Canadian licensing activity fell slightly last month. Between May 13 and June 12, 580 licences were obtained. This represents a modest 6.9% decrease compared to the previous month, which saw companies obtain 623 new licences. This past month’s licences were spread across 81 unique licensees, representing an average of 7.2 licences per licensee. The Montney was the runaway favourite producing formation once again this month, accounting for around 23.0% of all licensing. Our most interesting observations this month, however, are related to a number of big Canadian producers seemingly revisiting areas that they haven’t touched in 5+ years. Using data from BOE Intel and Petro Ninja, we’ve identified a number of trends across the various producers and producing formations.

LICENSEES

- Cenovus led the pack this month with respect to licensing, and its activity was largely in line with prior months; lots of Lloydminster heavy oil and oil sands licences. With that said, they did obtain some licences in an area where they haven’t drilled a well in over 5 years. Cenovus has a relatively quiet operation near Rainbow Lake in Alberta, and they are basically the only operator in the area. The asset was historically targeted with vertical wells before Cenovus’ foray into horizontal drilling at Rainbow Lake in 2018 and early 2019. The 3 licences appear to be targeting the Muskeg formation, suggesting the potential for oil-weighted production. While it’s just a few small exploratory licences from Cenovus, it’s always neat to see new concepts being tested.

- In a somewhat similar vein, although in a much more proven area, CNRL appears to be revisiting old ground as well. Specifically, Albertan ground they last drilled a well on in 2019. The company obtained 8 licences right next to an existing 5-well pad at Township 073-11W6, which contains Montney wells that came on production back in 2019. This proximal pad, which is part of the Wembley field, generated peak production of just under 4,000 BOE/d when it came onstream back in 2021, so we believe it is worth watching what CNRL does with these licences going forward.

