thursday, January 25, 2024.

For further information please feel free to contact: Ben Rye, Sydney Birkett, or Tom Pavic at 403.266.6133.