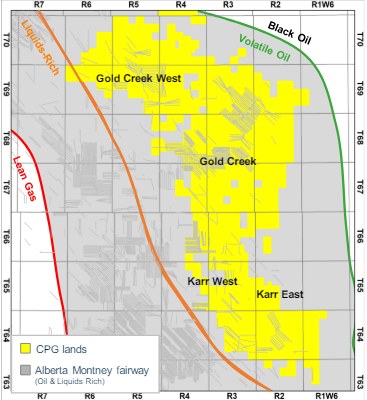

Just over twelve months ago, Spartan Delta made headlines in Canadian oil and gas with a series of asset transfers. Referred to by the company as a “repositioning“, the transactions resulted in a majority of Spartan Delta’s existing assets changing hands. The company’s Gold Creek and Karr Montney assets were acquired by Crescent Point (officially Veren, as of this morning), while its Pouce Coupe, Simonette, and Flatrock assets formed the foundation for a spin-off company, Logan Energy. With over a year having passed since this transaction, which altered the trajectories of all parties involved, we thought it was about time to take a look at the latest developments concerning these transferred assets. For the first entry in this two-part article series, we’re reviewing the assets acquired by Crescent Point (with part two naturally focusing on Logan). For any readers wondering about the assets Crescent Point acquired from Hammerhead later in 2023, don’t fret; we’re saving that analysis for a separate article down the road.

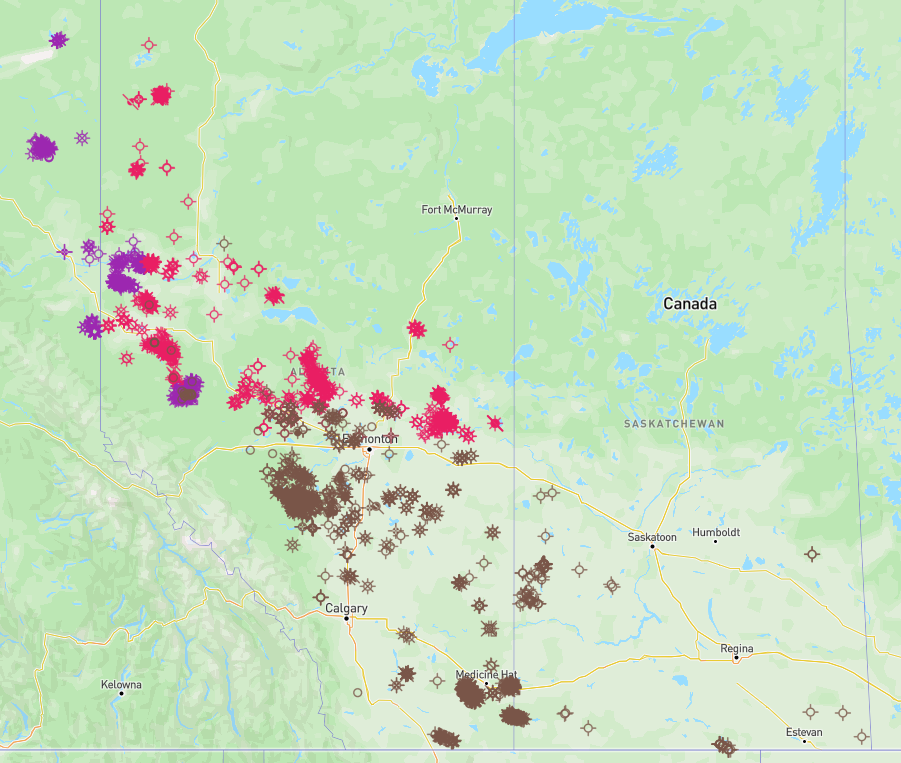

Map of Current Spartan Delta Licences and Transferred Licences (Spartan Delta Licences in Brown, Licences Transferred to Logan in Pink, Licences Transferred to Crescent Point in Pink)

Augmenting an existing position – Crescent Point

While the transaction well map above might lead you to believe that this acquisition targeted assets across central Alberta, the focal point of this deal is the Alberta Montney. Spartan Delta sold off virtually its entire Montney position, with a major portion of its Alberta Montney asset going to Crescent Point. Per Crescent Point’s March 2023 corporate presentation, which was released shortly after the acquisition was announced, they assessed that the acquired position contained more than 20 years of inventory with around 600 net Montney locations. For context, a more recent corporate presentation suggested that Crescent Point’s total number of identified premium locations in the Alberta Montney is upward of 1,400 locations. BOE Intel users can access the March 2023 corporate presentation here.