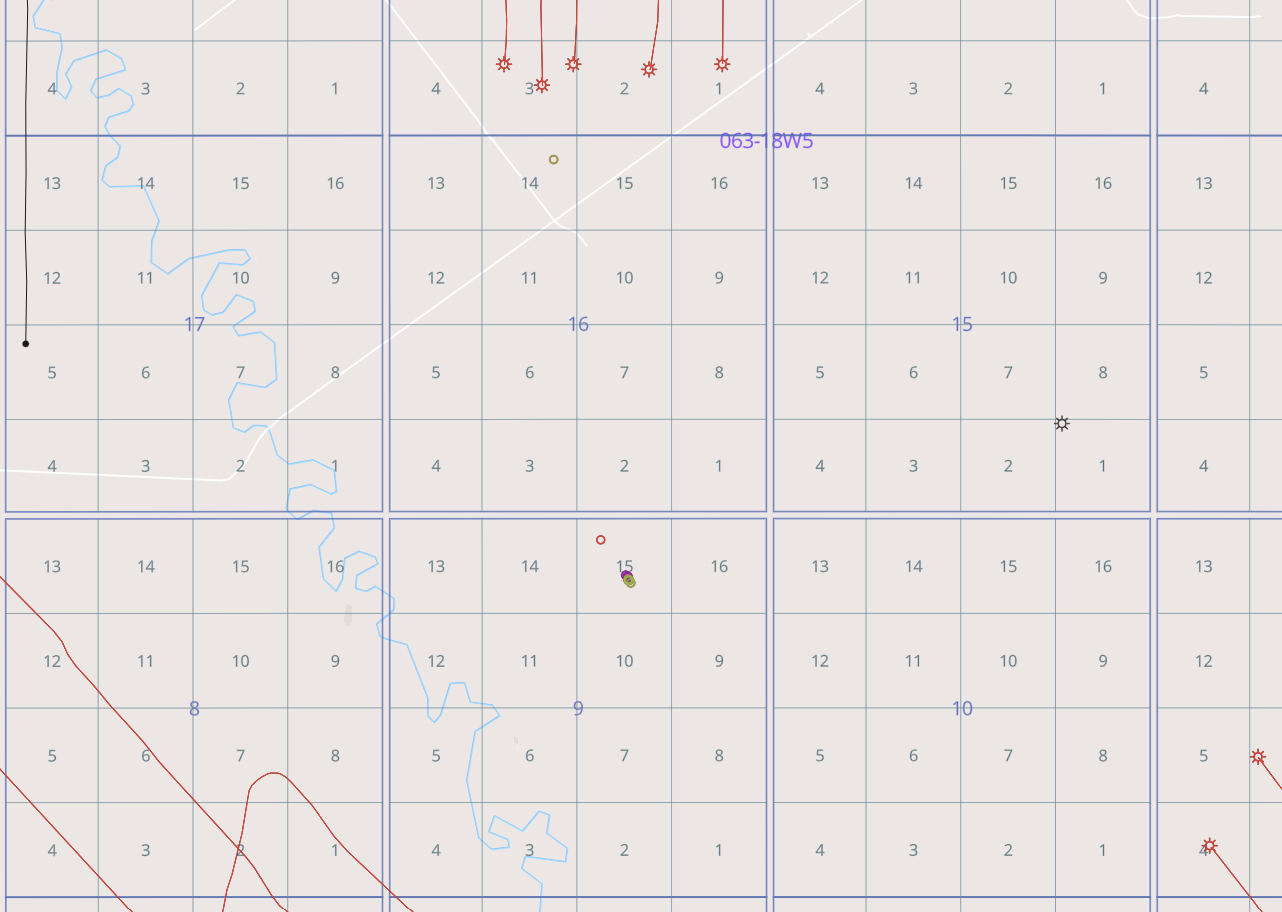

- Veren obtained 20 licences across its assets, ranging from the southeast corner of Saskatchewan all the way to the Montney. The most interesting wells in our view, however, are a selection of Kaybob Duvernay licences. This is interesting because the wells are located in almost the exact same spot as a number of cancelled Shell licences (recall that Crescent Point acquired these assets from Shell in 2021) that were obtained back in 2018. The fact that this immediate area is seeing new licensing activity by Veren after being cancelled by Shell may suggest that the producing economics of this part of the Duvernay have changed, or perhaps that Veren sees something in it that Shell did not.

