While Paramount Resources has not yet reported its Q4 (post publishing note: the quarterly report is now out. Click here for details on Paramount’s quarter as well as for further information from the company on the disposition referenced in this article), subscribers to BOE Intel will have noticed some interesting asset transfers over the last week. This is your cue to reach out for a demo if your company is not yet a subscriber of BOE Intel.

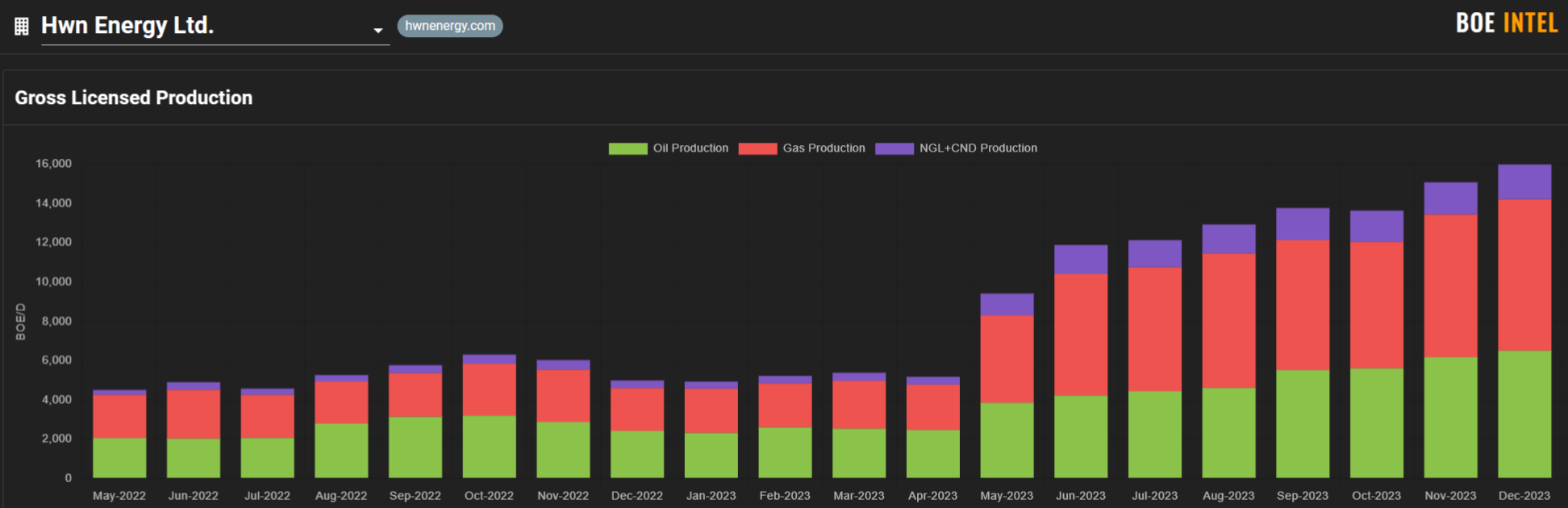

Paramount has an AER licence transfer application (currently listed as pending) to transfer 132 wells, 39 pipelines and 21 facilities to HWN Energy. There have also been mineral rights transfers totaling 100+ net sections (26,000+ hectares) from Paramount to HWN that went through this week. Those transfers are pictured below in Figure 1.