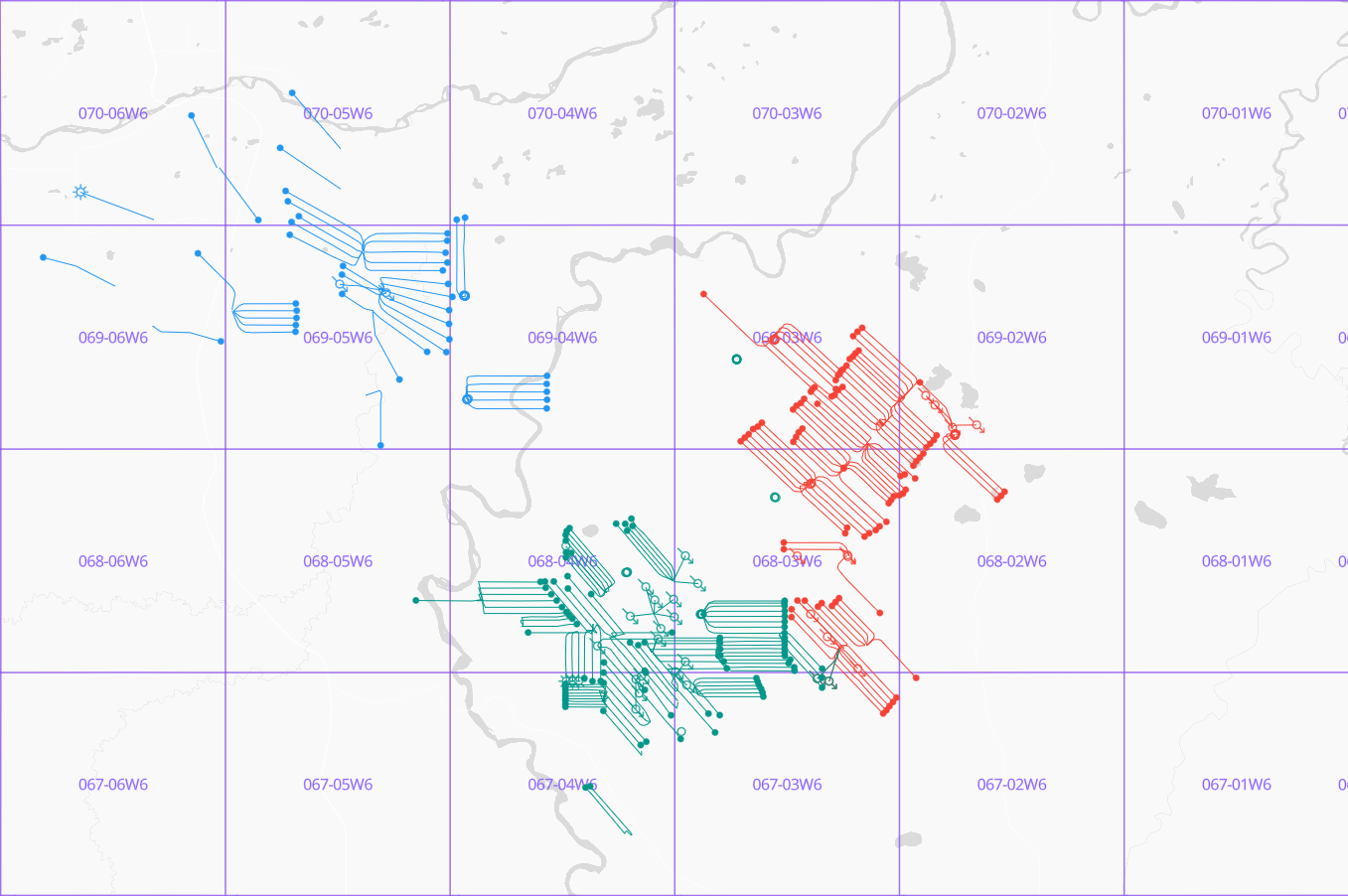

Active Wells Transferred from Spartan Delta to Crescent Point and All Active Crescent Point Wells (Transferred Wells in Red, All Others in Purple)