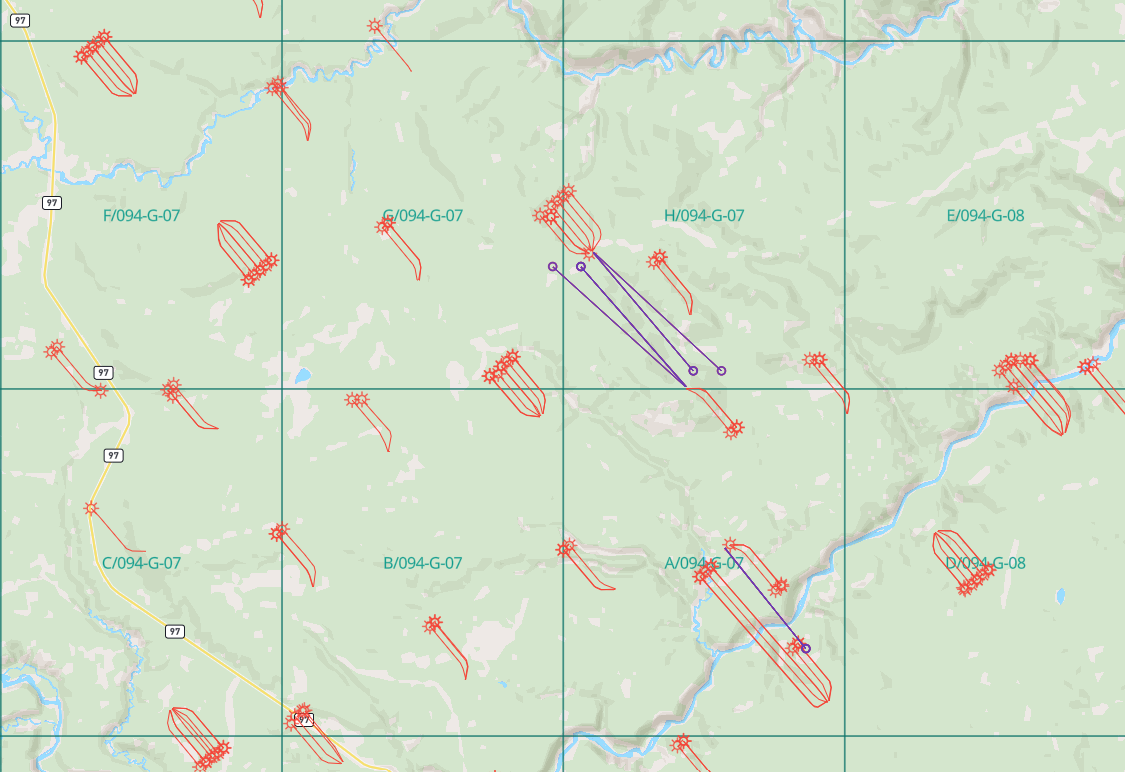

- Petronas (which we covered in our most recent Asset Review article) licensed across its Montney assets, but was particularly active toward the northwestern edge of its crown mineral rights position. Of the 55 wells the company obtained last month, 14 were obtained at Townships A/094-G-07 and H/094-G-07 with an additional licence obtained at neighbouring G/094-G-07. All of these licences appear to be extensions from existing well pads.

| Licensees | Licence Count |

| Cenovus Energy Inc. | 58 |

| Canadian Natural Resources Limited | 56 |

| Petronas Energy Canada Ltd. | 55 |

| Veren Inc. | 20 |

| Spur Petroleum Ltd. | 20 |

| Pacific Canbriam Energy Limited | 20 |

| Tourmaline Oil Corp. | 19 |

| IPC Canada Ltd. | 16 |

| Crew Energy Inc. | 15 |

| Teine Energy Ltd. | 14 |

| Others | 287 |

| Total | 580 |

Wells at Township 063-18W5 (Veren May-June Licences in Green, All Other Veren Licences in Red, Shell Licences in Purple, All Other Licences in Blue)

Cenovus Rainbow Lake Licences (May-June Licences in Red, All Other Cenovus Licences in Black)

CNRL Wells near Township 073-11W6 (May-June Licences in Red, All Other CNRL Licences in Black)

Select Active Petronas Licences (May-June Licences in Purple, All Other Petronas Licences in Red)