Figure 1

- AER licence transfers (affected locations) – Green

- Mineral rights transfers – Orange

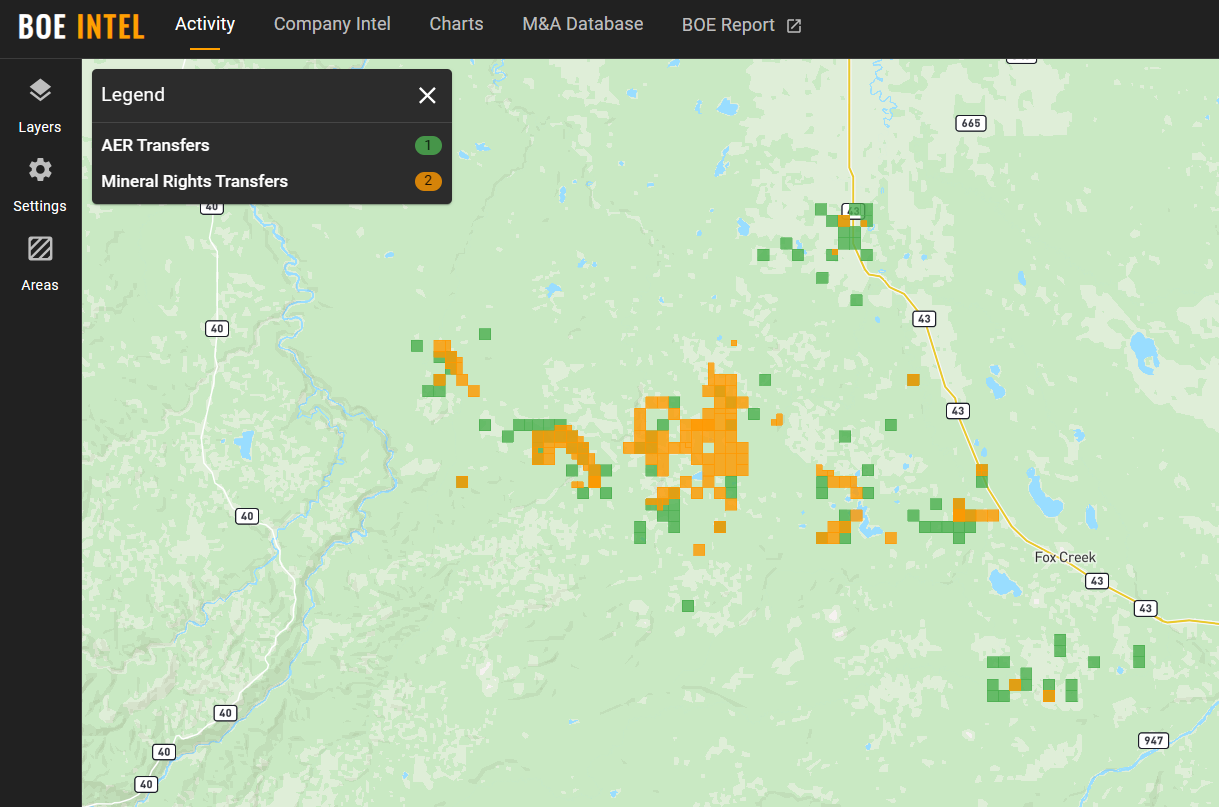

The transfers in the center of the page appear to line up with Paramount’s Ante Creek assets, which at last update were listed in the “other Montney assets” section of its corporate presentation. Seemingly a non-core asset that was seeing “limited capital being currently deployed.”

Figure 2 – Slide from Paramount corporate presentation

Source: Paramount Corporate Presentation

But the transfers showing up on BOE Intel seem to imply that it is more than just Ante Creek that is in the process of being sold, so we will have to wait and see if there is any commentary on this disposition when the company reports its Q4 later this week. We will also be on the alert for any commentary on the Woodside Liard Basin JV or any other tweaks to the company’s portfolio of assets.

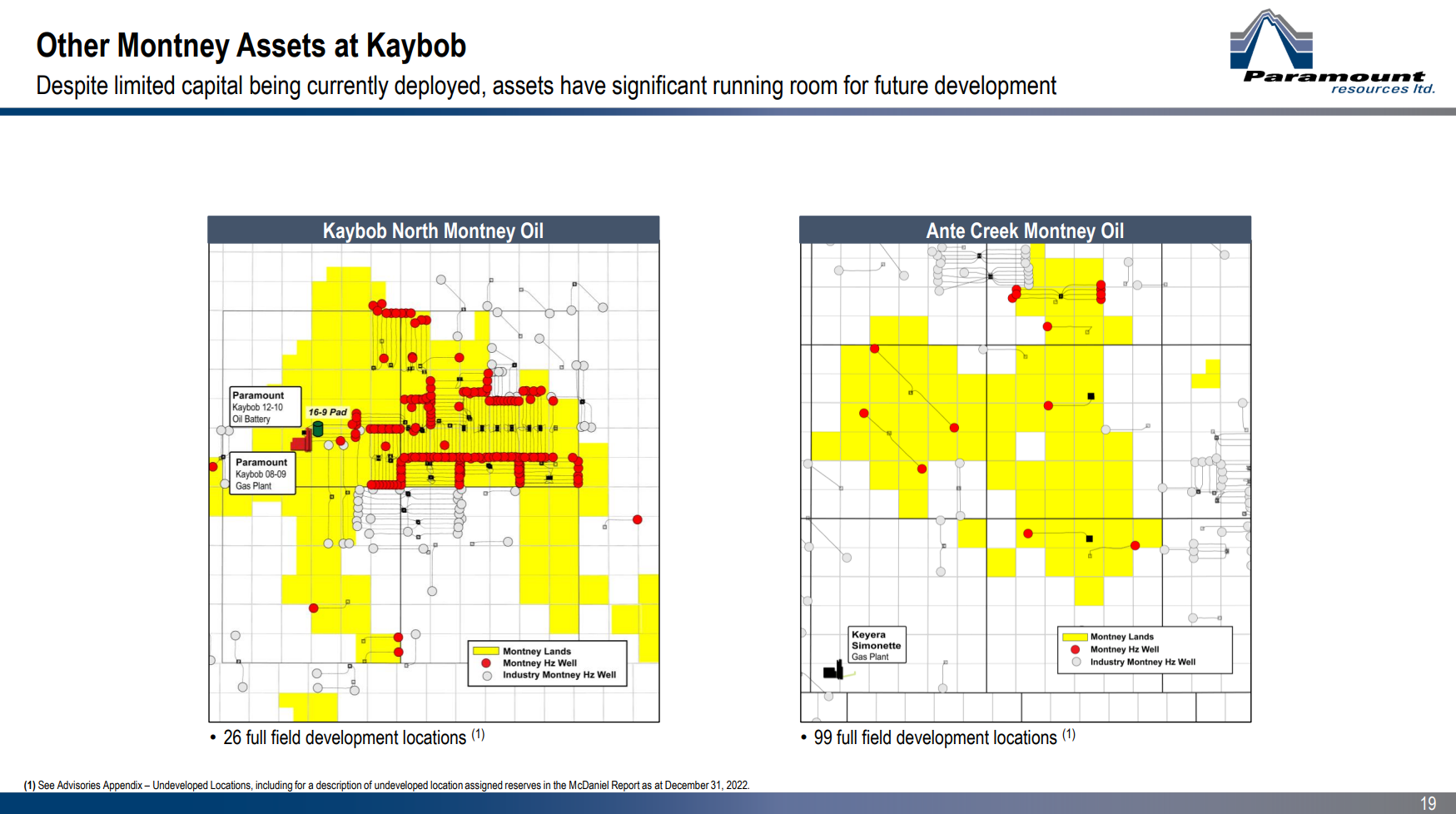

As for HWN, the company has been an active consolidator of assets over the last year and change, with total gross licensed production of almost 16,000 BOE/d as of December 2023 (Figure 3), and before the effects of any volumes associated with these transfers.

Figure 3 – Gross licensed production – HWN Energy