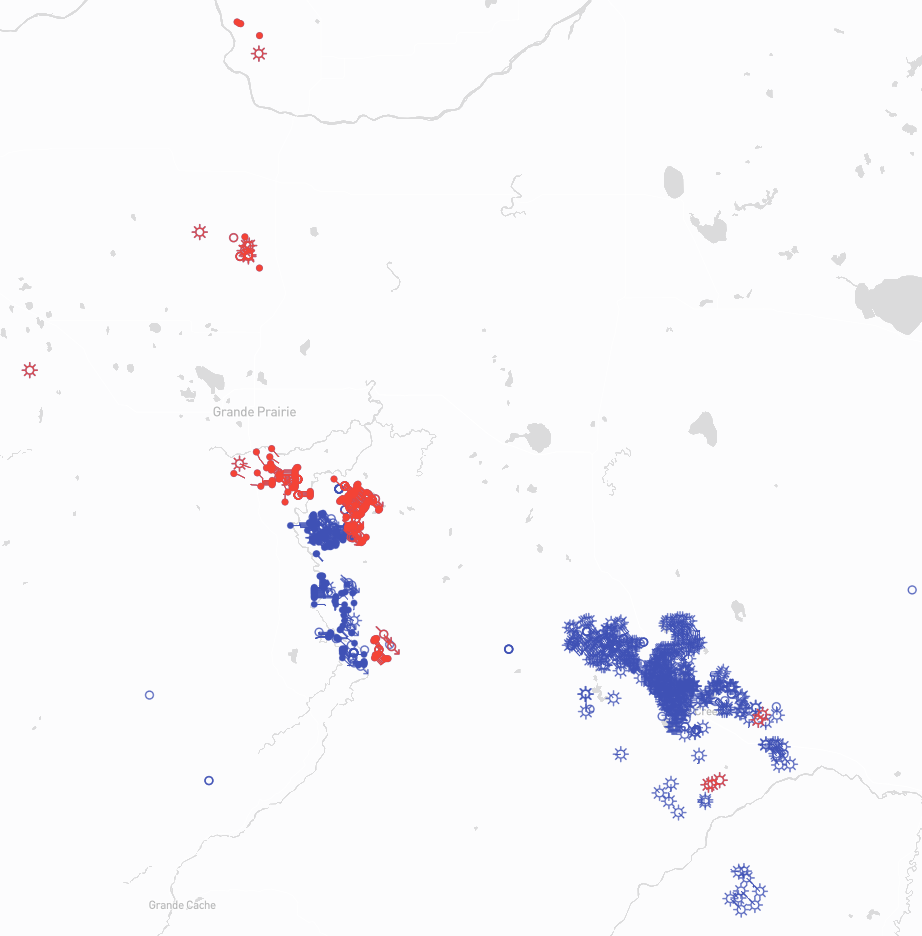

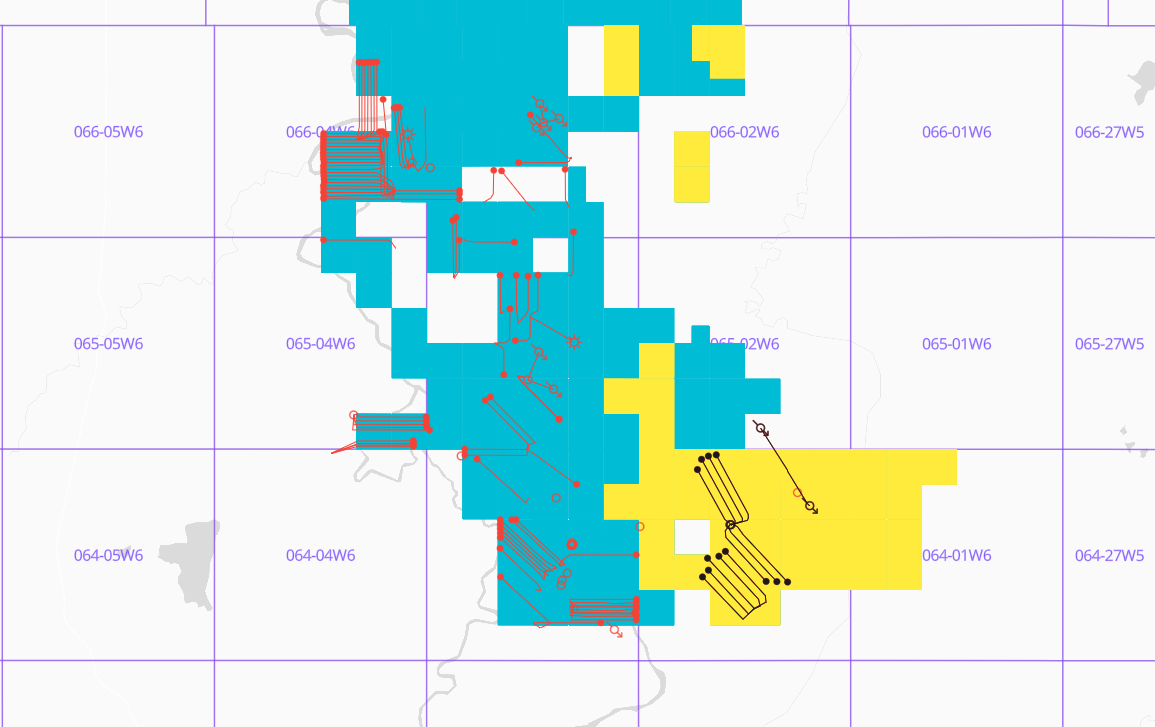

Digging in a little deeper, the Gold Creek and Karr portions of the acquisition are the focal points of this deal. As demonstrated in the crown mineral rights map below, Crescent Point effectively doubled its rights positions at Gold Creek and Karr with the acquisition of around 130 crown mineral right agreements. The company also acquired a large number of wells, particularly at Gold Creek where a total of 169 licences changed hands.

Crescent Point’s Wells and Mineral Rights (Acquired Licences in Black, Acquired Crown Mineral Rights in Yellow, Pre-/Post-acquisition Wells in Red, Pre-acquisition Mineral Rights in Blue)