PRODUCING FORMATIONS

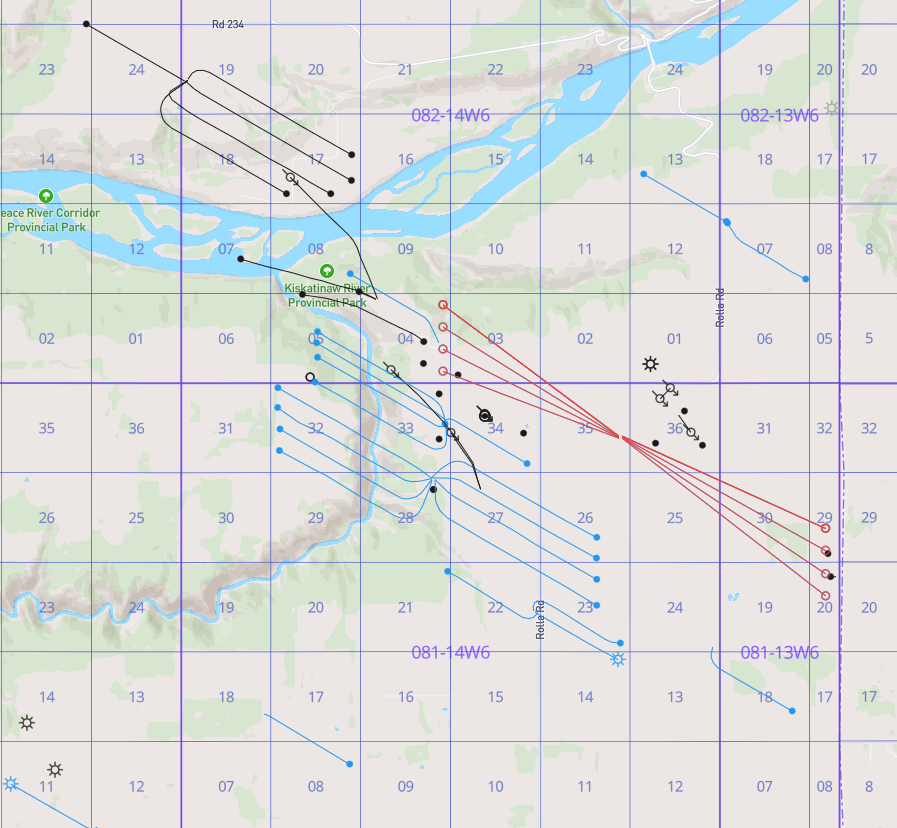

- The Montney was active yet again last month, with Canadian companies obtaining 134 licences targeting this producing formation. While the Alberta and BC portions of the Montney play usually see similar licensing activity, the May-June period was decidedly skewed towards BC with the province accounting for over 80% of Montney licences. Among these licences, Vermilion’s were among the most interesting. The company obtained 10 licences at its Mica project, which at present boasts 28 total active wells. Vermilion has been steadily building up its producing base and infrastructure at Mica, and the 10 licences obtained last month appear to be located near a 16,000 BOE/d battery at Township 081-14W6 that the company has said will commence operations in late Q2 2024. Other prominent Montney licensees include Petronas (an impressive 55 licences across multiple licences, although none at the West Gundy asset which we covered recently), Pacific Canbriam (20 licences) and CNRL (17 licences).

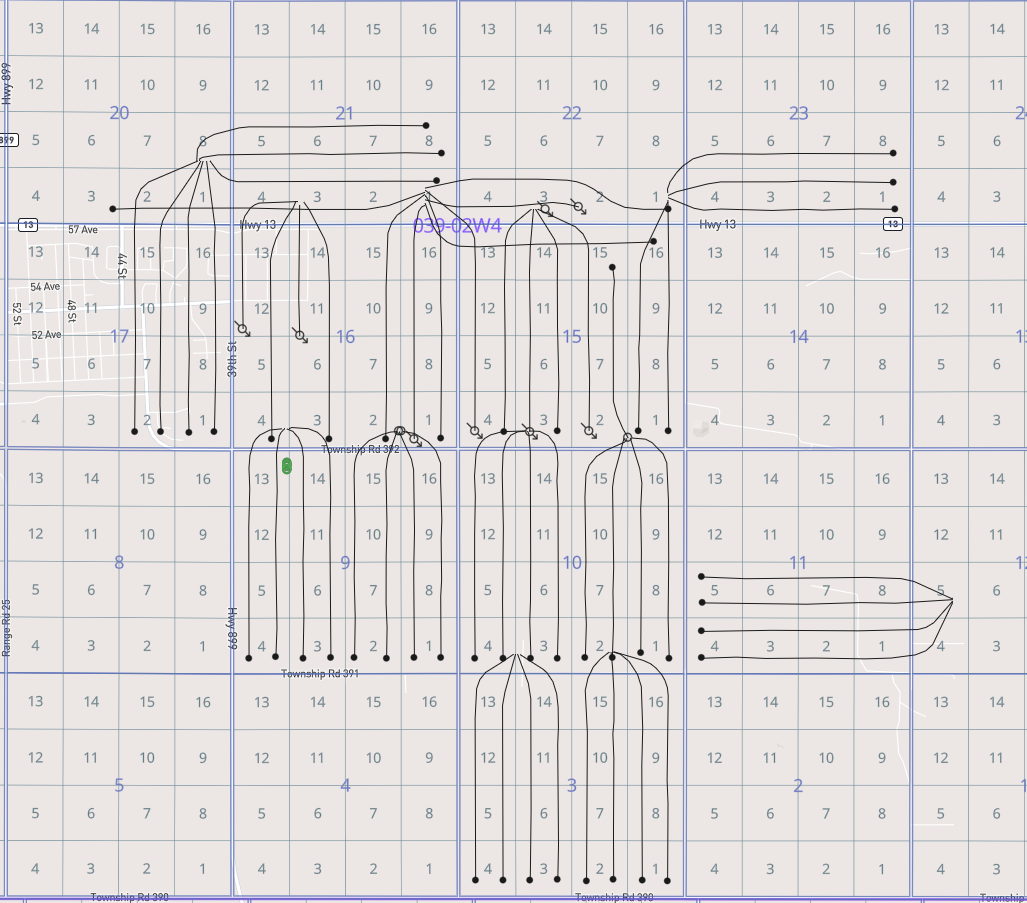

- The Sparky cracked the top producing formations for the first time in months, with an impressive 71 licences obtained across Alberta and Saskatchewan. CNRL led all producers with 34 Sparky licences, most of which were obtained near the company’s Bonnyville heavy oil asset. Moving a bit further South, however, another producer was busy. Surge obtained 13 Sparky licences, 6 of which were at Township 039-02W4 next to a substantial existing operation near Provost. The existing development produced just under 2,000 BOE/d in April 2024 gross licensed production, with an associated 91.2% liquids percentage.