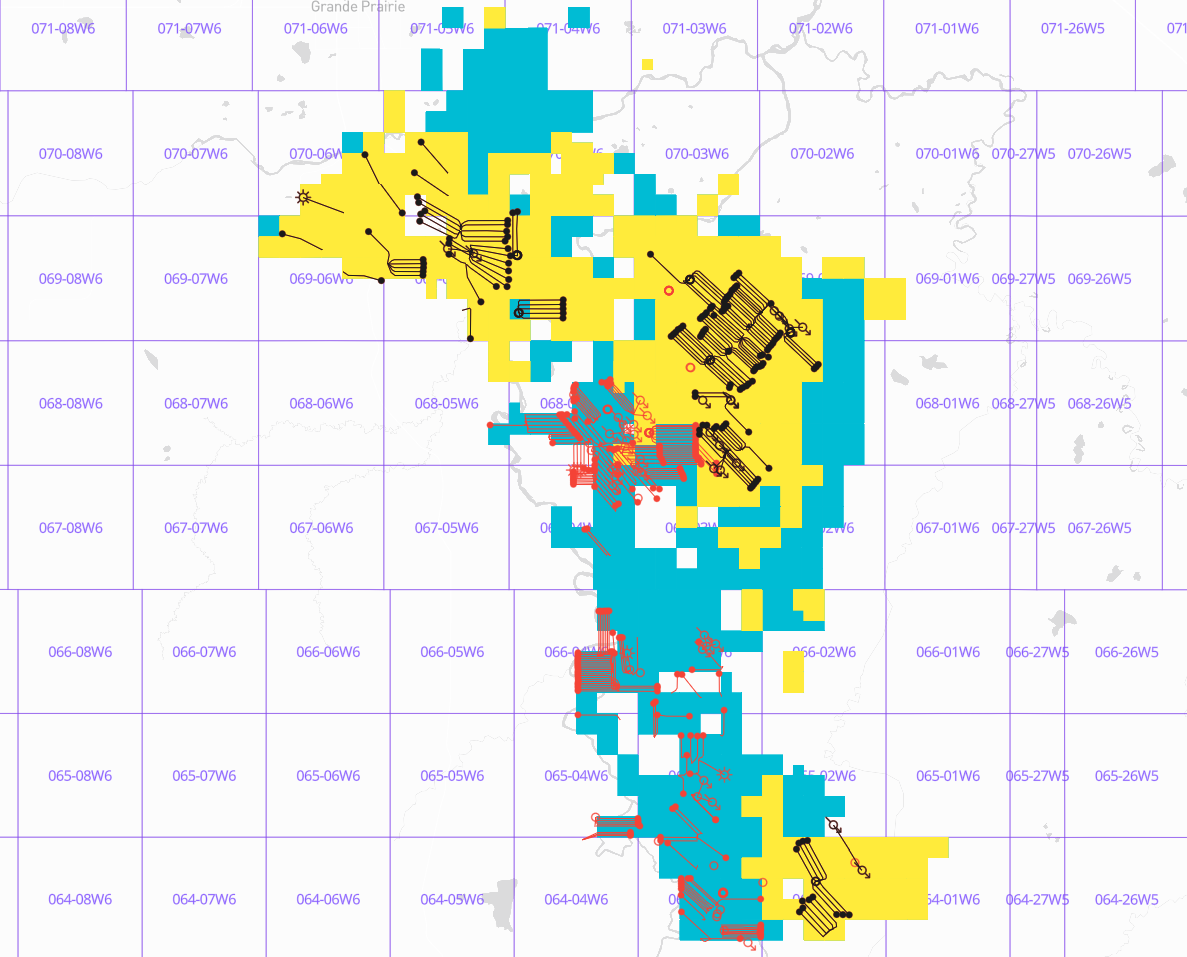

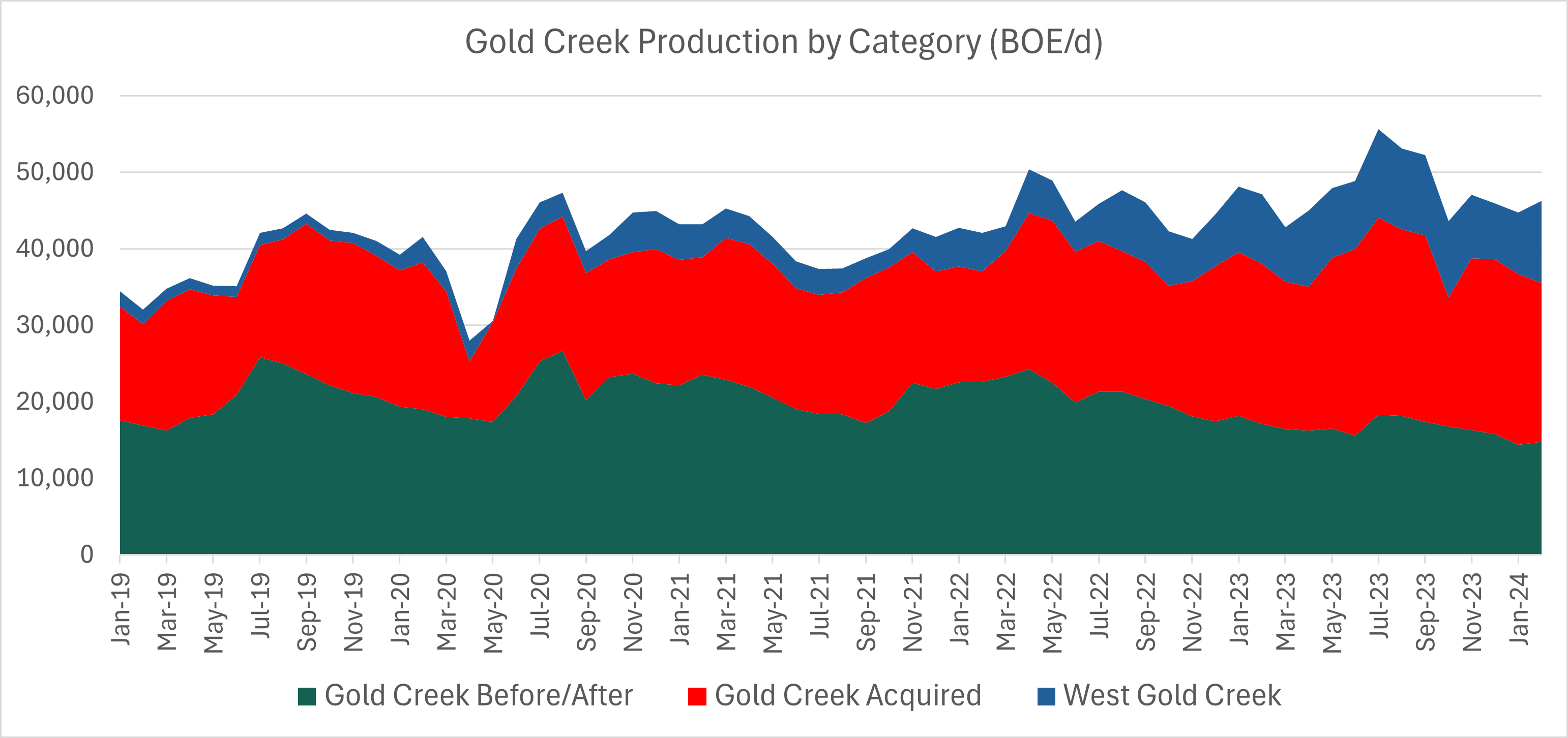

The most obvious synergies exist at Gold Creek, where the acquired wells are located directly adjacent to Crescent Point’s pre-existing holdings. We’ve grouped the company’s wells at Gold Creek into 3 clusters: Gold Creek West, Gold Creek Acquired, and Gold Creek pre-/post-transaction. To clarify, post-transaction wells are wells that were licensed by Crescent Point after the transaction closed and pre-transaction wells are wells that were licensed by Crescent Point prior to the transaction’s closing. As of May 2024, there are 57 Gold Creek West wells, 112 acquired wells, and 143 pre-/post-transaction wells; this means that the acquired position more than doubled Crescent Point’s Gold Creek well count.

Gold Creek Wells (West Gold Creek in Blue, Pre-transaction and post-transaction Crescent Point Wells in Green, Acquired Gold Creek Wells in Red)

In accordance with the well divisions established above, we’ve prepared a chart detailing historical production by category. West Gold Creek, which has not been the site of any Crescent Point licensing activity, represents a minority of production from the asset. With that said, production growth since 2019 has been enormous on a percentage basis; between January 2019 and February 2024, West Gold Creek production increased by almost 8,000 BOE/d. The Gold Creek wells acquired from Spartan Delta have been more consistent, with gross production since 2019 largely hovering between 15,000 and 20,000 BOE/d if you ignore COVID-impacted months in 2020. The acquired wells actually represented a majority of Crescent Point’s Gold Creek production as of February 2024, producing around 20,800 BOE/d compared to 14,800 from the pre-/post-transaction wells.

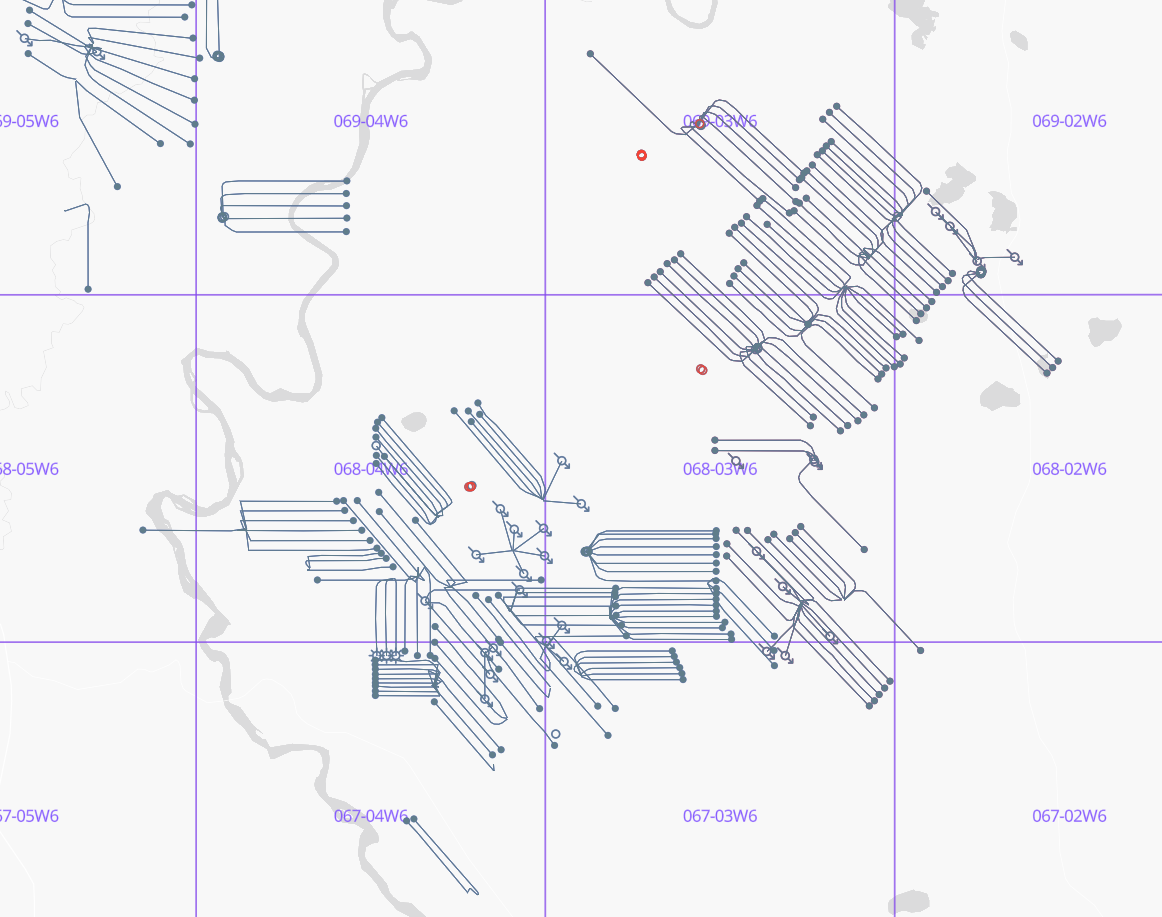

With respect to licensing and drilling activity since the transaction closed, Crescent Point has obtained 16 licences at Gold Creek since May 10, 2023. The majority of these licences appear to exploit crown mineral rights that were obtained from Spartan Delta, although we want to highlight that none of these 16 wells are producing. The most interesting licences obtained are at Township 069-03W6, where the company appears to be planning a 9-well pad. As a reminder, Crescent Point indicated in its April 2024 Corporate Presentation that it has allocated capital for the drilling of ~60 net Alberta Montney wells in 2024.

Gold Creek Wells with Post-Transaction Licences Highlighted (Post-Merger Licences in Red, All Other Crescent Point Licences in Grey)

While Crescent Point hasn’t independently obtained any licences on acquired positions that have come on production, 13 licences acquired from Spartan Delta have been spud and come on production since the transaction closed. Gross licensed production from these wells has ramped up substantially, increasing from around 7,500 BOE/d in November 2023 to just under 15,900 BOE/d in February 2024. With an implied average per-well production of over 1,200 BOE/d that’s almost 66% oil, these wells are generating impressive output. Please note that these wells have been given “Confidential” status, meaning that broken out NGL data is unavailable. Keep in mind that this also means that producing hours are not available for these wells, and that the missing NGL stream can often understate well performance, particularly in liquids-rich plays. Crescent Point has provided guidance on well costs at Gold Creek and Gold Creek West, which the company tagged at $9.0 and $9.5 million per well respectively.