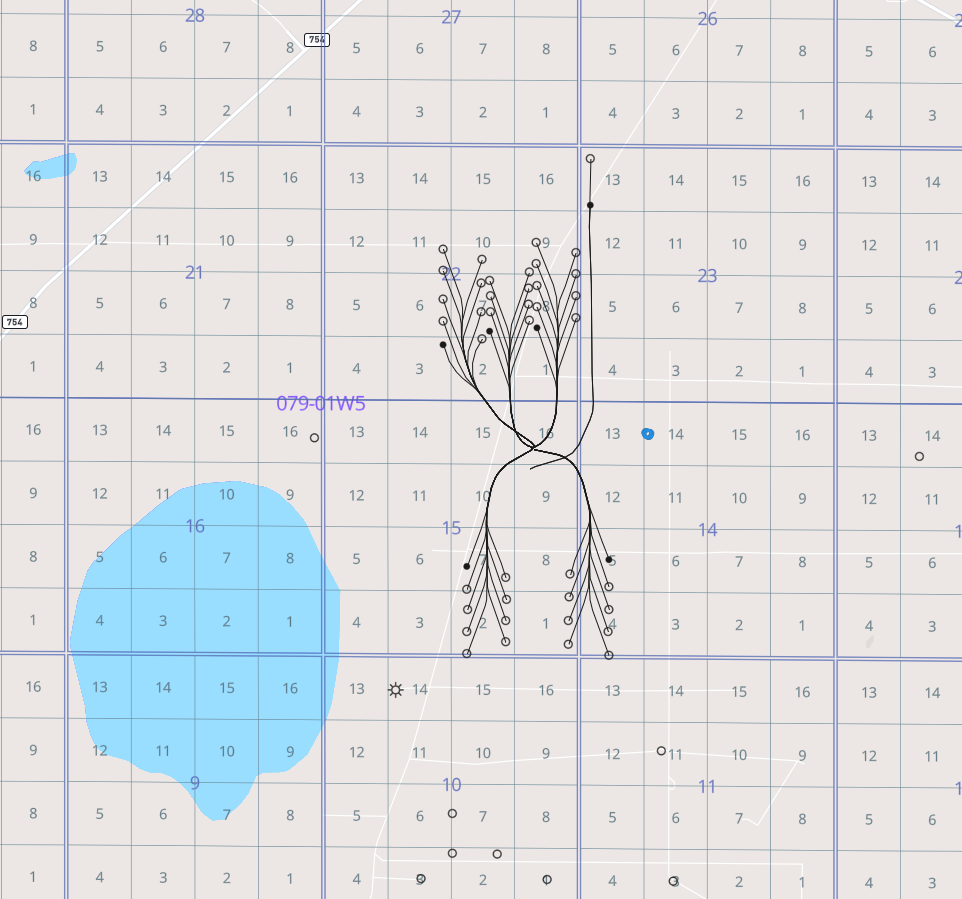

- The Clearwater was less busy than normal, with 37 licences compared to 62 licences last month. Spur was the top licensee with 17, which were spread evenly across its positions in the play. We were particularly interested by 5 licences that were obtained in close proximity to an existing development at Township 079-01W5. As shown in the well map below, the licences are an interesting mix of mostly 9-leg multilaterals; the new cluster of licences could suggest the potential development of similar multilateral structures. South of the North and South Wabasca lakes, this development is in a quieter part of Spur’s position in the Clearwater; we’ll be interested to see whether activity continues to build in the future. Other top Clearwater licensees include Tamarack (6 licences) and Strathcona (4 licences).

| Producing Formations | Licence Count |

| Montney | 134 |

| Sparky | 71 |

| Clearwater | 37 |

| McMurray | 37 |

| Viking | 33 |

| Waseca | 17 |

| Grand Rapids | 16 |

| Spirit River | 16 |

| Cardium | 14 |

| Duvernay | 13 |

| Other | 192 |

| Total | 580 |

May-June Vermilion Licences With Proximal Active Wells (May-June Licences in Red, Other Vermilion Licences in Blue, All Other Licences in Black)

Surge Licences at Township 039-02W4 (May-June Licences in Green, All Others in Black)

Active Spur Licences at Township 079-01W5 (May-June Licences in Blue, All Other Spur Licences in Black)

To keep track of the latest licensing activity in the Canadian oil patch for yourself, check out BOE Intel.