Moving south to Karr, the company significantly augmented its position in this headline-grabbing area of the Montney. While constituting a smaller portion of production compared to the Gold Creek asset, the rights at Karr still present a significant opportunity for future development. Crescent Point has indicated that the East Karr asset, of which the positions acquired from Spartan Delta are a part, has 390 net drilling locations.

Crescent Point Karr Crown Mineral Rights & Wells (Transferred Wells in Black, All Other Crescent Point Wells in Red, Transferred Mineral Rights in Yellow, Pre-transaction Mineral Rights in Blue)

Examining current and historical production data from Crescent Point’s pre-existing Karr licences and its acquired licences, it’s clear that the acquired production is a modest portion of its overall output from the field. No wells licensed by Crescent Point in the acquired areas have been drilled or come on production since the transaction closed; as such, all production is effectively “legacy” production. Accounting for around 3,500 BOE/d of February 2024 gross licensed production, averaging just over 250 BOE/d per well, the acquired asset has generated consistent liquids-weighted production; in February 2024, production from the acquired wells was approximately 74% liquids. Per Crescent Point’s May 2024 presentation, well costs in this area of the Karr play are between $9.5 – 10.5 million per well; it will be interesting to see how the company’s Karr drilling program progresses.

Stay tuned for Part 2 of this series, which will focus on what Logan Energy has been up to since the spin-off took place. To keep track of other developments, check out BOE Intel.